Growing and protecting your clients’ cash is simple with Flagstone’s cash deposit platform, and doing so, opens new business opportunities such as acquiring and retaining high-value clients.

Partnering with Flagstone gives you visibility over your clients’ cash assets, allowing you to understand the full picture of wealth, provide holistic advice, and increase your influence. Advise with the reassurance that your relationships are not undermined by other parties offering financial advice.

Enable your clients to grow their cash by switching to the best savings deals through a single platform. You can also earn commission from all your referred clients’ annual management fees.

Getting started is easy

1. Register to become a referrer

Registering yourself as a referrer is the first step. Financial advisers, consultants, planners, and wealth managers can do this by providing their basic personal details, company details (if applicable), and a dedicated UK bank account for commission payments.

You can simply register without referring a client at this stage.

2. Refer clients

Now you are ready to refer your clients to Flagstone’s cash deposit platform. Following your referral, you will have read-only access to your client's portfolio giving you oversight of their investments. You will need your client’s consent before you share their information with us.

3. Open a Flagstone account

Once your clients have signed up, not only can you view your clients’ cash deposits and keep up to date with the best interest rates on the platform, but also see upcoming maturities so you can inform and remind clients.

You will receive 15% commission from all your referred clients’ annual management fees. Commission is paid in January, in arrears.

Register and refer your client to the Flagstone cash deposit platform today.

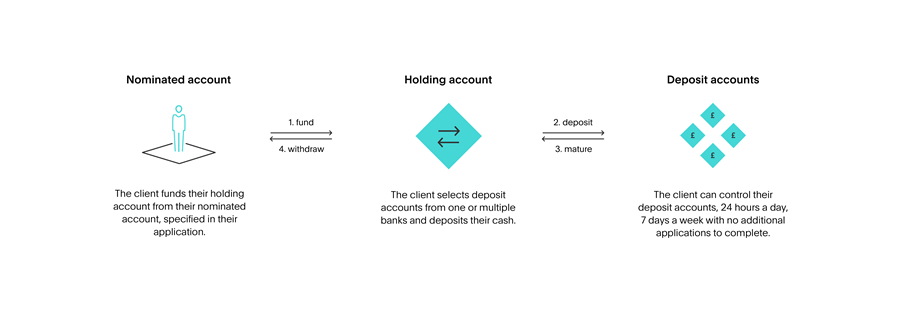

How it works for clients

Related articles

We're proud to feature in IFA Magazine, discussing the power of cash and how leveraging cash deposit platforms can provide advisers with a distinct competitive advantage.

Professional Adviser and Investment Week spotlight our insights on why cash remains king. Despite market uncertainty, cash offers security and steady returns. An opportunity advisers often overlook.

Cash is often overlooked in advisory discussions due to low interest rates, yet the market's size holds untapped potential. Our report outlines five reasons advisers should prioritise cash solutions.