Maximise your interest

Open hundreds of accounts from 65+ UK

banks, including market-leading and exclusive

rates. This is where cash goes to grow.

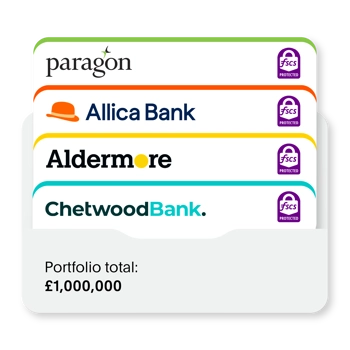

Protect what’s yours

Maximise FSCS protection on eligible cash deposits (up to £120,000 per client, per banking group). This applies to cash in the holding account and any UK savings accounts you open through Flagstone. Like a suit of armour for your savings.

Escape the paperwork

Access hundreds of rates with one application, and manage your savings with one password. Arrivederci, admin.

Protect and grow your cash in three simple steps

Manage your portfolio, maximise your interest, and keep your cash safe and secure.

Only with Flagstone.

Start saving with just £10,000

Open an individual or joint Flagstone account with a minimum deposit of £10,000.

Talk is cheap.

Trust is earned.

We work with more banks than any other cash deposit platform. The choice is yours.

See all banks

Our partner banks

You can browse and choose competitive and

exclusive interest rates from up to 60+ banks. Bank

access is dependent on your client profile.

We are all many things. Here’s what Flagstone is not.

A bank

We’re not a bank. Instead, banks list their accounts on our platform – including exclusive rates – to reach more smart savers. Like yourself.

A comparison site

We go beyond comparison. With Flagstone, you can open and manage an entire savings portfolio in one place, with one password.

A wealth adviser

We don’t provide financial advice, but we do make it easy for you to protect, grow, and manage your cash.

What is a cash deposit platform? →

How Flagstone

makes money

For each savings account you open through Flagstone, we receive a small share of the interest. We deduct that share before we feature any savings account in our platform – so the rate you see will be the rate you receive.

We also receive interest from cash in the holding account.

We’re at your service.

Still need answers? Whether you’ve opened your Flagstone account or you’re just getting started, we’re here to help.

Call us on +44 (0)203 745 8130, Monday-Friday 9am-5.30pm.