Base rate held at 5.25% – why smart savers are locking in rates now

There were no surprises today as the Monetary Policy Committee voted by a majority to hold the base rate at 5.25% for the sixth consecutive time. But with hints of cuts coming, is this the prime time for savers to lock in top rates?

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

There were no surprises today as the Monetary Policy Committee (MPC) voted by a majority to hold the base rate at 5.25% for the sixth consecutive time. But with hints of cuts coming, is this the prime time for savers to lock in top rates?

Two members of the committee switched to the ‘easing camp’ and voted to decrease the rate, backing a quarter-point reduction. This is a clear signal that the Bank of England (BoE) is edging closer to making cuts, following a cautious approach of holding steady since August 2023.

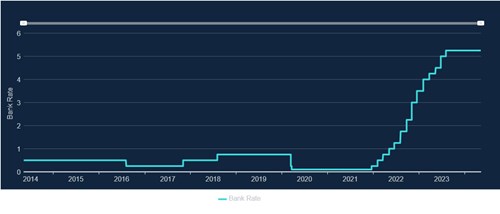

BoE base rate history

Source: BoE

The MPC’s outlier, Swati Dhingra, previously voted for rate reductions at the February and March meetings. So it was no surprise that she was one of the two members (alongside Dave Ramsden, one of the Bank's deputy governors) who took a dovish approach and advocated for a cut at today’s meeting.

Governor of the BoE, Andrew Bailey, said:

“We've had encouraging news on inflation and we think it will fall close to our 2% target in the next couple of months. We need to see more evidence that inflation will stay low before we can cut interest rates.

“I'm optimistic that things are moving in the right direction.”

A win for savers as the rate holds firm but inflation falls

5.25% continues to be the highest rate we’ve seen for 16 years. According to the latest figures from the Office for National Statistics, inflation currently stands at 3.2%, a marginal decrease from the previous 3.4%, and slightly below the anticipated 3.1% forecasted by analysts.

The interest rates on savings accounts tends to be linked to the base rate set by the BoE. So, when the base rate rises, banks often offer higher interest rates to attract customers. Inflation diminishes the purchasing power of your money over time. When your savings fail to grow at the same rate as inflation, the real value of your money decreases. By signing up to a savings account with an interest rate exceeding inflation, you can preserve or even increase the purchasing power of your cash over time.

With predictions of a rate decrease in the coming months, the time is ripe for savers to seize this opportunity. Our latest Flagstone Base Rate Poll found that a quarter (23%) of advisers are encouraging clients to lock in current rates in longer-term savings accounts.

If your money is sitting in an account earning little to no interest, there are hundreds of accounts offering rates above inflation. Many savers actively optimise their nest egg by regularly switching accounts to ensure they benefit from competitive rates.

If you’re looking for an effortless way to manage and grow your cash for maximum returns, our cash-deposit platform offers the solution. With a single login, unlock access to hundreds of accounts from 60+ banks, including exclusive interest rates.

View our partner banks and interest rates

When will interest rates start to drop?

After years of above-target inflation, which peaked at 11.1% in October last year, today’s outcome shows that policymakers are still wary of easing too soon.

The question is: if not now, when? Signs seem to be pointing towards the summer.

The next MPC meeting is Thursday 20 June. Before then, there’s two rounds of inflation and labour market data due to be released, which will heavily influence the outcome.

Confidence amongst financial advisers in the base rate holding at 5.25% is on the decline, according to our research data. Four in five (79%) advisers and wealth managers expect the rate to end the year at 4.5% or lower.

How can Flagstone help you manage your savings?

As the UK’s leading cash deposit platform, Flagstone lets you both protect your cash, and maximise its possibilities. Here are some of the benefits of opening an account with us:

- Maximise your interest: Grow your cash with exclusive rates from 60+ banks and hundreds of savings accounts.

- Protect what’s yours: Split your cash between banks, for maximum FSCS protection on your deposits.

- Escape the paperwork: Access hundreds of rates with a single application, and manage your savings with one password.

- Stay in control: Our platform is open and available 24/7. So you can manage your portfolio any time, from anywhere, at a moment’s notice.

- Secure your data: We protect your sensitive data with industry-leading Transport Layer Security (TLS). So you can take care of your cash, while we take care of your information.