If you’ve stumbled upon this page, there’s a chance you have cash savings somewhere. Whether it be in a current bank account, savings account, or stashed under the sofa.

In fact, 70% of adults had some form of savings account in 2022. Last year, savings in the UK hit £1.5 trillion. And for good reason – because having cash on hand brings peace of mind, propels you towards your goals, and enables you to explore opportunities when they come knocking.

Despite the perpetual benefits, some people who are able to save choose not to. Others fail to maximise the cash that they have. Take current accounts, for example – 17% of people stash their savings in these often zero-interest zones. While many make do with meagre returns from savings accounts offered by their current account provider.

Actively managing your cash is the best way to achieve higher interest rates and protect what’s yours. Read on to learn the essentials of saving, and start making the most of your cash.

Why saving cash matters

Saving means reserving cash for future use. And this has long been a rewarding and fundamental practice throughout history, evolving alongside economic systems and the establishment of banking institutions.

Today, saving cash remains the foundation of financial stability and opportunity, allowing you to weather storms and reach goals. It helps you enjoy greater long-term security, leading to a better quality of life.

Regardless of your net worth or aspirations, there are many reasons why you might want to save money or invest in cash. And if you can after covering all necessary expenses, your financial and personal situation is likely to improve.

Saving cash increases financial security

Saving is crucial for boosting financial security and wellbeing. By increasing saving contributions or setting aside money, you can build a safety net to ride out uncertain times, such as job losses or financial downturns. Having access to funds are a lifeline when you least expect it, offering peace of mind and empowering you to navigate life’s uncertainties with confidence. This can prevent you from falling into debt, jeopardising long-term financial goals, and experiencing periods of stress.

Saving cash helps you capitalise on opportunities

Setting aside cash for future use has a significant advantage compared to other investment options: its liquidity. This means you can access and use it immediately or with little notice. Having cash to hand lets you seize unique moments that arise, like forming a business, enjoying unmissable experiences, or splurging on an impulse purchase, all without resorting to high-interest loans.

In the investing world, promising opportunities present themselves at the drop of a hat, often leaving little time for planning. In this case, you can use cash savings as spontaneous ‘seed money’ for higher-yielding investments.

Saving cash helps you plan for life’s milestones

Saving is not only about creating a safety blanket, but also fulfilling aspirations and dreams. From buying a home, getting married, paying for a child’s education, or reaching retirement, life is full of milestones that come with hefty price tags. Having savings in your back pocket paves the way for a future filled with achievement, allowing you to reach goals comfortably and turn dreams into reality.

Saving cash prepares you for unexpected expenses

Many of us have felt the forces of life’s unpredictability, and the cost that comes with it – whether it’s an unexpected medical bill, car repair, property damage, or even a missed flight. A common reason to put savings aside is for when things don’t go to plan. Having a rainy-day fund for emergencies ensures you can handle sudden situations without disrupting other financial plans.

The benefits of understanding how saving cash works

Saving cash is not just about squirreling money away in a savings account and forgetting about it. It’s worth understanding the mechanics of saving, so that you can grow and protect your wealth.

Preserving and managing wealth

Mastering effective cash saving is key to preserving and growing your money. When you grasp saving principles and financial nuances, you’re more likely to make informed decisions that have a lasting impact on your wealth. Savings knowledge helps you allocate funds successfully, mitigate risk, and maximise interest earnings.

Reducing tax burdens

By understanding how and when different savings products incur taxes, you can make strategic choices that minimise your tax charges and keep more of your hard-earned money.

Achieving personal goals

Setting and achieving realistic goals becomes easier when you have a solid understanding of saving. Knowing how much to save, where to allocate your money, how to boost interest, and how to track your progress, can enhance your chances of reaching your objectives.

Saving vs. investing

Saving and investing are both financial practices, yet they differ in their intentions and approaches.

Saving is storing money in low-risk, liquid accounts for wealth preservation. While investing aims to grow money over time by putting it into riskier assets like stocks. Investing in cash and saving both involve depositing money into savings accounts, but investing in cash is a strategic method focused on generating returns.

Setting goals and choosing savings accounts

Whether you're saving for your dream wedding, a down payment on a house, or your retirement nest egg, defining your savings goals lays the groundwork for effective financial planning. But how do you determine the right amount to save? And where should you stash your cash for optimal growth?

Setting goals for saving and growing cash

Define your savings goals

Knowing exactly what you're saving for, and actively working towards those goals, will increase your chances of growing your wealth. Are you focusing on short-term cash growth before investing? Or perhaps you’re aiming for a medium-term goal such as buying property, or a long-term goal like retirement? Either way, understanding your objectives will help guide your financial planning.

Define your goals with precision, decide how much you want to accumulate, and set a realistic timeline to achieve this. SMART goals – Specific, Measurable, Achievable, Relevant, and Time-bound – provide a framework for saving success and accountability.

For example, if you’re saving for a down payment to buy a home, your SMART goal might be:

“I’ll grow my £50,000 savings by at least another £50,000 in two years. I'll achieve this by saving an extra £2,000 monthly in a fixed-term account earning 5% interest.”

How much should you save?

How much are you willing and able to save? Do you plan to make regular deposits into a savings account or do you have a lump sum you’d like to grow? Figuring out your answers to these questions will help you to set achievable goals.

Knowing how much to save depends on several personal factors, such as:

- Age and life stage

- Current income

- Lifestyle expenses

- Financial priorities

- Risk tolerance

As a first step, use a savings calculator to help you understand how much to save each month, and how long it’ll take to reach your goals.

The different types of savings accounts

Fixed-term account

A fixed-term account offers stability and a guaranteed interest rate for a set period. They typically provide security and higher interest rates, but you’ll need to lock in your funds for an agreed term. If your provider allows you to withdraw your cash early, you’ll usually have to pay a penalty fee.

Instant access account

An instant access account gives you more flexibility, allowing you to deposit and withdraw funds without penalties. It generally offers a higher rate of interest than a standard current account, without incurring any penalty charges.

Notice savings account

Notice savings accounts offer a balance between flexibility and high interest rates. Compared to instant access accounts, they generally offer higher interest rates, but you’ll need to give advance notice to your provider before withdrawing funds.

Learn: Glossary of common savings terms

Choosing the right savings account for your needs

There are several different types of savings accounts you can choose from, each with their own features, so how do you decide which savings account is right for you?

Choose savings accounts that align with your financial goals and timelines. For example, an instant access account is suitable for a shorter-term savings goal, while a fixed-term account offers stability for longer-term goals. Consider factors such as:

- How quickly you’ll need access to your cash should you need to withdraw it

- What charges you’ll incur for withdrawing funds, whether at home or overseas

- How much you’re planning to deposit into a new account

- The degree of certainty you need regarding the stability of your interest rate

Explore: What type of savings account should you open?

How many savings accounts should you have?

Having multiple savings accounts is a smart strategy with a range of advantages, including:

- Accelerated savings growth

- Enhanced goal tracking

- Improved cash protection

- Reduced temptation for unnecessary spending

Opening and managing several accounts might seem like a lot of admin. But with a cash deposit platform, you can access a range of savings accounts and interest rates from different banks – all in one place. This simplifies the process of transferring money into multiple high interest savings accounts.

How to open a savings account

Now that you’ve set your saving goals, it’s time to open a savings account – or several. You can go directly to the bank or you can open a cash deposit platform to access multiple savings accounts.

Opening a savings account directly with a bank

Step one: choose a bank and savings account

Before opening a savings account, do your research and compare the options available. Decide on the bank, interest rate, term, fees, and minimum balance requirements that align with your financial goals and personal values. Remember, there are alternative banks beyond the high street names.

Step two: gather the required documents

Along with your name, date of birth, email address, and phone number, you’ll need to provide some documentation. Typically, banks ask for photo ID such as a passport or driving license, and proof of address like a recent utility bill or bank statement.

Step three: visit the bank or apply online

It’s time to open the account. Most banks will let you apply online, but you may need to apply in branch, over the phone, or by post. If applying online, visit the website of the bank, agree to the terms, and follow the application instructions.

Step four: deposit your funds

Once your application is approved, you’ll need to fund your account. For online applications, this is usually done via a bank transfer. If you visit the branch, you can often deposit cheques or physical cash. Some savings accounts require a minimum deposit to open the account, so be sure to have the funds ready.

Opening a savings account via a cash deposit platform

Read more: What is a cash deposit platform

Step one: choose a cash deposit platform

Take some time to research the cash deposit platforms available. Look at factors such as number of banks on the platform, interest rates, fees, minimum deposits, and reviews.

Step two: sign up for a platform account

Visit the platform’s website and follow the prompts to create your platform account. Prepare to input basic personal information, including name, employment status, NI number, and the source of your deposit funds. You may need to provide ID and proof of address too.

Step three: transfer your funds

Once set up, log in and fund your platform holding account via a bank transfer. The holding account receives and stores your money before it’s moved into your chosen savings accounts.

Step four: select your savings accounts

It’s time to pick your savings accounts from the many options available. Browse the selection and open as many as you like by selecting the account and entering the amount you wish to deposit into each.

How to create a plan to protect your savings

Before considering strategies for growth, it's important to ensure the safety of your hard-earned money. Here's how to get started:

1. Evaluate your financial situation

Begin by assessing your current financial situation. Take stock of how much cash you have, how much you plan to add to your savings pot, and where your money is allocated across different banks and building societies. Understanding where you stand financially will provide a foundation for developing your savings plan.

2. Set aside an emergency fund

An emergency fund is a pot of money set aside in case of an unplanned expense, such as medical bills or a loss of income. Having a financial safety net gives you peace of mind that, should the unexpected happen, you’re prepared for any financial setbacks. To build your emergency fund, aim to set aside at least three to six months' worth of living expenses in an easily accessible account.

3. Choose safe haven options

When it comes to safeguarding your savings, prioritise stability over high returns. If you prefer low-risk options, consider safe haven assets like high-interest savings accounts. These offer greater security for your money compared to more volatile options, such as investing in stocks.

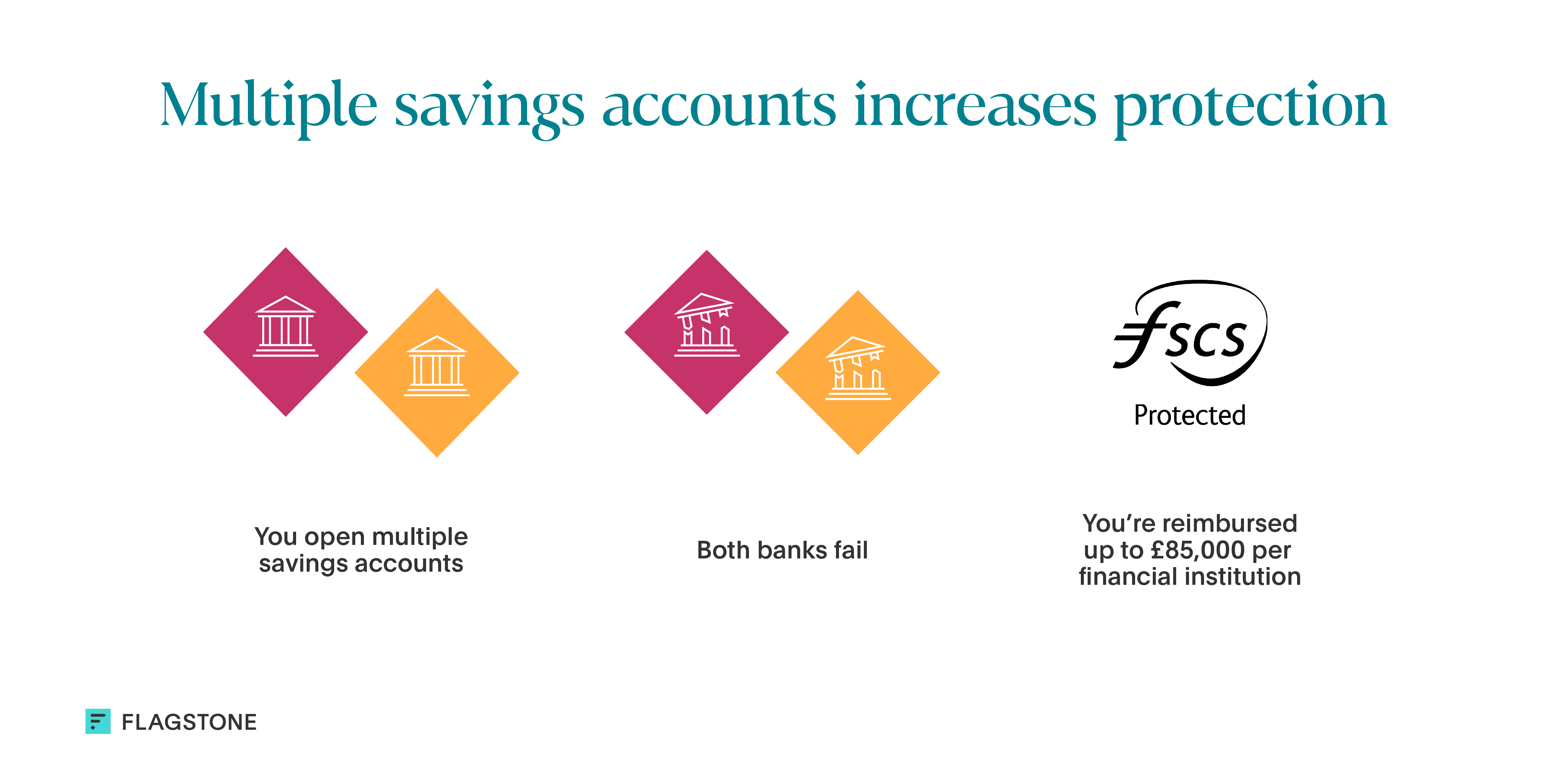

4. Diversify your cash savings

If you have over £85,000 in cash, it's wise to diversify within this asset class and avoid putting all your eggs in one basket. Instead, spread your savings across different accounts and banks to maximise Financial Services Compensation Scheme (FSCS) protection. FSCS protection ensures you receive compensation up to a set limit if your provider collapses.

5. Consider inflation

Inflation can reduce the purchasing power of your money. This means the money you have today might not be worth as much in the future. So while focusing on safety, don't forget to account for inflation. If possible, choose savings accounts that keep pace with inflation to ensure your savings maintain their value in the long term. You can keep track of the latest UK inflation rate on the ONS website.

6. Review and adjust your plan

Financial circumstances change, and so should your savings strategy. Regularly review your plan to ensure it remains aligned with your goals and risk tolerance. Be prepared to make adjustments as needed to adapt to evolving economic conditions.

How to create a plan to grow your cash

Building a tailored savings plan is a solid way to grow your wealth. Let's look at some of the key considerations:

1. Assess your saving goals and risk tolerance

Define your saving goals and assess your risk tolerance. Are you saving for a wedding, a down payment on a house, or retirement? Understanding your objectives will guide your decisions and risk appetite. Even if you’re just saving for a rainy day, making it an intentional goal means you’re more likely to succeed.

2. Research high-interest savings accounts

Explore high-interest savings accounts that offer competitive interest rates. These accounts provide a safe haven for your cash while allowing it to grow. If possible, apply for high-interest savings accounts with rates that beat inflation, so rising prices aren’t lowering the value of your money.

Which savings accounts offer the best interest rates?

Typically fixed-term savings accounts offer the best interest rates, because you’re committing to locking your money away for longer periods of time. The longer you lock it away, the higher the rate tends to be.

3. Shop around to compare rates and terms

Don't settle for the first savings account you come across. Shop around and compare rates, terms, and fees across different financial institutions. Look for accounts with favourable terms and minimal fees to maximise your returns. There are several factors to consider when thinking about what type of savings account is right for you.

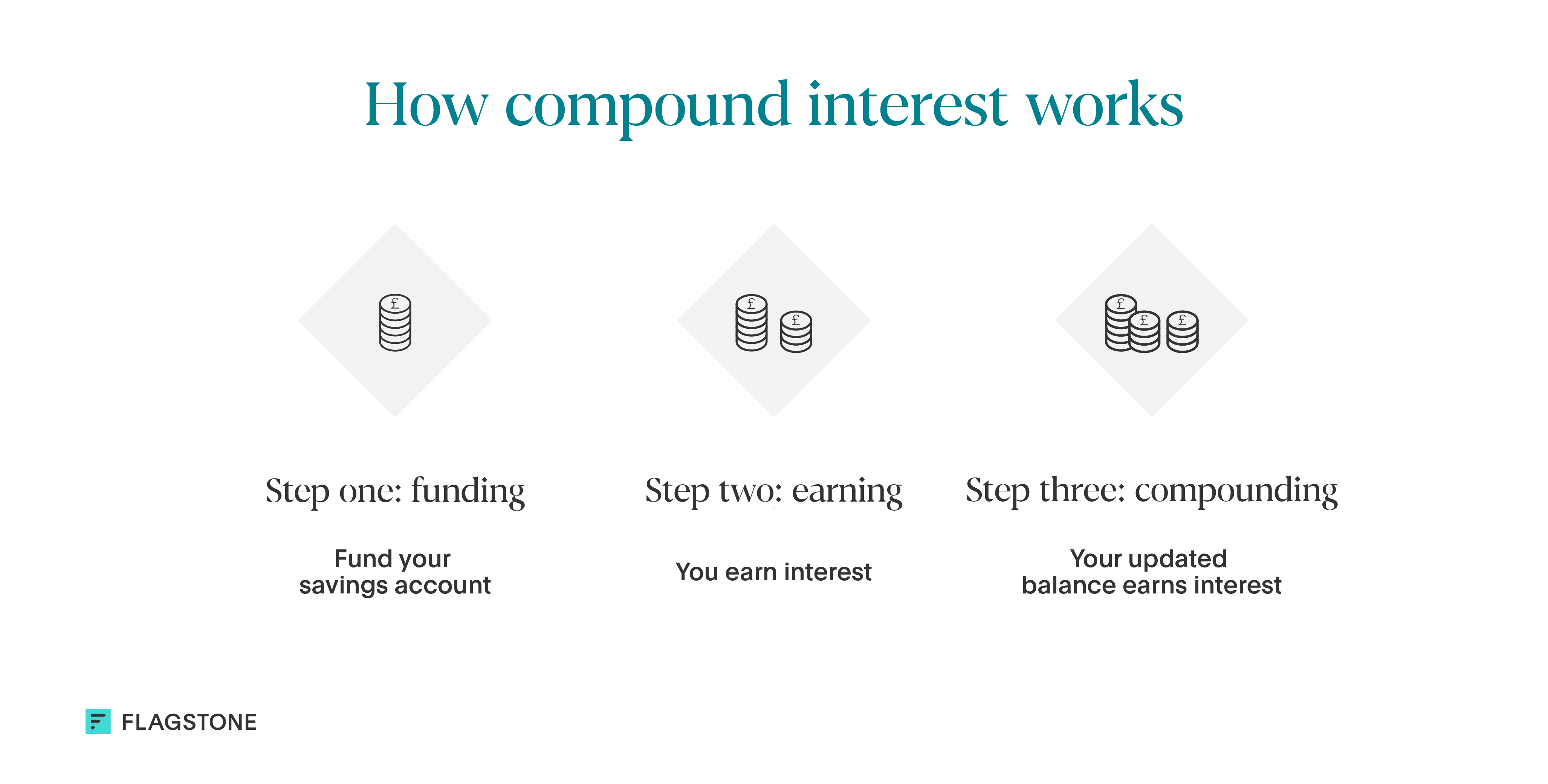

4. Consider compound interest

Compound interest can be a powerful tool to grow your savings passively. Understand how often your interest compounds in your savings account to figure out the rate of growth. Is it monthly, quarterly, or yearly? The more often compound interest occurs, the better.

By committing to saving as early as possible, over a long period of time, your savings pot can grow much faster than it would with simple interest. This makes it an effective approach for long-term savers. The sooner you start saving, the more time your deposit has to compound and increase.

5. Monitor and rebalance your cash savings portfolio

Regularly monitor and adjust your savings portfolio to make sure you’re capitalising on the latest rates and higher returns. Keeping track of how you’ve allocated your funds helps you to spot new opportunities to grow your cash.

Tax-efficient saving strategies

It’s important to know how tax-free allowances and accounts work, so you can keep and grow your hard-earned money.

Personal Savings Allowance

Depending on your income, you might have to pay tax on your savings. While the cash you have won’t be taxed directly, the interest you receive might be.

The Personal Saving Allowance (PSA) lets you earn a certain amount of interest on your savings each year without paying tax. However, not everyone gets the same allowance. It varies based on your income tax band:

- Basic rate taxpayers (20%) can earn up to £1,000 in interest before tax is due.

- Higher rate taxpayers (40%) can earn up to £500 in interest before tax is due.

- Additional rate taxpayers (45%) do not get a PSA.

It’s not just your savings at the bank or building society that count towards your interest amount. If you have a trust fund or bonds that also pay interest, this will be included. View a full list of financial products and services your allowance applies to.

Cash ISA

Cash ISAs are a tax-free haven for your savings. While there are annual limits on contributions, cash ISAs allow you to maximise your returns by shielding it from Income Tax and Capital Gains Tax.

The government sets the limit on how much you can save while making the most of the tax-free benefits. In the 2024/25 tax year, you can save up to £20,000 in a cash ISA.

There are different types of cash ISAs depending on how you plan to use them, including instant access and fixed-rate accounts. The latter will usually pay a higher interest rate, but your money will be locked away for longer.

How to allocate cash in a portfolio

Like many other savings decisions, the allocation of cash within your investment portfolio depends on your risk appetite and goals. Cash provides liquidity and stability to your portfolio. As a rule of thumb, aim to keep at least three to six months' worth of living expenses in cash to cover emergencies and unexpected expenses. Depending on your savings goals, you may need to adjust this. A Financial Adviser can help you to decide how best to allocate your wealth.

Adapting to economic trends and market changes

As the financial landscape changes, it’s important to stay informed and flexible. By doing so, you can adapt your saving strategy accordingly and make your money go further.

Economic factors to watch when saving

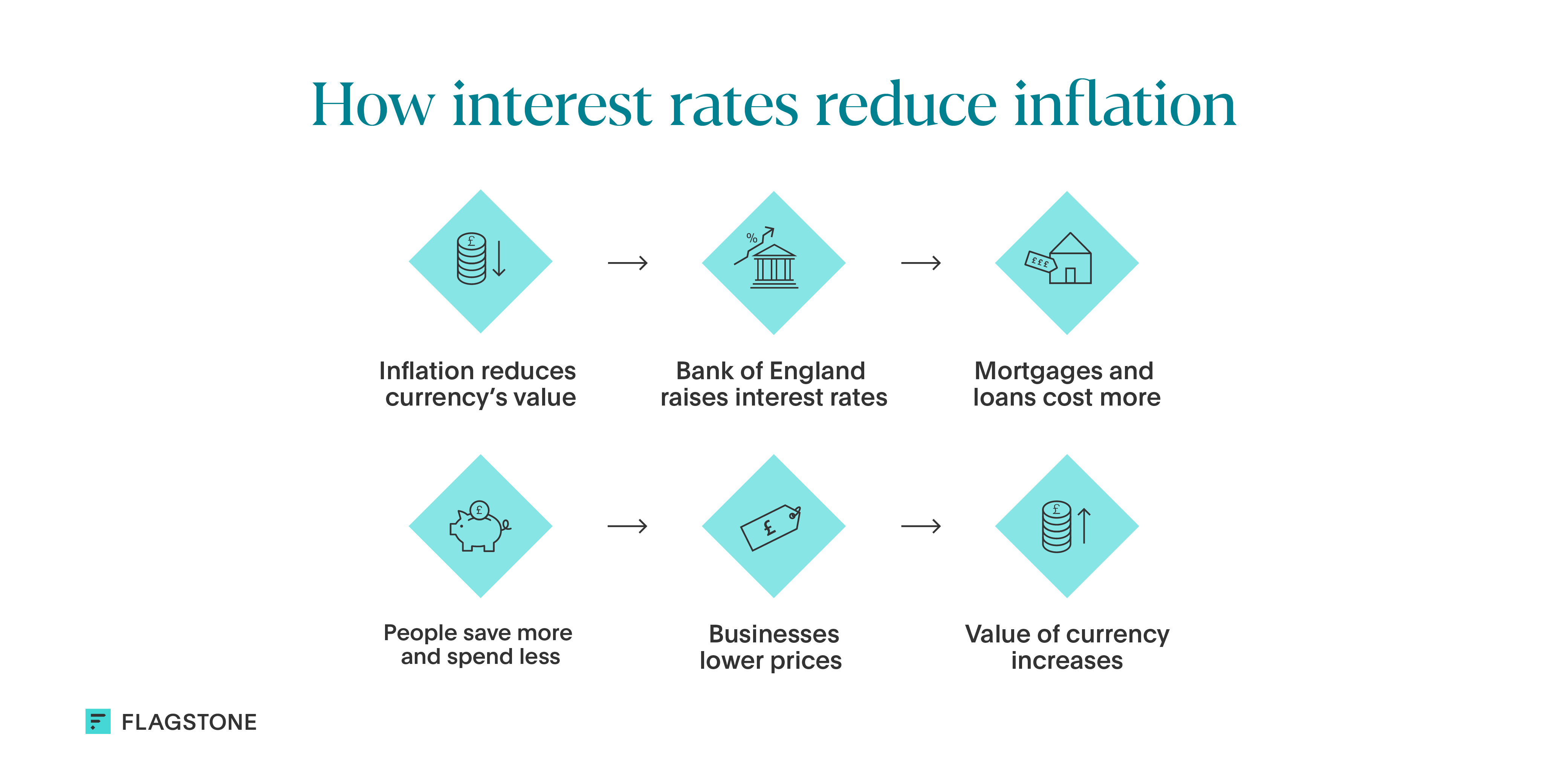

Inflation rate

Inflation directly influences the value of your cash savings, so it’s important to consider the rate of inflation when deciding how to protect and grow your wealth. If the inflation rate surpasses the interest rate on your savings account, your money's purchasing power diminishes over time. Although the actual value of your cash doesn’t decrease, its ability to buy goods and services weakens when inflation is higher than interest rates.

If you’re investing in cash for growth or preserving your savings for the future, inflation can affect your choice of savings account and how regularly you switch. Opt for high-interest savings accounts to make your money go further.

Interest rates

Keeping track of the base rate, or Bank Rate, is important when managing your savings. Set by the Bank of England to control inflation, the base rate determines the amount of interest paid to commercial banks. It acts as a benchmark for national saving and borrowing rates offered by other banks.

Changes to the base rate could impact the interest you receive from your savings account. Stay informed about upcoming review dates so you can adjust your plan accordingly.

View 2024 dates for the Bank of England base rate announcements.

Gross Domestic Product

Gross Domestic Product (GDP) is a metric indicating the health and direction of the economy. When GDP grows, it suggests more consumer spending, investments, and employment opportunities. This can lead to better savings rates. In contrast, a shrinking or stagnant GDP may signal economic challenges like a recession or inflation. The Bank of England often adjusts interest rates to mitigate economic downturns and stimulate activity. It’s worth understanding these monetary policies for optimising returns on your savings.

The labour market

The labour market is closely tied to the health of the economy. Income, employment, and spending confidence are intertwined, shaping how consumers save. When wages rise and people feel secure in jobs, spending tends to follow suit – and vice versa. Due to the principle of supply and demand, changes in saving habits can ripple through to interest rates.

Read more: Understanding inflation, the base rate, and GDP

Financial trends to consider when saving

New technology and digital innovations

Financial technology (fintech) is rapidly evolving, offering a range of tools and platforms designed to revolutionise saving. From robo-advisers to app-based banks and cash deposit platforms, digital developments have transformed how people manage their finances.

Embracing tech innovations boosts efficiency and convenience, enabling you to stay ahead of the curve and achieve the best possible savings results.

Environmental, social, and governance (ESG)

As awareness of sustainability and corporate responsibility grows, people are recognising the importance of integrating ESG criteria into their investment and saving decisions. You can now opt for banks that prioritise sustainability, ethics, and corporate responsibility to align your values with your financial choices and contribute to positive change.

Read more: Understanding the different types of ethical banks

Take control of your financial future

Knowing how to optimise your cash savings can be confusing as first, but with a commitment to actively manage your savings and the right approach, you can steadily grow and safeguard your wealth.

Start by assessing your finances and setting goals before choosing your tactics. And don’t forget to regularly review and adjust your plan as needed.

Flagstone’s cash deposit platform can help you proactively grow and protect your savings by simplifying the process of opening and managing multiple accounts – all in one place, with one application and log in.