Growing your savings with a five-year savings plan

Whether you're looking to save for a house, a new arrival, or you want to shore up your finances, planning ahead makes all the difference. In this article, we explore the range of options to help grow your savings.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

What do you want your finances to look like in five years? Perhaps you dream of purchasing a property, starting your own business, or simply building a safety net for the future. Taking a long-term approach to saving can unlock greater financial security, as you work towards your aspirations.

You can think of a savings plan as your financial road map, there to hold you accountable and guide you towards achieving your life goals. A savings plan can give you an accurate picture of the current state of your finances and what you’re working towards next.

Below, we’ll uncover how a savings plan can help you grow and preserve your wealth and legacy for years to come.

What is a savings plan?

A savings plan is a wealth management strategy designed to help you manage your finances and save money over time, giving you a better chance at reaching specific financial goals. Funding major life events or building an emergency fund takes discipline and perseverance, both of which a savings plan can foster.

A savings plan often involves establishing both short-term and long-term financial goals. You can use different savings accounts to accumulate interest and grow your wealth over time.

What does a savings plan involve?

The key components of a savings plan vary depending on your financial circumstances and aspirations, which is why it’s important to start by defining your short and long-term goals.

From there, you can identify the amount of money you need to save and the strategies you’ll adopt to achieve your milestones.

Here are some strategies to consider when building your savings plan:

- High-yield savings accounts: If you’re looking to protect your wealth but still want to have a pot of cash to hand, a high-yield savings account may suit you. Remember, you can use your Personal Savings Allowance (PSA) to earn tax-free interest up to a set amount. The allowance you’re entitled to will depend on the income tax band you’re in. Our guide to interest rates explains this in greater detail.

- Diversification: It’s important to spread your investments across different asset classes, known as diversification. Doing so can maximise your gains and could minimise risk to your investments. By investing in a range of financial products, from stocks and bonds to real estate, you can still benefit from your other investments should one asset class dip in value.

- Tax-efficient strategies: Tax efficiency is an important consideration for your savings plan. Understanding which investments are most tax-efficient can significantly impact the value of your investments. For example, Individual Savings Accounts (ISAs) allow you to save or invest up to £20,000 without paying tax on any returns you gain.

If you’re not sure where to begin with putting together your savings plan, consider reaching out to a Financial Adviser. They can provide professional advice tailored to your unique circumstances.

Financial advisers can also help you compare savings accounts, investments, and ISAs to find the right one for your needs.

How long should your savings plan be?

Generally, you want to ensure your savings plan stretches a few years into the future. Below, we’ll cover the most popular durations for savings plans and the pros and cons of each approach.

Short-term savings plan – up to three years

A short-term savings plan is designed for purchases in the near future, such as home improvements or holidays.

| Pros | Cons |

| Funds are easily accessible. | Savings won't have time to grow as much through compound interest. |

| Calculate finances accurately, based on current market conditions. | Rates are generally less competitive for shorter time periods. |

Medium-term savings plan – 5-10 years

A medium-term savings plan is ideal if you’re saving for a larger purchase, such as a house deposit or your child’s university fund.

| Pros | Cons |

| Funds benefit from longer periods of earning compound interest. | Less flexibility to withdraw funds in case of an emergency. |

| Fixed term accounts offer more competitive rates if you don't need money right away. | Market conditions can change, requiring you to update your plans. |

Long-term savings plan – 10+ years

If your financial goals require significant funds, such as retirement savings or a major philanthropic project, a long-term savings plan could be the best way to make them happen.

| Pros | Cons |

| Maximum opportunity to earn from compound interest. | Extended timelines lead to greater unpredictability of market performance. |

| Increased financial stability at later stages in life. | Significant life changes can occur over ten years. |

While each of the examples above have their strengths and weaknesses, the medium-term savings plan is usually the most popular. This is because it offers a balance between looking to the future and focusing on tangible goals.

How to create a five-year savings plan

Here are some steps you can take to put together a five-year savings plan that works for you:

- Reflect on your current situation: List all your monthly expenses, review your accounts, and how much you’ve saved already.

- Define your goals: Make sure you know exactly what you’re saving for. Break down your goals into manageable steps so they’re more achievable. If you have numerous financial goals, assign a target amount to each one.

- Put together a schedule: Calculate how much you’ll need to set aside each month to reach your five-year goal, with milestones to track your progress.

- Choose your tools: Decide where you’re going to save your money and the investment options you’ll use. Cash deposit platforms can make it easy for you to move your money between accounts and maximise the returns on your savings.

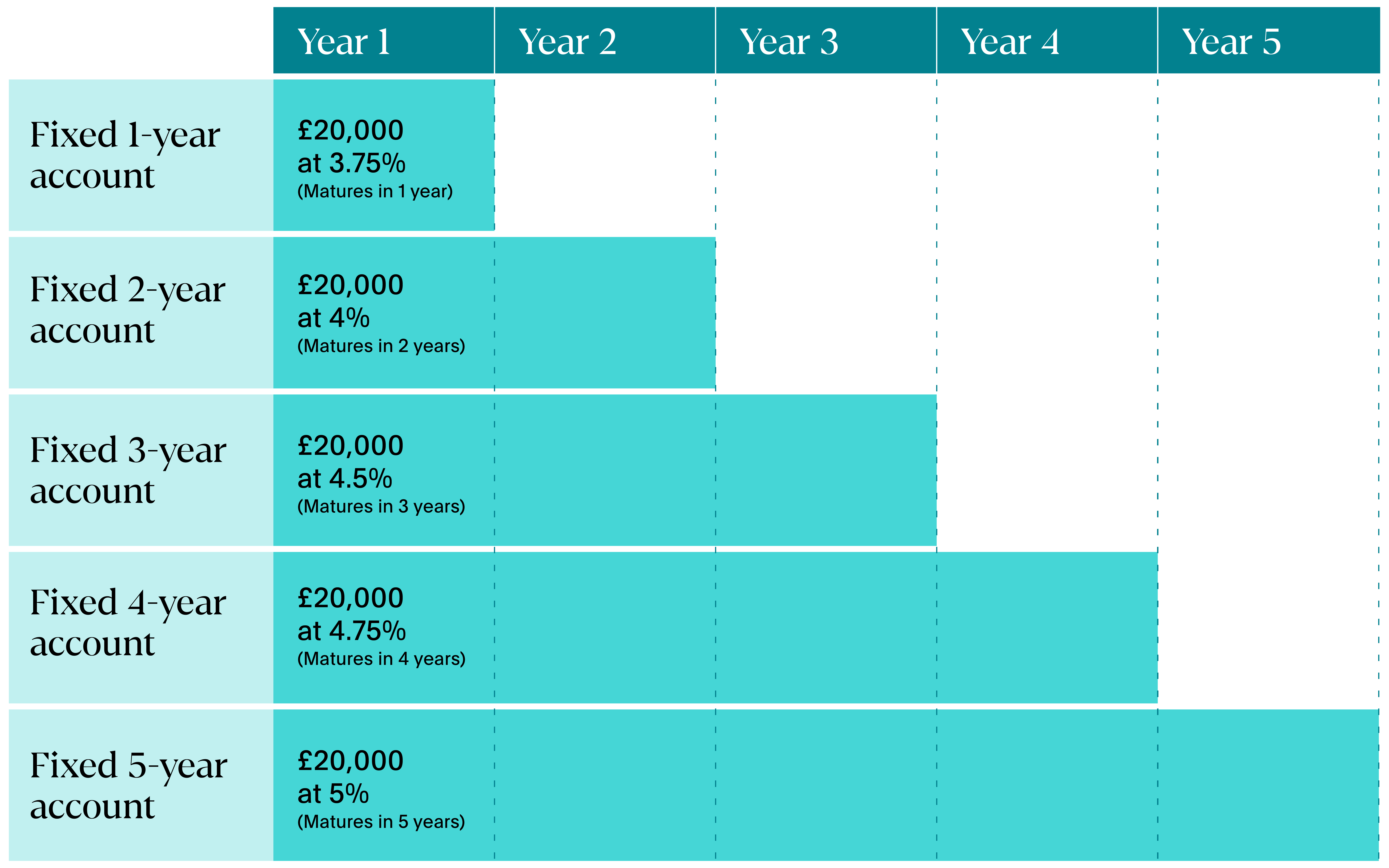

You can use cash deposit platforms like Flagstone to put a five-year savings plan into action and see all your savings accounts in one place. By spreading your investments across several accounts, you can tier your investments to mature at various times.

This means you can balance the returns from long-term investing without locking all your funds away for half a decade.

Savings plans can grow your finances for the future

Your financial goals could soon be within reach with a five-year savings plan in place. Whether you’re looking to grow your emergency fund or invest in your future, a savings plan gives you both structure and motivation to bring you closer to your goals.

Flex your finances through saving with Flagstone

Our cash deposit platform can spread your funds across multiple account types, ensuring you have the flexibility to save for the short and long-term with confidence.

You’ll be in complete control of your portfolio, with full visibility to watch your savings grow.