Bank of England holds rate at 15-year-high

The Bank of England has held the base rate at 5.25% for the third time running. The rate still stands at its 15-year-high, and is now higher than inflation.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

There were no fireworks today as the Bank of England met for the final time in 2023 to discuss rates. As predicted, the Monetary Policy Committee (MPC) held the base rate at 5.25% – making it the third meeting in a row resulting in a ‘no change’ vote. Six of the committee members voted for the base rate to remain and three members voted for a rise by 25 basis points.

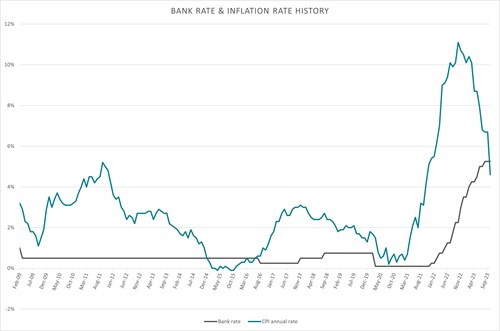

Before pausing the hike-cycle back in September 2023, the central bank raised the base rate 14 times over the course of two years. The surge in rates followed a dreary inflationary spike fuelled by Covid-19 and bolstered by Russia’s invasion of Ukraine.

The decision to leave the rate untouched comes as no surprise, with the market previously pricing an almost 100% chance of a hold. The question of what will happen next year causes more of a debate though.

What will happen next year?

Some market circles anticipate a rate reduction happening earlier than expected. This speculation stems from the accelerated decline in inflation and analysis of historical trends in rate adjustments. A faster speed in cuts seems to be more consistent with patterns observed in previous cutting cycles.

Despite bets on early rate cuts next year, the Bank of England’s Governor Andrew Bailey opposes such ideas. He claims it’s “far too early” to consider lowering rates, emphasising the importance of keeping rates at their high levels for the foreseeable future.

In fact, today the bank warned that it could raise the rate higher (if needed) as they “continue to monitor closely indications of persistent inflationary pressures”. The bank’s first aim is to restore inflation to its 2% target, and the MPC believes premature cuts could hinder the process.

What does this mean for savers?

Although the base rate has remained unchanged, it’s worth noting that it has not reached this high level since 2008, almost 16 years ago. Considering this, savings accounts continue to offer attractive rates and robust returns for cash holders.

The current base rate at 5.25% is not only a departure from historic lows, but also now higher than the inflation rate which stands at 4.6%. This presents an opportunity for individuals to find inflation-busting savings accounts – a trend not seen for over six years, with the last instance happening in May 2016.

Sources: Office of National Statistics and Bank of England

However, it's crucial for savers to remain vigilant, as inflation persists at over two times its target. For those whose savings accounts don't offer competitive rates, there is a risk of losing out to the eroding effects of inflation.

Flagstone helps ensure you're always on top of the changing rate climate and making the most of your savings. Our cash deposit platform lets you move money around different savings accounts in just a few simple clicks – so you can make sure you're earning the best possible returns.

See how much you could earn on your savings.