What’s the outlook for the base rate and inflation?

Ahead of the Monetary Policy Committee announcement, we surveyed over 230 senior savings professionals to gauge their predictions on the base rate decision and inflation outlook.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

On Thursday 9 May, the Bank of England's Monetary Policy Committee (MPC) will meet to decide whether to keep the base rate at its current level of 5.25%.

Ahead of the announcement, we surveyed over 230 senior savings professionals* to gauge their predictions on the base rate decision and inflation outlook. They also shared their strategies for safeguarding your savings.

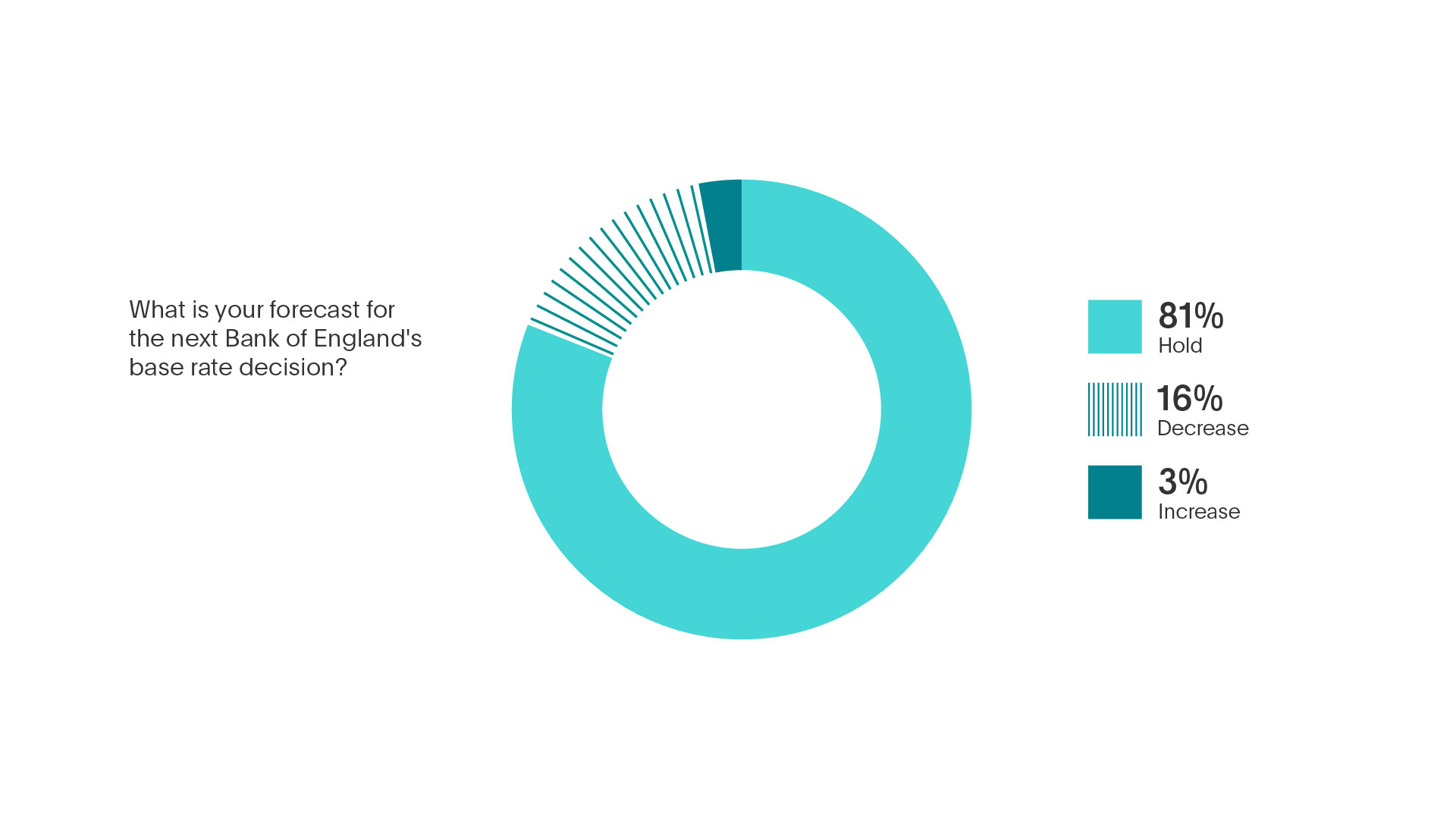

The base rate forecast

Of those surveyed, 81% believe the MPC will vote to hold the base rate at 5.25% for the sixth consecutive time. This is down from the 96% who correctly predicted a no-change vote in our March poll.

At the March meeting, the MPC voted by a majority of 8–1 to maintain the base rate at 5.25%. The current rate is the highest it’s been for almost 16 years, although many anticipate a rate cut in the summer.

Unsurprisingly, the biggest factor influencing a hold prediction is stubborn inflation, which fell to 3.4% in February. Although it’s now showing signs of coming under control, inflation is still above the government's 2% target. Many respondents expressed concerns about inflation levels, suggesting it's still higher than desired or not decreasing as quickly as anticipated.

The prevalent sentiment was that the Bank of England (BoE) will take a cautious approach before considering rate cuts. Respondents cited several factors influencing their decision, including:

- Uncertain economic conditions

- Geopolitical risks

- The need for clearer signs of sustained economic improvement

There's also a perception that the BoE may align its decision with the US Federal Reserve, who have left rates unchanged since July 2023.

The impact on the savings market

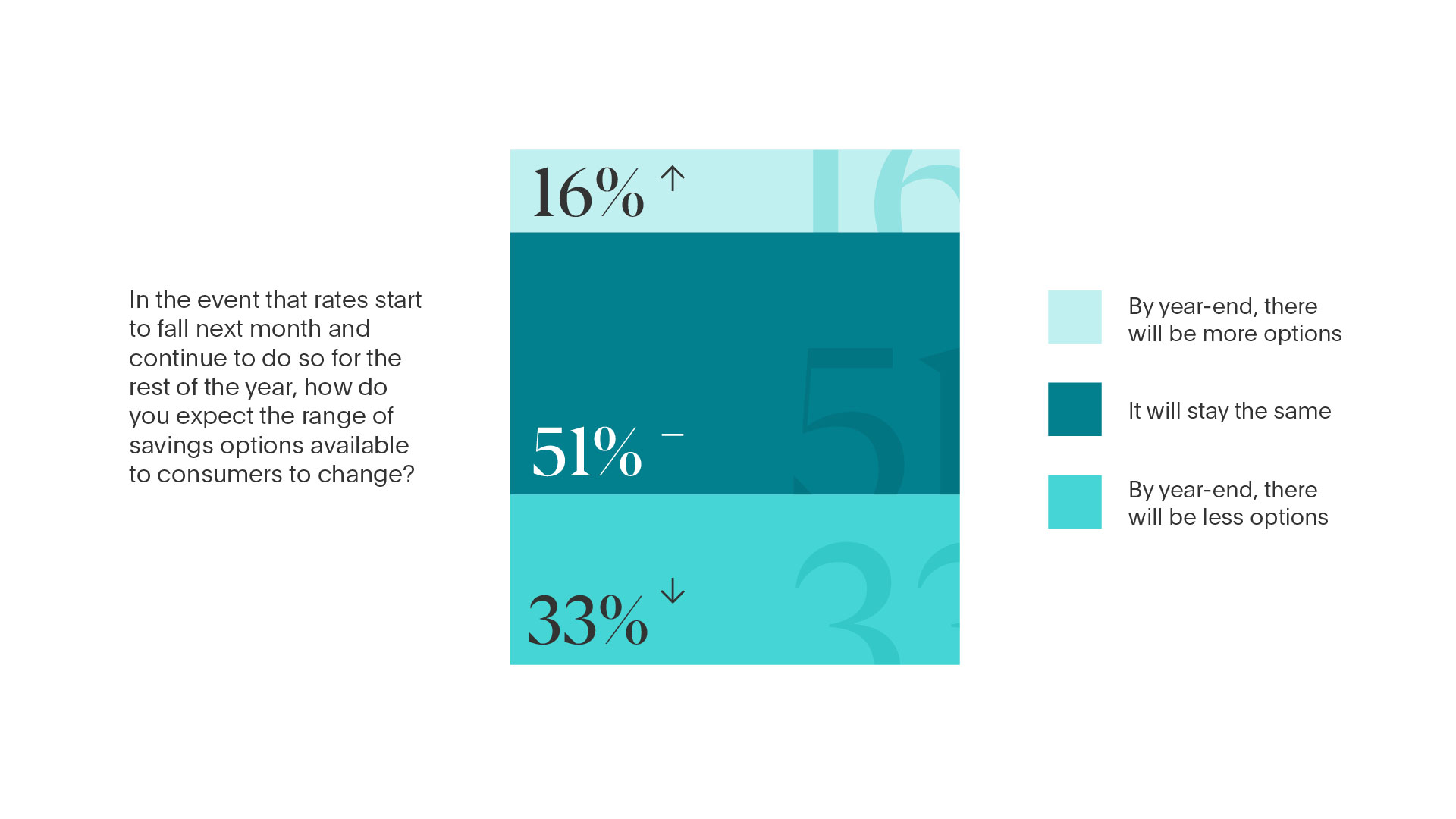

Over half (51%) of savings professional at banks speculate that the number of savings options available to consumers will stay the same when the base rate eventually begins to fall. A third (33%) expect there to be less options, while the remaining 16% forecast more options for savers.

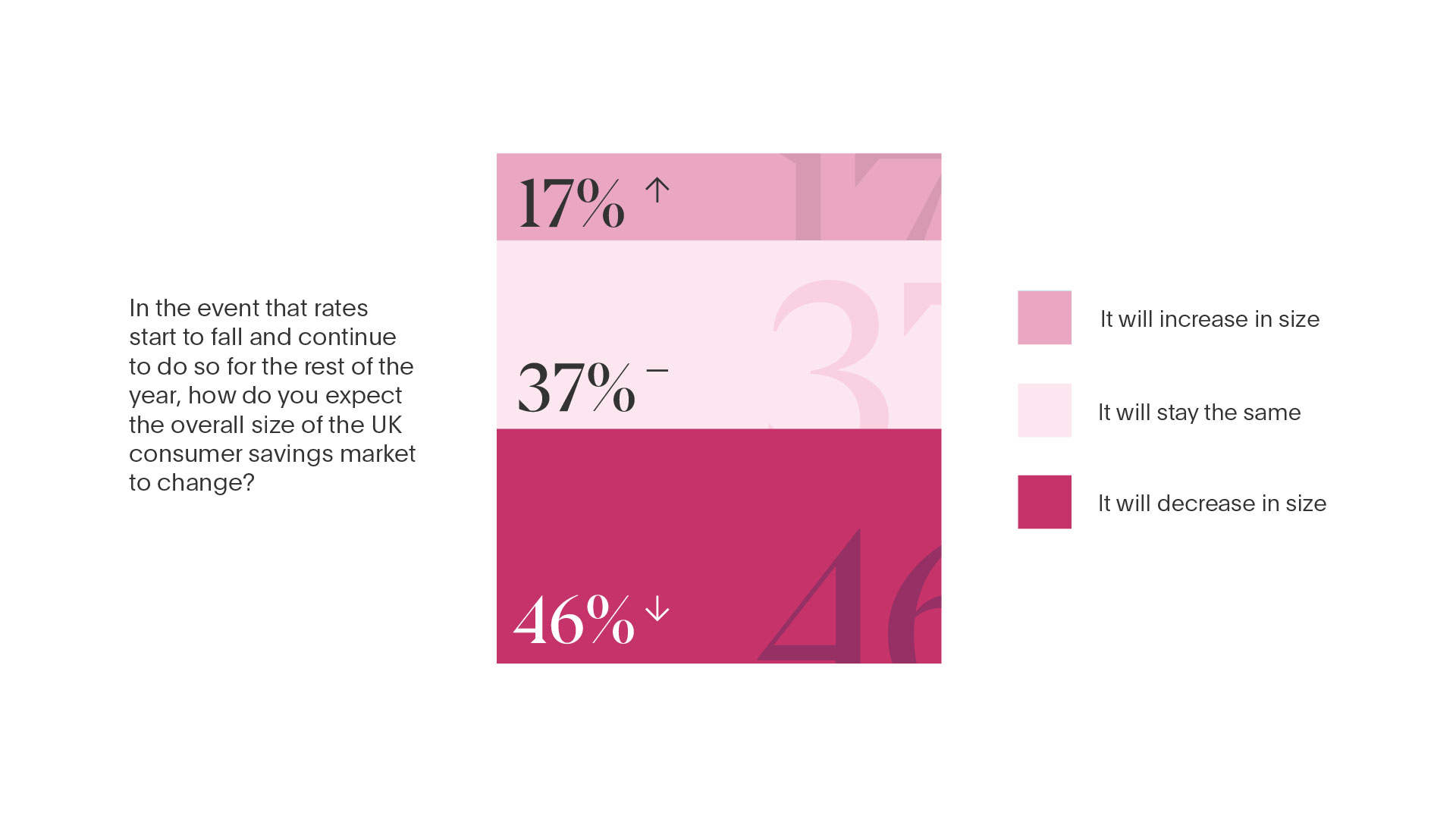

Almost half of respondents (46%) foresee a decrease in the size of the UK consumer savings market (currently valued at £1.5 trillion) if the base rate starts to fall this year. This suggests an outlook of increased consumer spending as the ‘green shoots’ of economic recovery start to emerge.

The future of the base rate and inflation

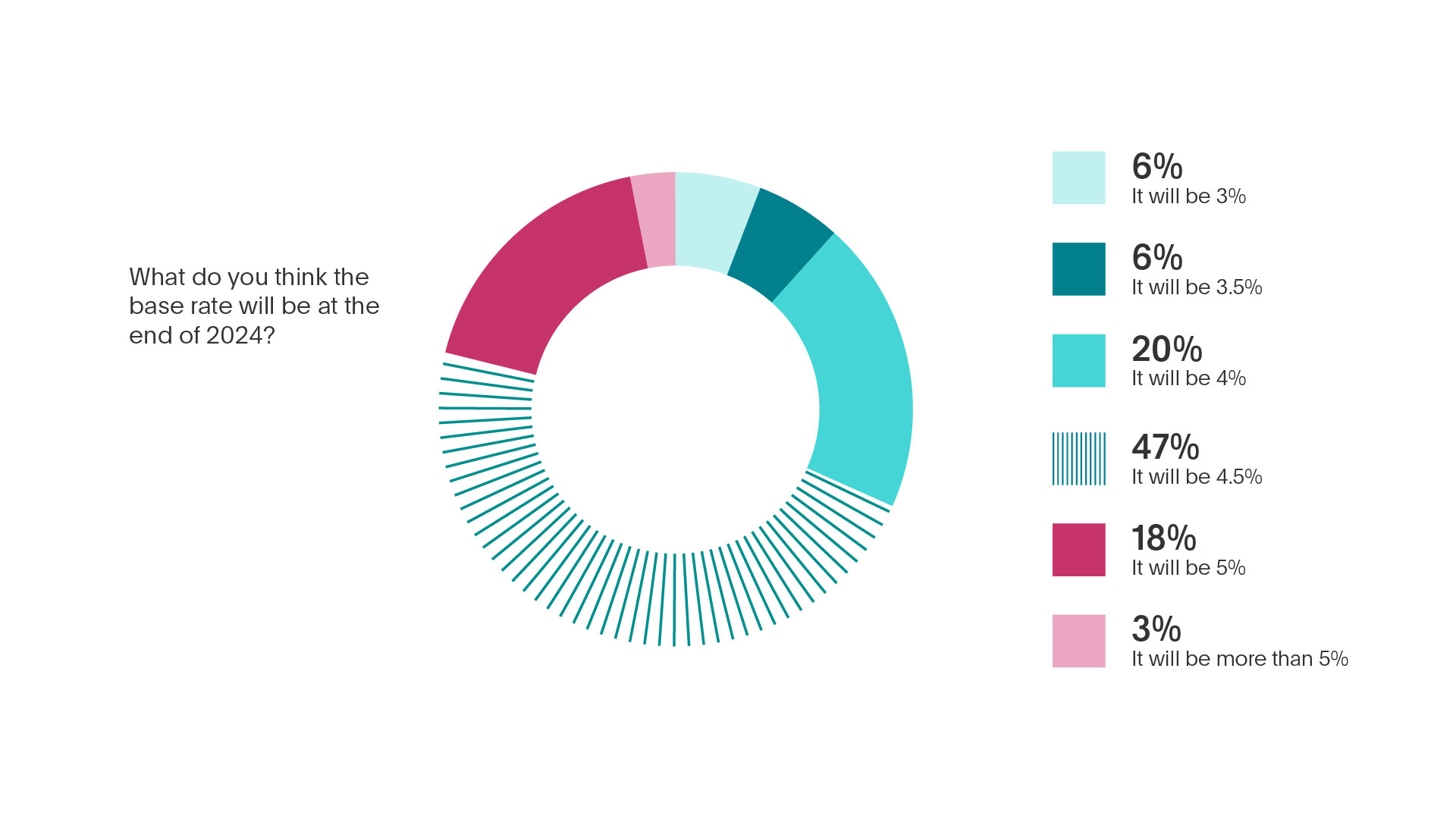

The majority of financial advisers (47%) anticipate the base rate to be at 4.5% at the end of 2024, signalling a sentiment towards a moderate but not drastic decrease from current levels.

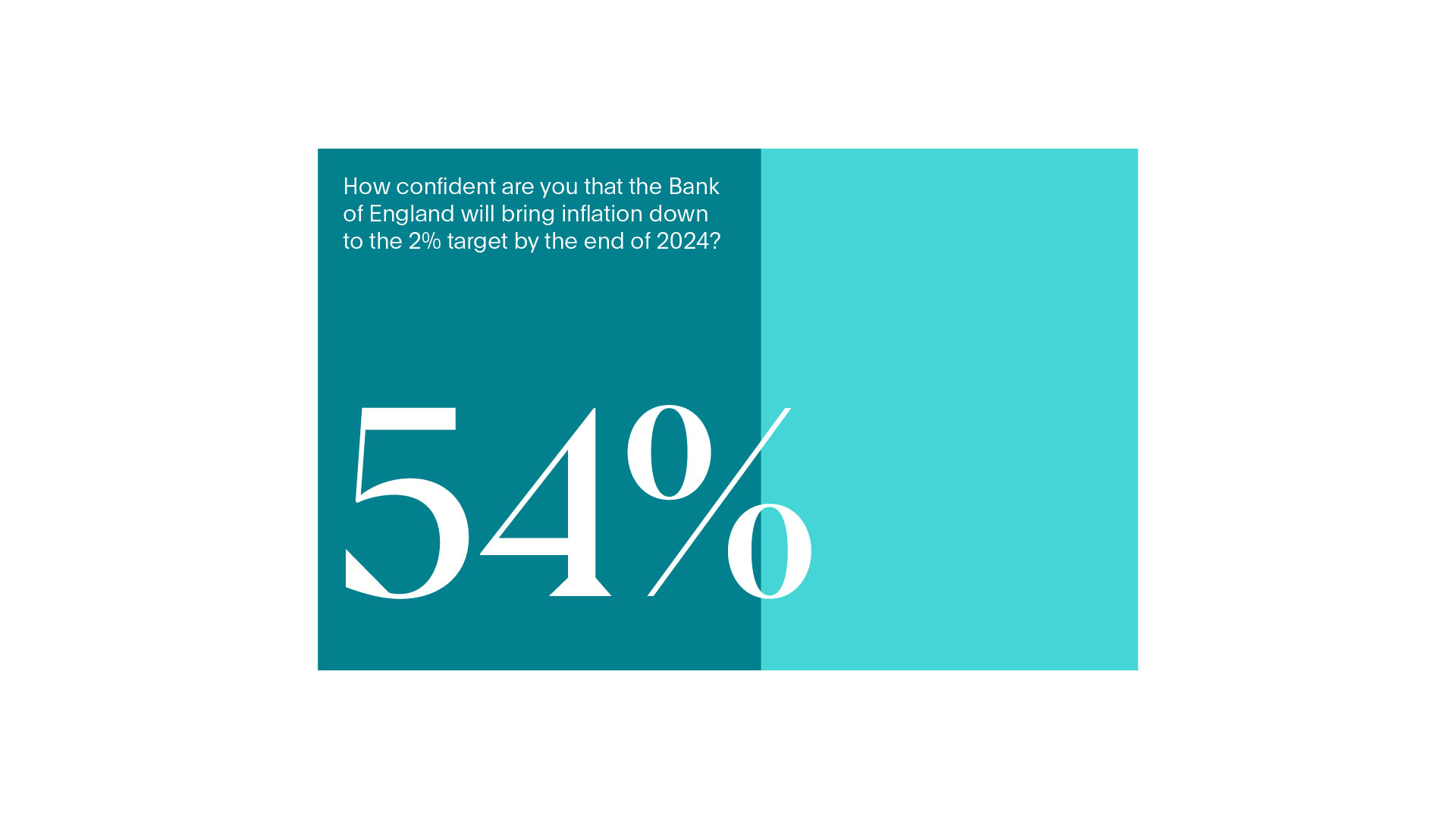

There were varying levels of trust in the BoE's ability to manage inflation. A significant portion (54%) lack confidence in the BoE meeting the 2% inflation target by the end of 2024.

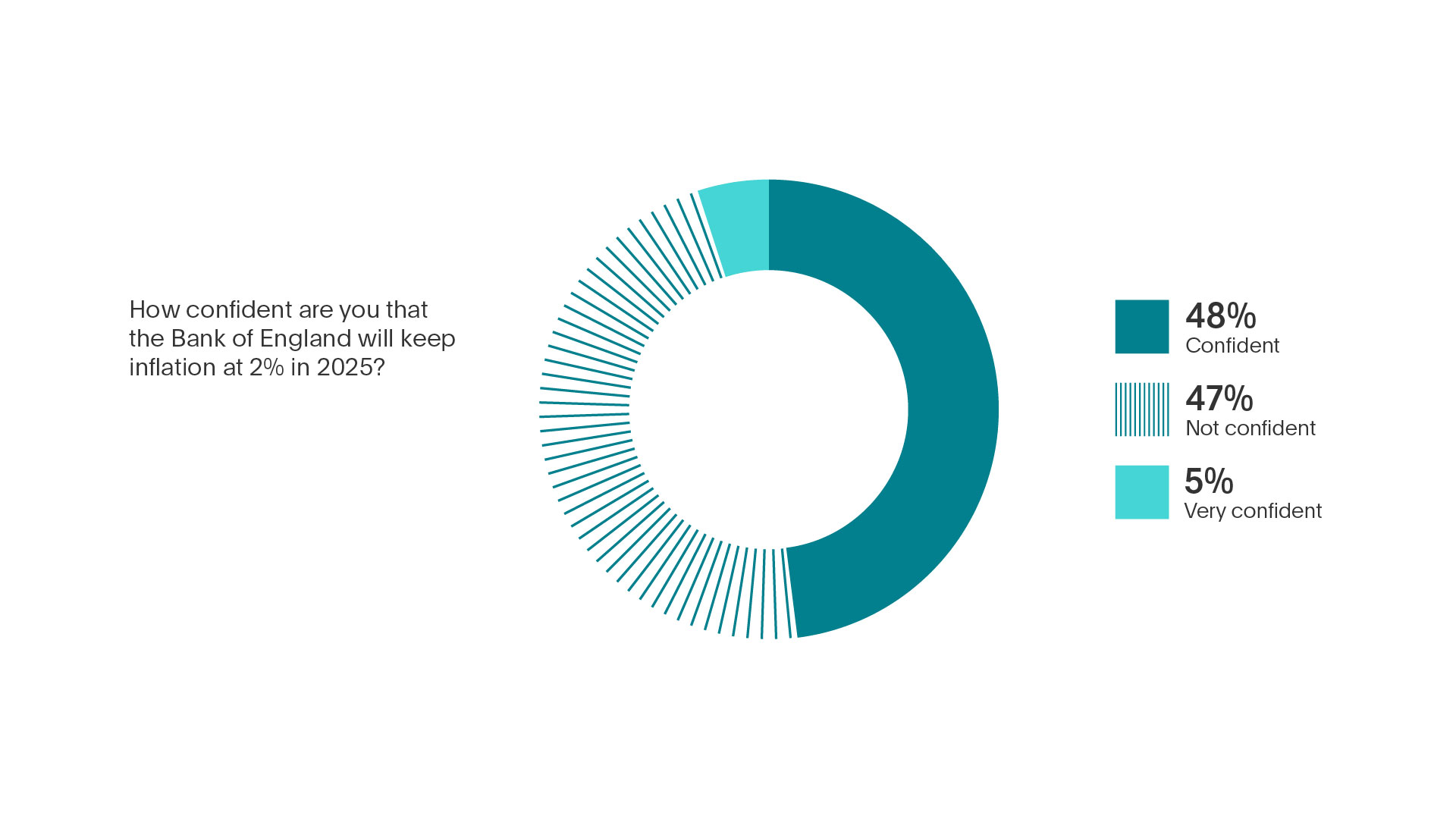

Looking ahead to next year, the outlook remained balanced, with 53% expressing confidence in the BoE's ability to sustain the inflation target in 2025.

Strategies for safeguarding your savings

In response to anticipated base rate decreases, almost a quarter (23%) of financial advisers encourage savers to lock in current rates with long-term savings products. A further 7% suggest savers should try out different cash management solutions. However, the majority (35%) of financial advisers foresee no significant changes to the advice they offer clients around savings once rates start to fall.

If you’re prepared to lock your money away for longer to take advantage of higher interest rates, a fixed-term savings account could be the solution. These types of accounts are popular with people who want to grow their cash and can put money aside without the need to access it in the short term.

If you’re prepared to lock your money away for longer to take advantage of higher interest rates, a fixed-term savings account could be the solution. These types of accounts are popular with people who want to grow their cash and can put money aside without the need to access it in the short term.

The next BoE base rate announcement is on Thursday 9 May.

Follow us on LinkedIn for the latest news and commentary

*Flagstone Base Rate Poll methodology: industry research canvassing opinions of 236 senior savings professionals – including UK banks and building societies, financial advisers, wealth managers, and businesses – 24-29 April 2024.