Protecting your savings with the FSCS

Learn about FSCS protection limit and who is covered by FSCS. Understand how FSCS safeguards your savings and investments.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

Last updated: 07 February 2025

What is the FSCS?

The Financial Services Compensation Scheme (FSCS) was established in 2001 as an independent organisation to protect clients from financial services providers that go bust. They can pay out compensation if the bank, building society, insurer, or credit union you are saving with fails and is unable to settle the claims filed against it.

Savings accounts, pensions, investments, insurance policies, and mortgages are all protected by the FSCS. Through fees collected from licenced financial services companies, the FSCS can safeguard your funds and pay this compensation.

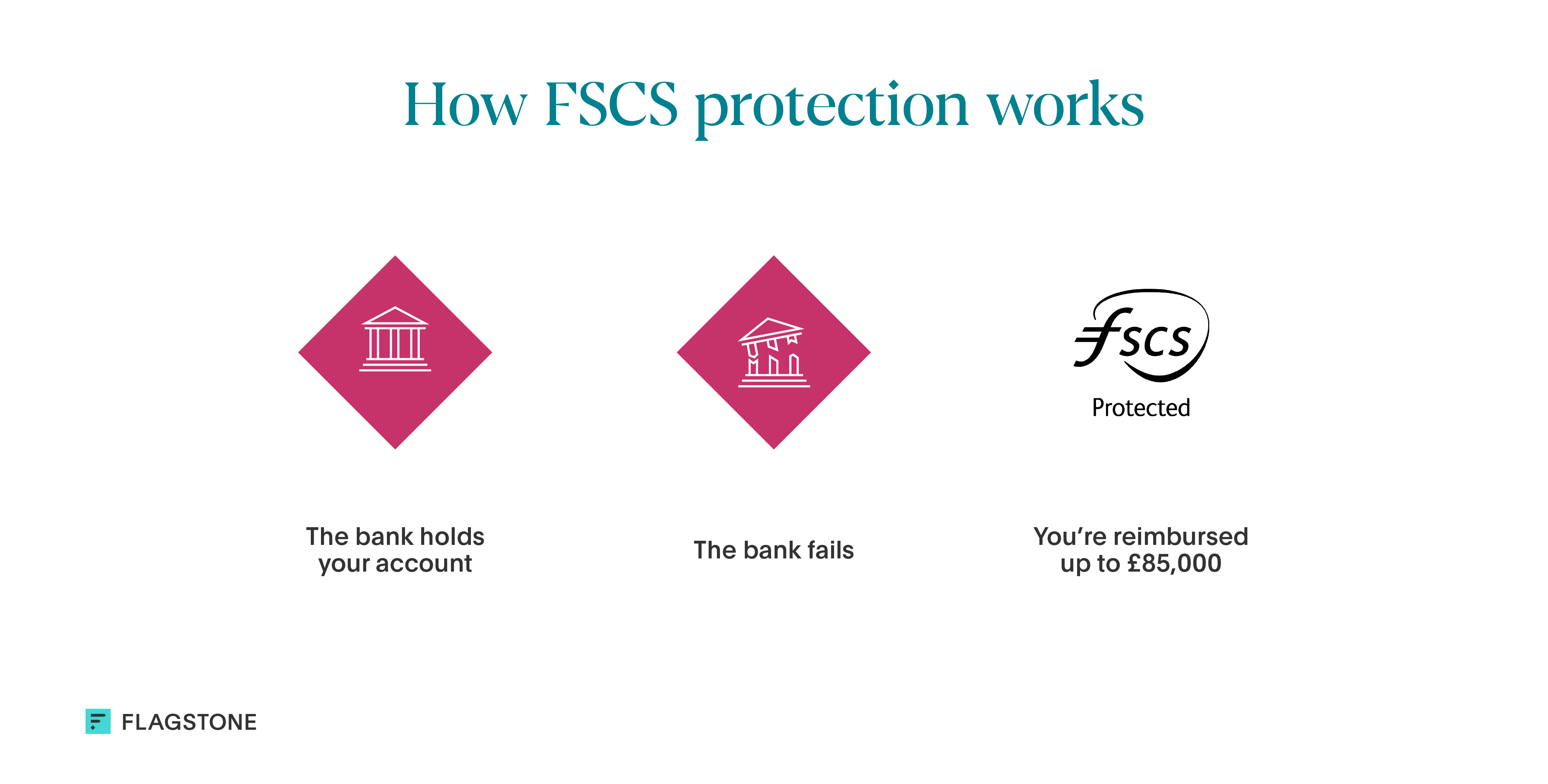

How the FSCS protects your savings

If your provider collapses, you are entitled to compensation of up to £85,000 (per individual, per financial institution) as long as they are registered with the Prudential Regulation Authority and Financial Conduct Authority (FCA). For joint accounts, up to £170,000 is protected per financial institution.

It’s important to highlight that ‘financial institution’ does not mean bank or bank account. Some banks are authorised under the same banking group which means the FSCS compensation limit applies to the total amount held across all these accounts.

The scheme is free to consumers, and you will typically get back the money you have lost within seven working days. Claims relating to deposits made via services such as a cash deposit platform may take longer to process. Any cash saved above the limit is unprotected and at risk of loss.

Additionally, there is a measure in place to protect temporary balances of up to £1m with a single institution after a ‘life event’ such as the sale of a property or an inheritance. This cover is only available for six months.

Ensuring your money is protected

To have financial peace of mind and guarantee your hard-earned cash is covered, follow these steps:

1. Spread your money across different banks

Diversifying your wealth is a common risk management method in investing, and saving is no different. If you have more than £85,000 in cash, you will need to split it up and deposit it across multiple banks to ensure it’s all covered.

2. Be aware of bank mergers and shared licenses

Understanding who owns your bank is essential to gaining full protection over your savings. Several providers share the same banking license and previous years have seen some banks merge. If you have money with more than one bank with the same shared licence, your cash may be under protected.

3. Think twice before going offshore

There are pros and cons to putting your money in a foreign savings account, so it is important to do your research first when it comes to protection. Banks operating in the European Economic Area (EEA) are protected by their own compensation scheme which pays out 100,000 euros. Those that are located outside of the EEC, must get FCA authorisation in order to do business in the UK.

4. Consider a joint savings account

Consider opening a joint savings account if you and your partner have accumulated a large amount of savings and don’t want to spread it across different pots. By keeping your money in a joint bank account with your partner, you double your FSCS coverage to £170,000 with each financial institution.

Frequently asked questions about FSCS protection

What does FSCS stand for?

The Financial Services Compensation Scheme.

Why was the FSCS set up?

The scheme was set up by the government to protect private individuals and small businesses from losing their money if their financial provider went bust. It generates public confidence in the financial services industry.

How do I make an FSCS claim?

If your bank, building society, or credit union has failed and you are entitled to compensation, you do not need to make a claim. The funds will be reimbursed to you automatically.

The FSCS accepts online claims for insurance, mortgages, pensions, payment protection insurance, investments, and debt management.

Where does FSCS money come from?

The FSCS is funded by levies paid by each UK authorised financial services firm.

Who is eligible for FSCS protection?

Most small businesses and individuals are protected by the FSCS if their bank, building society, or credit union is authorised by the Prudential Regulation Authority and Financial Conduct Authority.

You are not protected if your money held with an e-money or payment services firm.

Does FSCS cover investments?

Yes, you may be eligible to claim compensation if you have an investment (or you were recommended to invest) and the provider or adviser has gone out of business. Take a look at the website for more information.

FSCS also covers mortgage advice, life and pensions advice, debt management and long-term care insurance.

How long does it take to get my money back?

The FSCS will normally pay deposits compensation within seven working days of a bank, building society, or credit union failing. Some complex claims or deposits placed via services such as Flagstone may take longer to process. The FSCS will pay these as soon as possible and always within three months.

Claims for other financial products or services take different lengths of time to process. You can find out how long here.

How Flagstone can help

We make it easy to spread your cash across different banks so you can gain the maximum FSCS protection.

Instead of enduring the lengthy and laborious task of opening numerous savings accounts, Flagstone allows you to access a range of accounts via one application – saving you time and providing peace of mind.