About this savings account

Everything you need to know, from FSCS protection to minimum deposits.

The rate is 3.75% | 3.75% (AER | Gross).

AER stands for Annual Equivalent Rate – and illustrates the interest rate if interest was paid and compounded each year.

‘Gross’ is the interest rate without the deduction of income tax.

We’ve already deducted Flagstone's share of interest from these rates.

The interest you receive comes without any deduction for income tax. You are responsible for paying any tax due on interest/profits that exceed your Personal Savings Allowance to HM Revenue & Customs. Tax treatment can change.

The bank will return both your initial deposit and any interest when your account matures.

No. Once you’ve opened this Fixed Term account, the rate will remain the same for the full term.

Initial deposit: £10,000

Balance at maturity: £10,375

We’ve made this projection for illustrative purposes only – it doesn’t take into account your individual circumstances. In making this projection, Flagstone has assumed that you’ll deposit £10,000.00 in the account at the time you open it, and that you’ll make no further deposits or withdrawals.

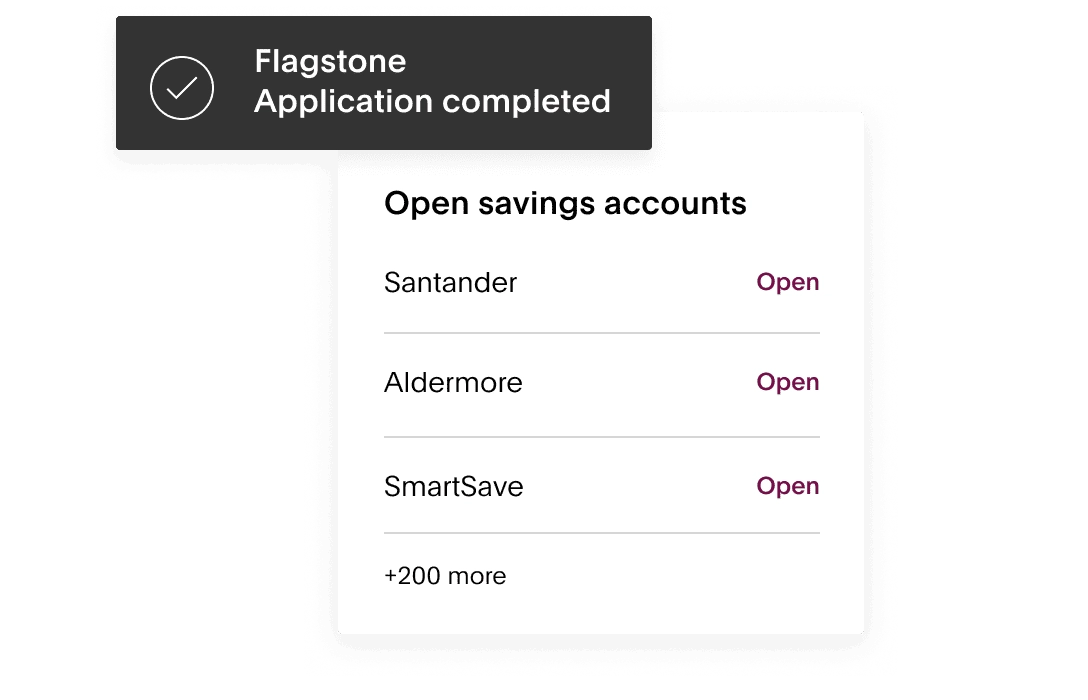

You can open savings accounts with Flagstone in three easy steps.

First, complete your application (you can get started in just a few minutes). Then, fund your Flagstone holding account. This acts like a wallet, which you can use to make deposits and open new savings accounts with any of our partner banks.

Then, it’s simply a case of choosing the account (or accounts) that work best for you. Agree to their T&Cs, and you can open them in a couple of clicks.

IsBank is part of the FSCS deposit protection scheme. Eligible deposits are protected up to a total of £85k (or £170k for joint accounts).

The minimum deposit for this account is £10,000. This is also the minimum account balance.

The maximum deposit and account balance is £1,000,000

Never apply for a savings account again.

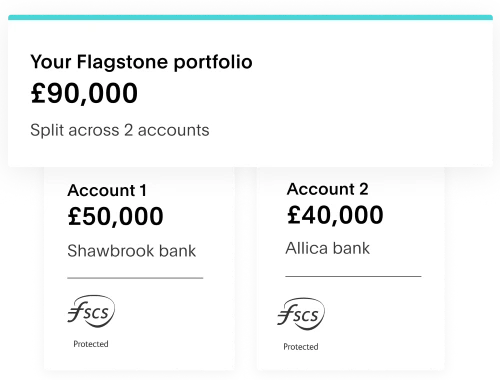

Spread your savings across 200+ savings accounts from 60+ banks. All in one platform, with one password.

Secure what's yours with FSCS protection.

All UK savings accounts on our platform are FSCS-eligible. So you can protect your eligible funds up to £85,000 per banking group (£170,000 for joint accounts).

Grow your cash with exclusive rates

Flagstone offers exclusive savings accounts through our trusted bank partners. Capitalise where others can't.

Create your personalised illustration

Use our cash deposits calculator to see how much

interest you could be earning, whilst spreading your

deposits to maximise FSCS protection.

Start saving in three steps

Brian, Flagstone client

Paul, Flagstone client

Still have questions?

Whether you've opened your Flagstone account or you're just getting started, we're here to help.

Call us on +44 (0)203 745 8130, Monday-Friday 9am-5.30pm.