Getting high-interest accounts for your lump sum savings

Choosing the right high-interest accounts can transform your lump sum into even greater savings. In this article, we explore the five main factors to consider when selecting the best accounts to grow your lump sum.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

Receiving money as a lump sum can be transformative for your finances, especially if you decide to strengthen your savings. But the way you set up your accounts can affect how quickly your money grows over time.

With so many savings accounts on the market, comparing them is crucial to maximising your earnings. In this article, we’ll explore the key considerations to bear in mind when choosing accounts for your lump sum savings.

Depositing your full lump sum vs. saving in instalments

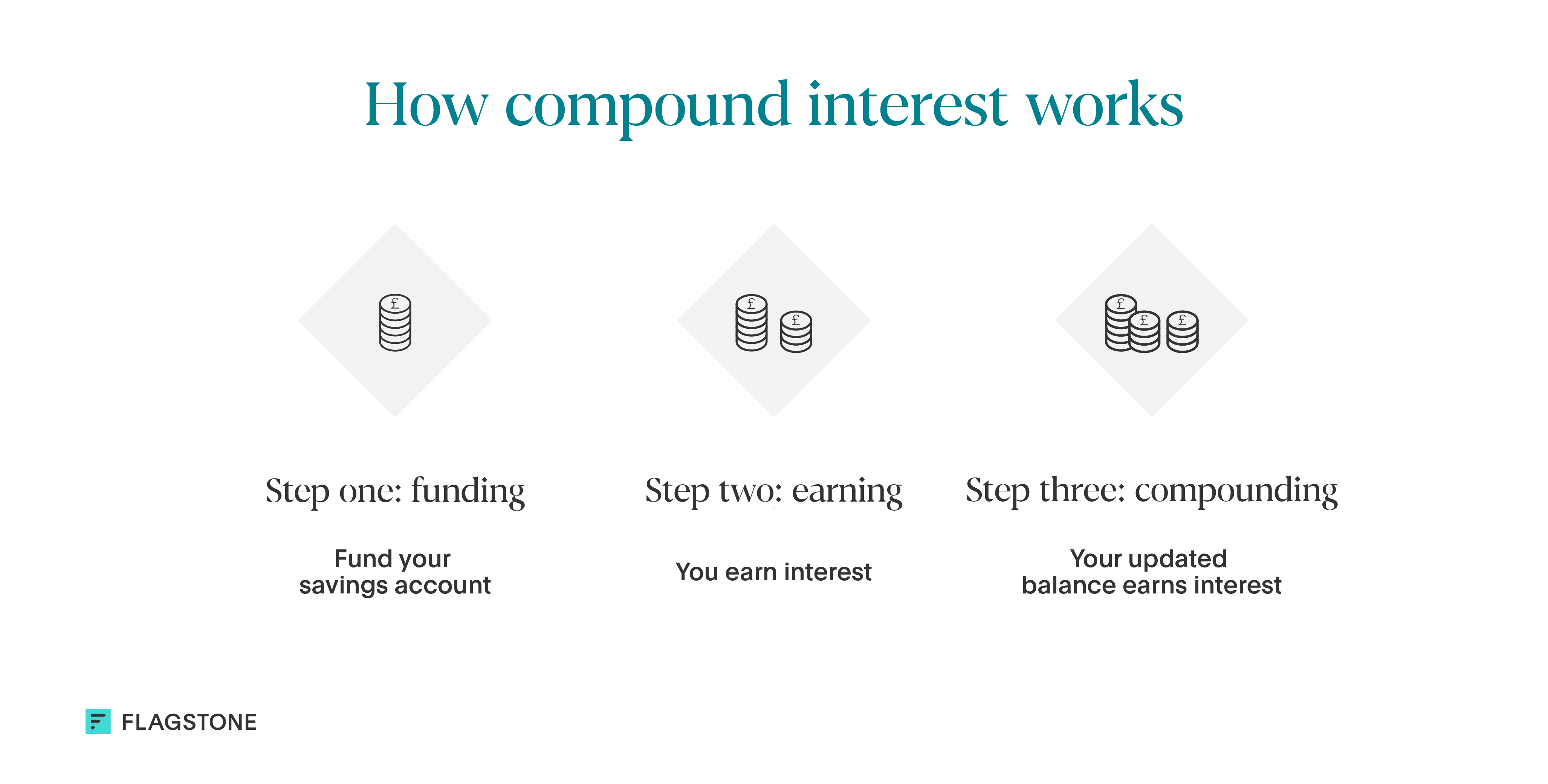

Depositing your funds as a lump sum means making a single, large payment all at once. When you deposit the total amount, the full balance starts to earn interest immediately, allowing you to benefit from compound growth.

Paying into a savings account in instalments spreads out your investments. This means only part of the total earns interest at any given time. While it’s a more cautious approach, making smaller deposits can slow the growth of your savings.

Five key factors to consider when choosing a lump sum savings account

There are five key factors to consider when deciding which savings accounts are right for you:

- Interest rates: Compare interest rates to make sure you’re maximising your income. The higher the AER (Annual Equivalent Rate), the more your lump sum will grow.

- Type of account: The type of account determines how easy it’ll be to access your funds. For example, Fixed Term savings accounts keep the interest rate the same for a set period, usually by limiting your withdrawals before the end of the term. Instant Access savings accounts (also referred to as ‘Easy Access’ accounts) offer more flexibility, but you’re likely to be offered a lower interest rate as a result.

- Fees: Check for administration costs, such as withdrawal fees, that can reduce your earning potential. These fees often apply to Fixed Term Deposits (FTDs) to discourage people from withdrawing their money early.

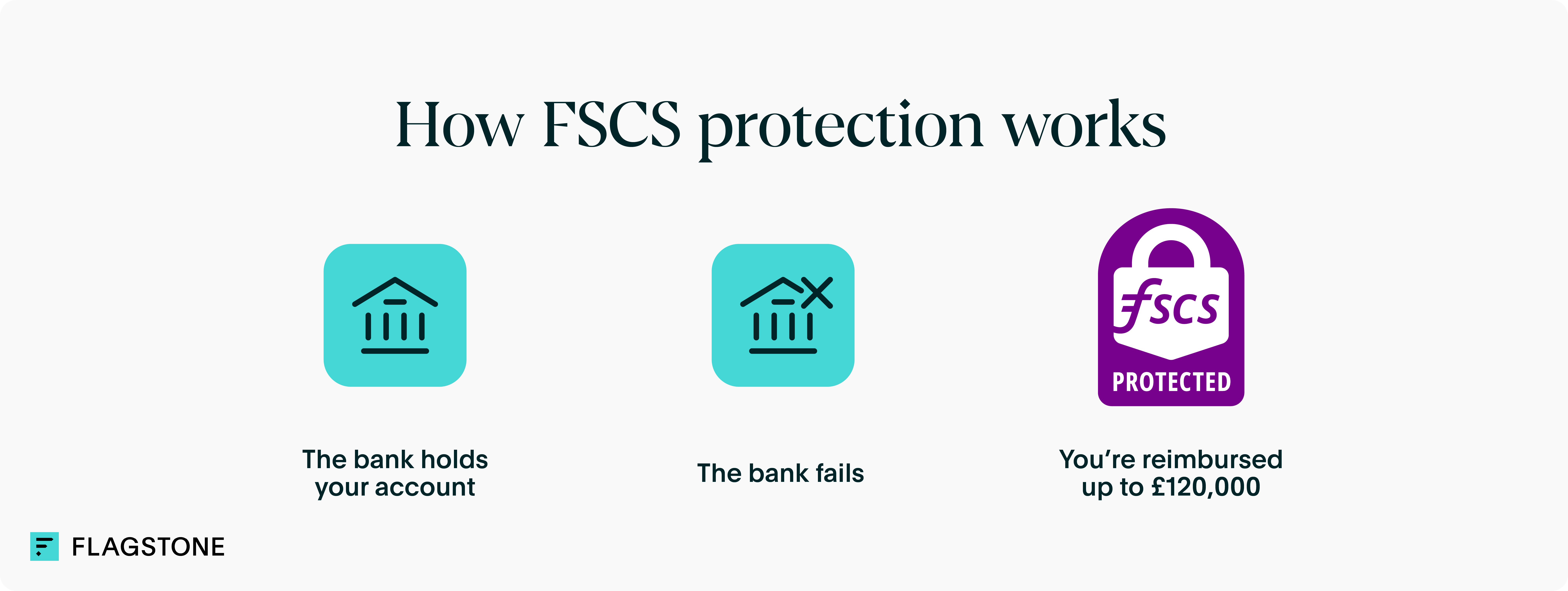

- FSCS protection: Ensure the account provider is covered by the Financial Services Compensation Scheme (FSCS), to protect your funds should the bank or building society fail.

- Extra benefits and features: Some savings accounts offer rewards for your loyalty, such as interest tiering based on your balance, cashback, and free subscriptions.

How secure is your money in a savings account?

It depends on whether the account is FSCS protected. If it is, then you’ll be covered up to either £120,000 or £240,000 for a joint account.

In a savings account, your money earns interest because banks lend your deposit to other people. If too many people withdraw their money all at once, this can cause the bank or other financial institutions to go out of business.

Insuring lump sum savings at scale

In the event your bank or building society goes bankrupt, FSCS protection means you’ll get reimbursed up to the limit for every financial institution you bank with. This is why it’s beneficial to open another savings account with a separate financial institution, especially for significant lump sum savings.

A cash deposit platform like Flagstone lets you spread your cash across multiple accounts with different banks, maximising your protection at high interest rates.

Spreading the risk for a lump sum in savings

A high-interest savings account can help your lump sum grow significantly thanks to compound interest. But balancing competitive rates with access to your funds maximises value and flexibility.

By using tools that make it easy to spread your risk across multiple accounts, you can safeguard your finances as your savings grow.

Transform lump sum savings into a financial asset

With one application, you can access high-interest savings accounts from 60+ banks and financial institutions through Flagstone.

Spread your savings across multiple accounts to maximise your FSCS protection.