How to save money for greater returns

Saving more money is unlikely to exceed your financial goals on its own. In this article you’ll learn how to save money to scale returns and maximise interest.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

Putting money aside isn’t the only way to grow your savings. Often, it’s how you save money that makes all the difference. If you have substantial deposits, the rewards of using your increased influence to maximise returns can be significant, especially when you have the right tools to help you.

In this article, you’ll learn how to save money for greater returns. By following three clever ways to save money, you can ensure that every time you save, your cash is in a better position to grow.

How to save money for greater returns

In general, getting a higher return on your savings depends on a handful of factors. These include:

- how much you have saved

- what access you need to your funds

- the interest you get paid

- the rules that apply to your accounts

Larger deposits mean greater rewards. The more you have, the more you can gain from smart saving strategies.

Clever ways to save money

1. Leave loyalty at the door

Banks make more profit by paying lower interest to savers. Our research shows that 58% of UK savers keep most of their savings with the same bank as their current account. This means that there is little incentive for banks to offer more competitive rates to current customers.

Caution is different to inaction. Stay loyal to a low-rate bank, and you could miss out on stronger returns. In the same way that moving jobs can often earn you a higher salary, moving your money could earn you greater interest. If you’re more proactive with your savings, it could pay dividends in the future.

2. Balance earnings with access

Limiting access to your savings has multiple benefits. It helps you earn more compound interest over time and makes it easier to resist the urge to overspend. It can also grow your earnings by securing a higher interest rate.

Some banks offer notice savings accounts, which typically give a higher AER (Annual Equivalent Rate). In exchange, you have to give the bank notice before withdrawing your funds.

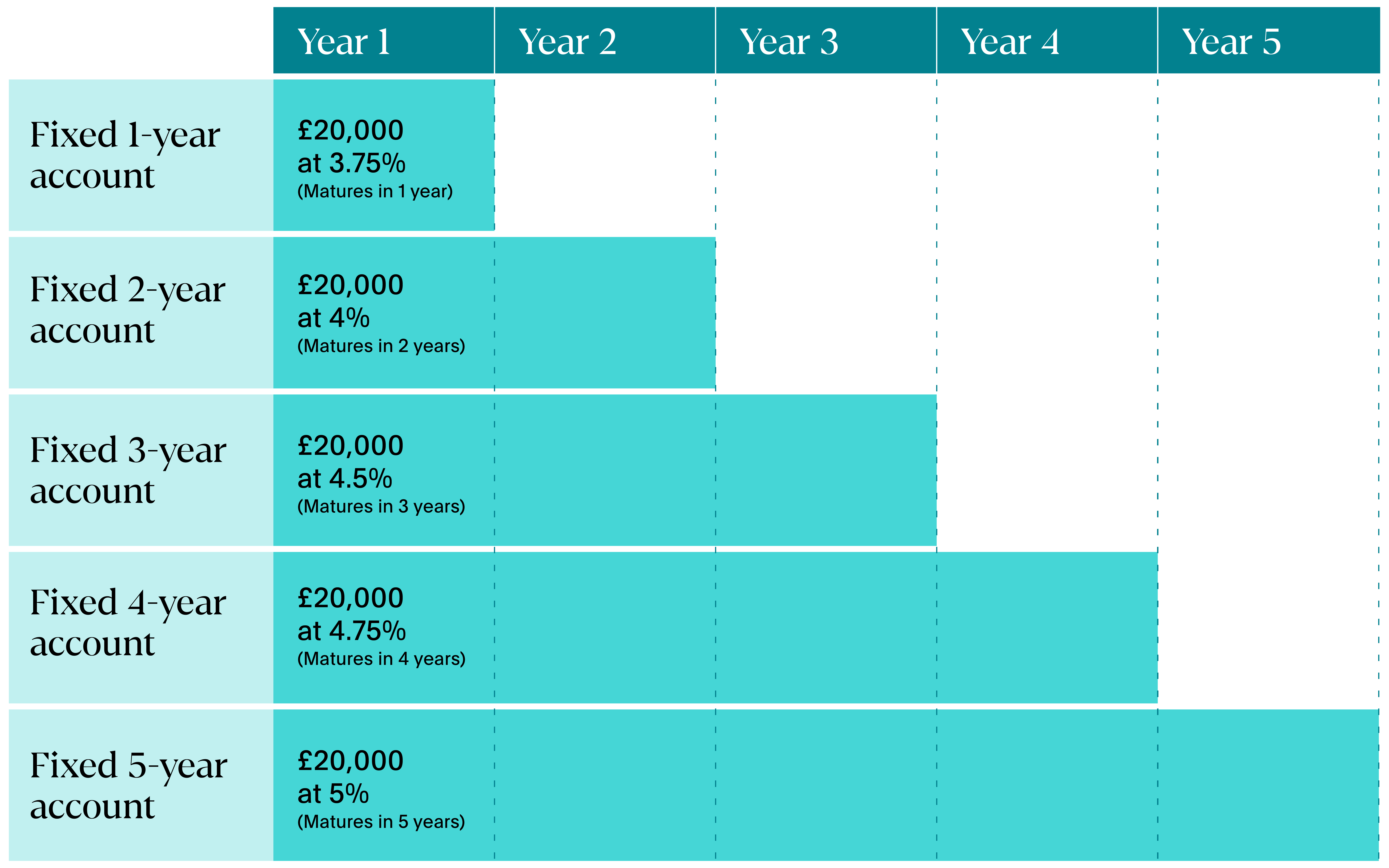

But savings are usually kept as a financial buffer. There’s always the chance that you’ll need quick access to your money for unexpected expenses. That’s where the ‘laddering’ technique comes in – helping you balance accessibility with better returns.

Once your accounts mature, you can reinvest the returns into a new account with a five-year term. With laddering, after your initial investment, you’re never more than 12 months away from accessing a portion of your cash.

The exact amount of money you can lock away for the long-term depends on your individual circumstances. But with a clear plan for your finances, you can confidently set up your savings to earn the maximum level of interest.

3. Consider broader bank account types

In this article, you’ve learned how notice accounts can help you earn higher returns on your savings. But there are other specialised accounts that offer even more flexibility – like Sharia bank accounts.

How Sharia bank accounts work

Sharia accounts follow financial principles set out in Islamic law. This means they don’t charge interest when you borrow money, or pay interest on savings accounts. The banks that offer Sharia accounts also aren’t allowed to benefit from businesses that work in sectors like tobacco, adult entertainment, or alcohol.

How Sharia accounts make you money

Sharia accounts share profits more fairly between account holders and banks. This differs from most other savings accounts, where you earn interest on the value of your cash deposits in exchange for holding a bank account.

Anyone can open a Sharia bank account in the UK. By doing so, you can diversify your cash portfolio adding a different way to generate returns on your savings.

Saving money effectively can vary with age

The best place to save your money will depend on whether access or earnings is more important to you. If you’re younger, you might prioritise higher earnings, since you have enough time to lock away the best rates at high interest. As you approach retirement, balancing high returns with easy access to your cash becomes more important.

Cash savings platforms let you open multiple savings accounts, with a range of competitive rates and access types. It’s worth deciding on the best balance for you, so that you can structure your savings effectively.

Structure, balance, and breadth: how to save money for greater returns

Whether you’re searching for the best rates, balancing access with growth, or exploring different account types, there are plenty of ways to save money for better returns. But learning how to to maximise your money is just the first step. With a few small changes, you can grow your savings over the long term.

Thankfully, savings platforms like Flagstone make it easy to manage multiple high-interest accounts. This ensures that you can set up a portfolio of savings accounts, structuring them to deliver the maximum returns for the cash you put aside.

Learn why multiple savings accounts builds financial resilience

Discover why spreading your cash across different bank accounts increases your financial resilience.