The benefits of filing your Self Assessment tax return early

Avoid the last-minute rush by filing your Self Assessment tax return early. Avoid fines, get refunds quicker, and free up your time for what matters most. Here's why it pays to start now.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

The deadline for filing your Self Assessment tax return looms on 31 January every year.

But contrary to popular belief, you don’t have to wait until January to submit it. In fact, you can get ahead by filing it as early as the start of the new tax year.

In 2024, almost 300,000 people beat the January rush and and submitted their tax returns in the first week of the tax year.

In this article, you'll learn the key benefits of filing your tax return early.

Filing your Self Assessment early means you can spend more time building your business or doing the things that you enjoy, and less time worrying about completing your tax return.

Seven reasons to file your Self Assessment tax return early

1. Minimise your risk of paying HMRC fines

An estimated 1.1 million customers missed the 31 January deadline in 2024. HMRC sends reminders to customers well in advance of the deadline. If you don't file your tax return on time, HMRC will send a penalty notice detailing the amount you owe, the reason for the charge, and any further actions required from you.

Penalties for filing a tax return late are:

| Timeframe | Penalty |

|

Up to three months late |

£100 fixed penalty – even if there’s no tax to pay, or if the tax due is paid on time |

|

Over three months late |

£10 daily penalties – up to a maximum of £900 |

|

Over six months late |

£300 or 5% of the tax due – whichever is greater |

|

Over 12 months late |

An additional £300 or 5% of the tax due – whichever is greater |

If you believe you’ve been unfairly penalised or have a reasonable excuse for filing your tax return late, you can appeal against the penalty. HMRC provides guidance on how to appeal online.

Incurring penalty fines not only affects your finances but can also disrupt your financial planning. By submitting your tax return early, you reduce the risk of any unexpected financial setbacks.

2. Receive your refund more swiftly

On a more positive note, if you overpaid during the last year, HMRC will owe you a refund (also known as a tax rebate). At the end of the tax year, HMRC will send you a P800, which will tell you how to get your refund. Depending on several factors, processing this can take anywhere between five days to six weeks.

The duration it takes for HMRC to process your tax return significantly hinges on their workload. Unsurprisingly, their service team experiences the heaviest burden in January. Sending in your tax return early can help you avoid long waits, so you'll get your refund faster.

You can use HMRC’s online tool to claim back any refunds you’re owed.

3. Maximise your tax payment fund

Filing your tax return early gives you the advantage of receiving your tax bill sooner, including the exact tax you owe for the last year. This allows you to plan ahead for the payment deadline. With the extra time at your disposal, you can strategically set aside cash and explore ways to earn interest on the money earmarked for taxes.

If you prefer low-risk options, high-interest savings accounts can help you to grow your cash safely while you wait to pay your tax bill.

Rather than letting your future tax payment sit in a low-interest account, let it flourish with Flagstone. Our cash savings platform gives you access to hundreds of high-interest accounts from 60+ banks – all in one place. Open a dedicated savings account for your future tax bill, so it can earn interest until it’s time to pay HMRC.

4. Reduce the likelihood of making mistakes

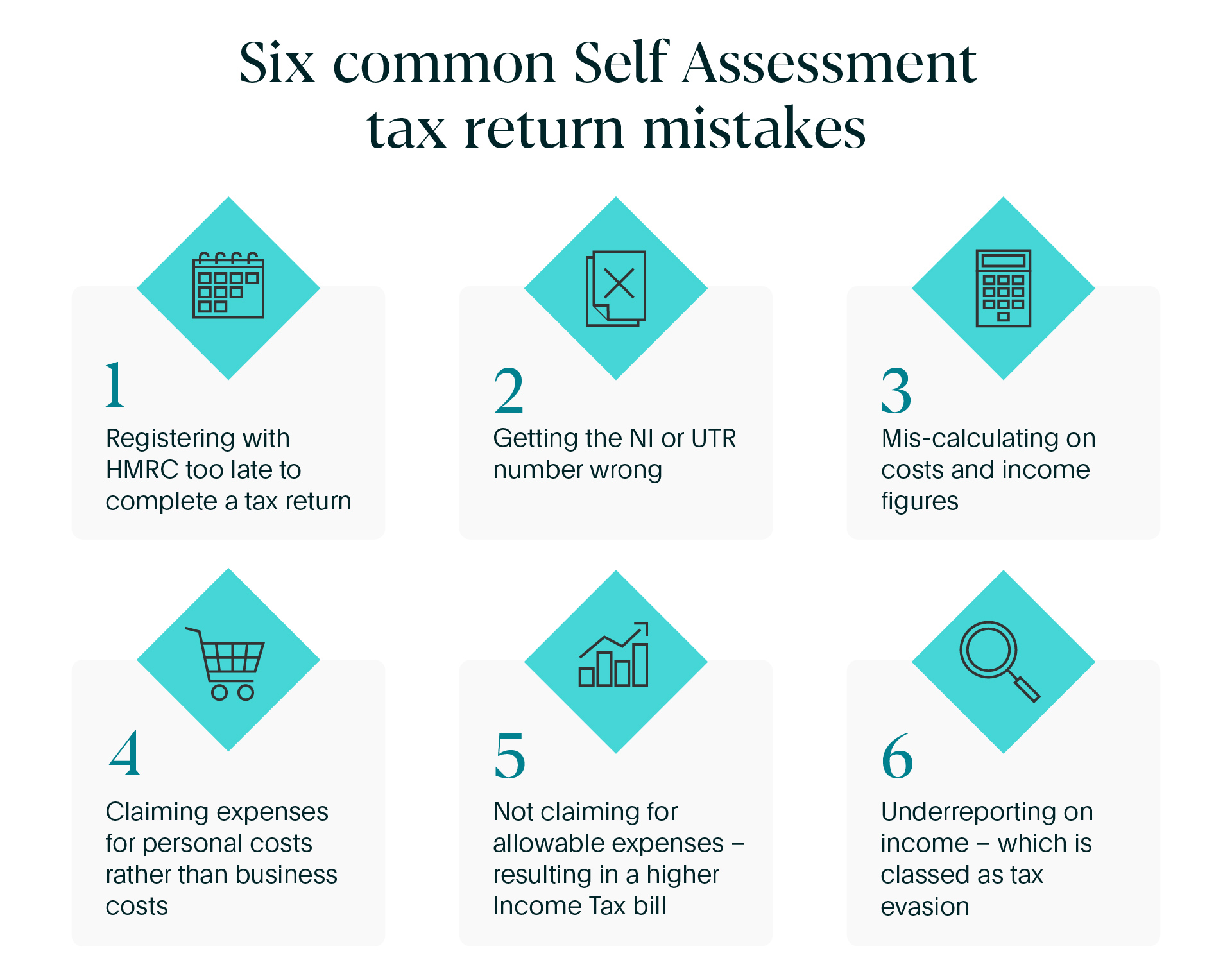

Completing your tax return in a hurry to hit the deadline puts you at risk of making errors. When you’re rushing and short on time, things can slip through the net. Some common mistakes people make include:

If you submit your tax return before the due date and find out you’ve made an error, there’s still time to correct your tax return for that tax year.

If HMRC finds any minor mistakes in your Self Assessment tax return, they can fix them or get in touch with you to resolve it. They may charge you more tax due to the error, or refund you if you’ve overpaid.

5. Beat the lengthy hold queues

Come January, HMRC’s call centres get hugely overwhelmed. According to data from the National Audit Office, HMRC took an average of nearly 23 minutes to answer calls.

If you’ve got better things to be doing than listening to hold music, getting your return filed early could save you some precious time. Especially if you’re new to the process and are likely to need some guidance from HMRC.

If you’re struggling with call wait times and want to self-serve, HMRC offer a range of online guidance to help you file your return.

6. Avoid the last-minute panic of submitting your tax return

Are you in the habit of putting off your tax return until the final moment? If so, you’re not the only one procrastinating. Unsurprisingly, 31 January is the busiest day for filing your tax return with HMRC.

A record-breaking 11.5 million taxpayers completed their Self Assessment tax returns by the deadline for the 2023 to 2024 tax year.

732,498 customers completed it on the 31 January 2024. Of those that submitted in the final hours:

- 58,517 (8%) customers filed between 4.00pm and 4.59pm (the peak hour for filing).

- 31,442 (4%) customers filed between 11.00pm and 11.59pm.

It’s worth noting that you also need to register in advance. Outside of the peak January season, this can take a couple of weeks. But if you wait until January, the wait could be much longer.

Getting it off your to-do list early also means you avoid the dread that January brings. This gives you one less thing to worry about over Christmas, and means a relaxing start to the New Year.

7. Gather everything you need in sufficient time

To file your Self Assessment, you’ll need to gather all the essential paperwork, such as P45s, P60s, expenses, invoices, and bank statements. If you’re filing in January, you’ll need to prepare records dating back nearly two years, which some banks may not provide easily.

Depending on your bank, you may need to request past statements, which could result in charges. Keep in mind that it may take some time for your bank to process your request. Even if you’re organised, and download and store your monthly statements, mistakes can still happen.

So, file early to tackle any paperwork-related issues promptly.

Frequently asked questions about filing Self Assessment tax returns

What is a Self Assessment tax return?

Self Assessment is how HMRC collects Income Tax. If you have extra income, such as money from a business or property, you usually have to tell HMRC about it by filling out a Self Assessment tax return form. This form shows how much money you made and where it came from during the tax year.

People with other income streams must prepare their tax return and send it to HMRC, along with paying what they owe, by the deadline of midnight on 31 January each year.

Who needs to complete a Self Assessment tax return?

If any of the following apply to you, you’ll need to send a tax return:

- You were self-employed as a sole trader and earned more than £1,000 (before taking off anything you can claim tax relief on)

- You were a partner in a business partnership

- You had a total taxable income of more than £100,000

- You had to pay Capital Gains Tax when you sold or disposed of something that increased in value

- You had to pay the High Income Child Benefit Charge

If you’re still not sure whether you need to submit a tax return, check the GOV.UK website for more information.

How do you register for a Self Assessment tax return?

To start your Self Assessment, first you’ll need to register. The process varies depending on your employment status (self-employed, earning income, or in a partnership). Once registered, you'll receive your Unique Taxpayer Reference (UTR).

If you’re submitting your return online, you’ll need to create a Government Gateway account using the instructions provided with your UTR letter. Once you’ve set this up, you'll receive an activation code by post, allowing you to finish setting up your Gateway account.

If you’re submitting your return by paper, you’ll need to call HMRC and request a SA100 form. If you’re sending a tax return for trustees of a registered pension, you’ll need to request a SA970 form.

If you’ve previously filed a tax return, you can use your old UTR to register and set up your account. Ensure you have access to your Gateway account before you submit your return to save you time in case of any login issues.

When are Self Assessment tax returns and bill payments due?

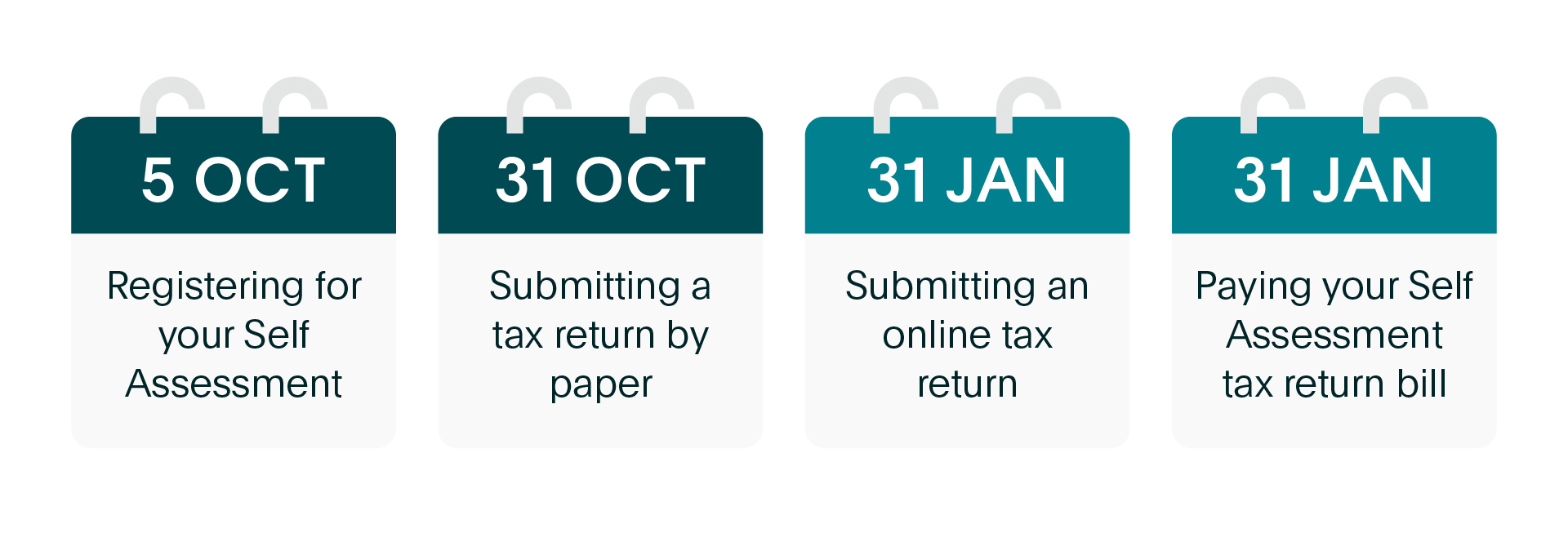

You must tell HMRC by 05 October if you need to complete a tax return and haven’t sent one before. You can tell HMRC by registering for Self Assessment.

If you’re doing a paper tax return, you must submit it by midnight on 31 October.

If you’re doing an online tax return, you must submit it by midnight on 31 January.

You need to pay the tax you owe by midnight on 31 January. This underscores the importance of avoiding last-minute tax return filings.

How do you pay your tax bill?

There are many ways to pay your tax bill, including online, by bank transfer, via the HMRC app, or using the Time to Pay payment plan.

For a comprehensive list of all payment options, visit the GOV.UK website.

File your Self Assessment tax return early for peace of mind

It’s never too early to get on top of your finances – especially if you file a Self Assessment tax return each year. Getting organised ahead of time can help you balance the books well before the 31 January deadline.

It also makes sense to simplify things by using tools that let you manage multiple accounts in one place.

Manage multiple savings accounts easily with Flagstone

Flagstone's cash savings platform gives you access to hundreds of accounts from 60+ banks.

With just one login, you can compare and choose competitive interest rates to make sure your savings are reaching their full potential.

Use our calculator to see how much interest you could be earning.

Create your personalised illustration

Use our cash deposits calculator to see how much

interest you could be earning, whilst spreading your

deposits to maximise FSCS protection.