With more than a fifth of British adults borrowing more money because of the increased cost of living in 2023, economic uncertainty has significantly impacted the UK’s financial wellbeing. These financial pressures may cause you to doubt whether your pension pot will serve you during your retirement. And after decades of hard work, you deserve a retirement that both serves and rewards you.

In 2022, 33% of 50-64 year olds were recorded as retired - a slight but noticeable decline from 34% in 2021. If you’re looking to retire before the state pension age of 66, you may be questioning the feasibility of early retirement and the earning potential of your pension.

Your golden years should be something you look forward to, and being well equipped to deal with your retirement planning can alleviate any worries you may have. This guide will explore how inflation and economic change can impact your pension and financial planning for retirement.

Deciding when you might want or need to retire

When deciding when you want or need to stop working, it’s important to calculate when you can afford to retire and if you’re ready to say goodbye to the working world for good.

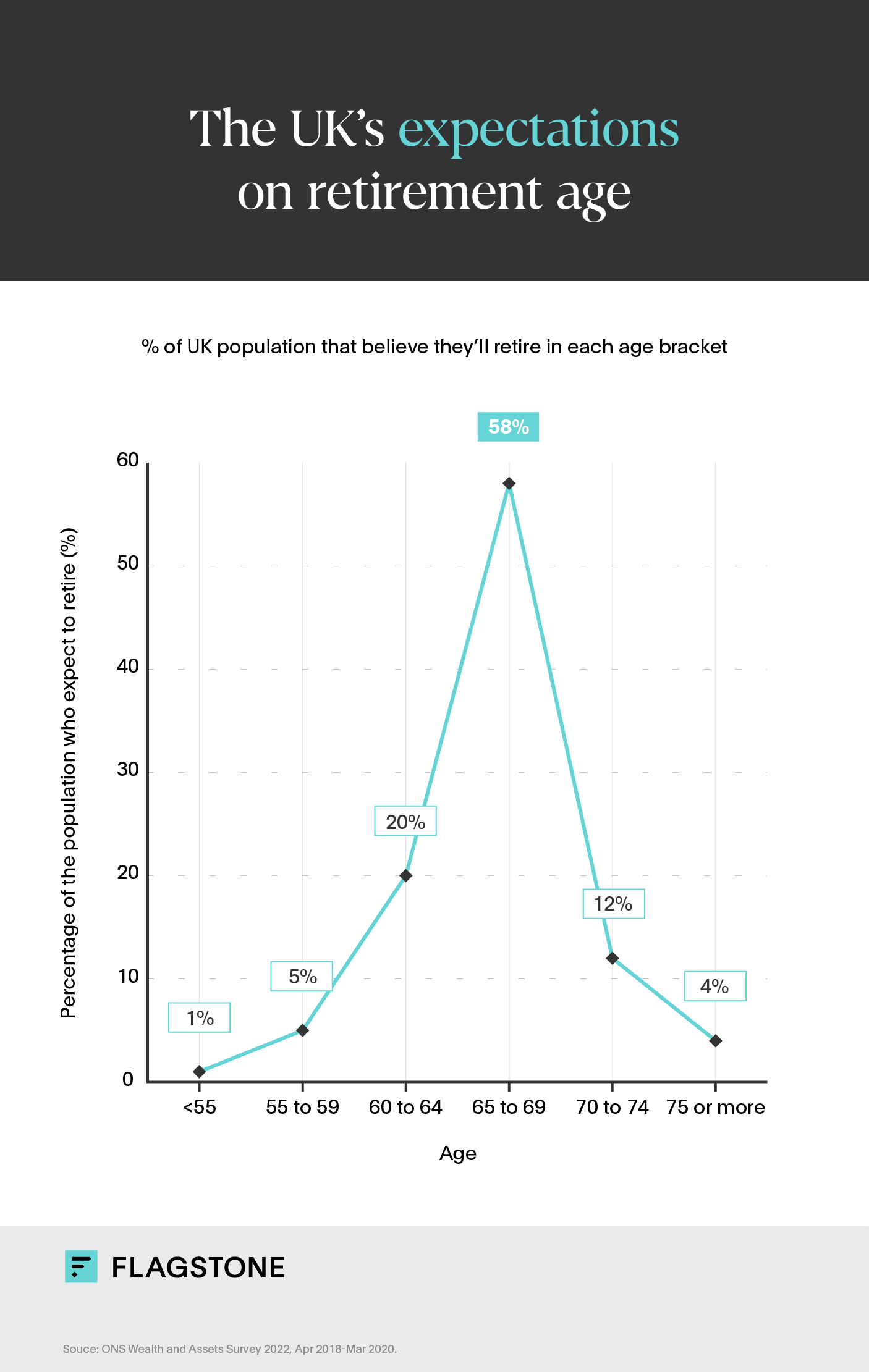

60% of Britain’s labour force have retired between the ages of 65 and 69, while others choose to retire as soon as they reach the minimum pension age of 55. Remember the age you choose to retire is your decision alone - perhaps you’re financially comfortable and ready to embrace retirement, or maybe you love your job and don’t feel ready to give up work just yet. Whatever your circumstances, it’s important that you’re both financially and emotionally prepared for your next chapter.

Recent industry changes

For many, retiring at 55 has been the goal since the government introduced the Pension Freedoms legislation in 2015. This allows you to access as much of your savings as you wish from a defined contributions pension scheme from the age of 55.

But from 2028 onwards the pension freedom age will increase to 57 which may affect your retirement plans. Those who are a few years away from 55 and plan to stop working may need to reconsider their financial planning for retirement, in alignment with this new legislation. Only 6% of those employed in the UK have more than one pension type - it may be worth you diversifying your investment options to reach your retirement goals.

Can I withdraw my private pension before 55?

Whether you can withdraw your private pension early depends on your provider. Some private schemes allow you to take money out before you’re 55 (aged 57 from 2028), but will charge you a penalty fee. You’ll also receive an income tax bill of 55% from HMRC which could drastically affect your future plans.

With this in mind, you may prefer to wait until the minimum pension age before you withdraw your money, to protect your investment value.

Semi-retirement

If you’re not ready to give up work completely but would value a more relaxed lifestyle, semi-retirement may suit you. This involves transitioning to fewer working hours, or taking on a less demanding job so you can unwind at the end of the day. By doing so, you can adjust to a slower pace of life to prepare for complete retirement later on. Semi-retirement may also help you to save for your retirement for longer and contribute more to your pension.

Early retirement

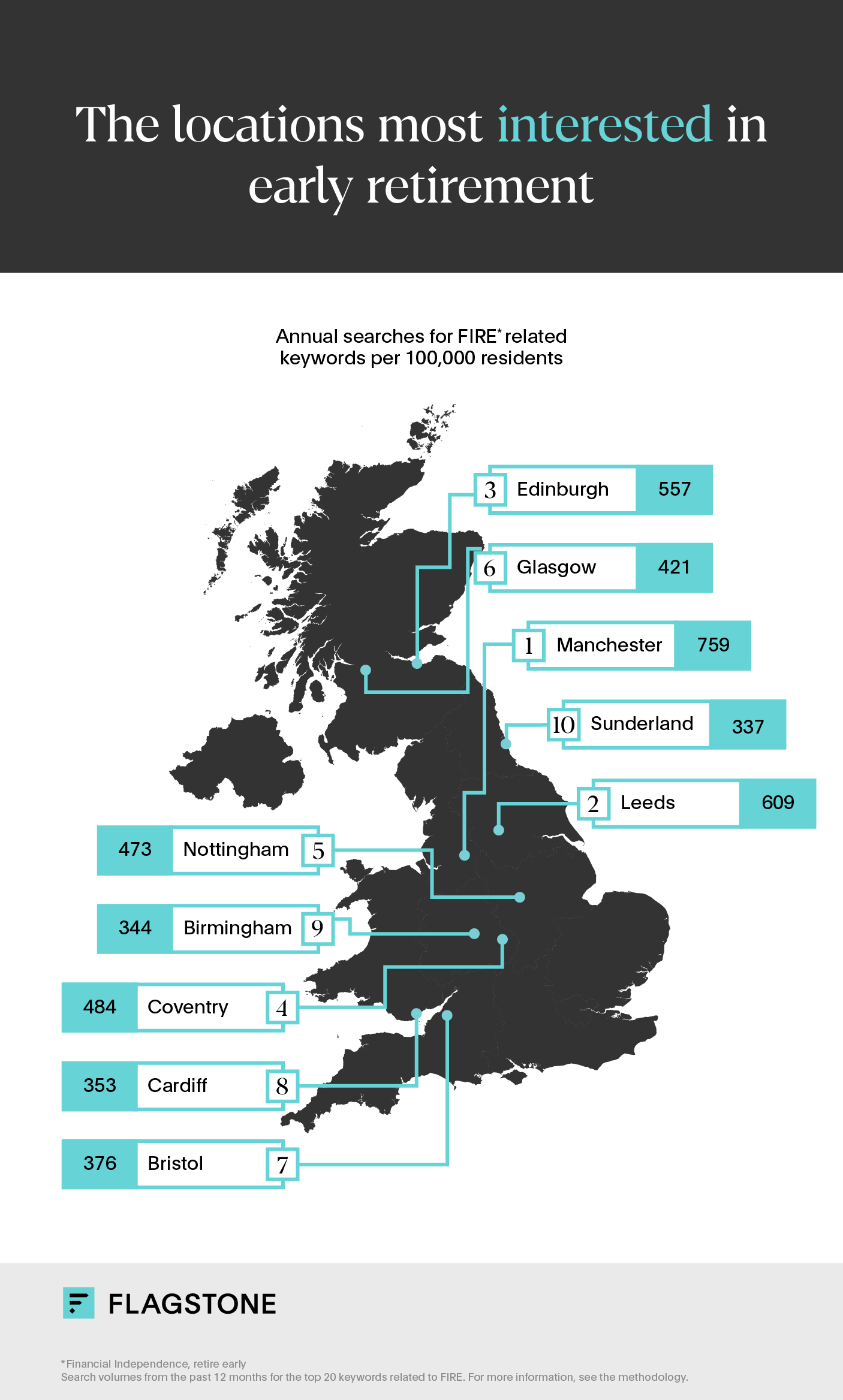

What is considered early retirement has changed over time with the rising state pension age. For both men and women, this is currently 66 years old but is scheduled to rise to age 67 between 2026 and 2028. With this in mind, early retirement could be anything before 66 years old, but is often viewed as retiring during your 50s. And when it comes to the cities in the UK most interested in FIRE (financial independence, retire early), the north seemed more eager to retire early. Manchester came out on top with 759 FIRE-related searches per year, per 100,000 residents.

Methodology for the UK cities most interested in FIRE

We took the top 20 most populated locations of the UK, and focused on the 18 cities to ensure a comparative dataset. The two lowest populated cities were excluded due to low search volumes and not enough data being available.

Search volumes from the past 12 months for the top 20 keywords related to FIRE were analysed for each location, with annual totals taken for each location. Totals were then adjusted per 100,000 people to allow comparison between cities. Population data was taken from worldpopulationreview.com for both the seedlist of top locations analysed and the adjustment of searches per 100,000 people.

Your retirement income options

If you have a defined contribution pension, where contributions are made over time by both you and your employer, you can choose how you’ll receive an income from it.

You can decide whether you want to:

- Draw money from your pension fund to give you an income, known as income drawdown or flexible retirement income. This approach allows the remaining amount to still be invested, giving it the opportunity to grow in value.

- Use some of your pension fund to buy short-term annuities to give you an income. An annuity is a financial product that ensures you’ll have a lifetime income, in return for a lump sum payment. While an annuity is taxable, you’ll gain 25% tax-free as a one-off lump sum.

Take a look at our guide on retirement income options for more detail.

Use our calculator: see how much your pension is worth

Setting goals and making your retirement plan

Establishing a retirement plan can help you evaluate your financial situation and feel excited for the future. Here are some steps you can take to prepare for your next chapter, to help alleviate any anxieties.

1. Calculate the income you’ll need

As mentioned, it’s important to estimate the amount of money you’ll need to live on when you retire. Try and make a budget broken down by essentials and luxury costs - the bills you have to pay and any holidays or leisure activities.

2. Estimate your retirement income

Calculate how much money you’re likely to have once you retire. Getting a State Pension statement is a good place to start - this will give you an idea of how much State Pension you’ll receive. Next, you can check how much is in your pension pot (if you have a workplace pension and private pension, make sure to check both). Finally, make sure to track any lost pensions you may have forgotten about. You can use the government’s Pension Tracing Service to identify any pensions you’ve misplaced, both workplace and private.

3. Decide on your timeline

Are you looking to retire at a specific age, or will you reduce your hours and retire gradually through semi-retirement? Setting a timeline can give you a goal and timescale to work towards.

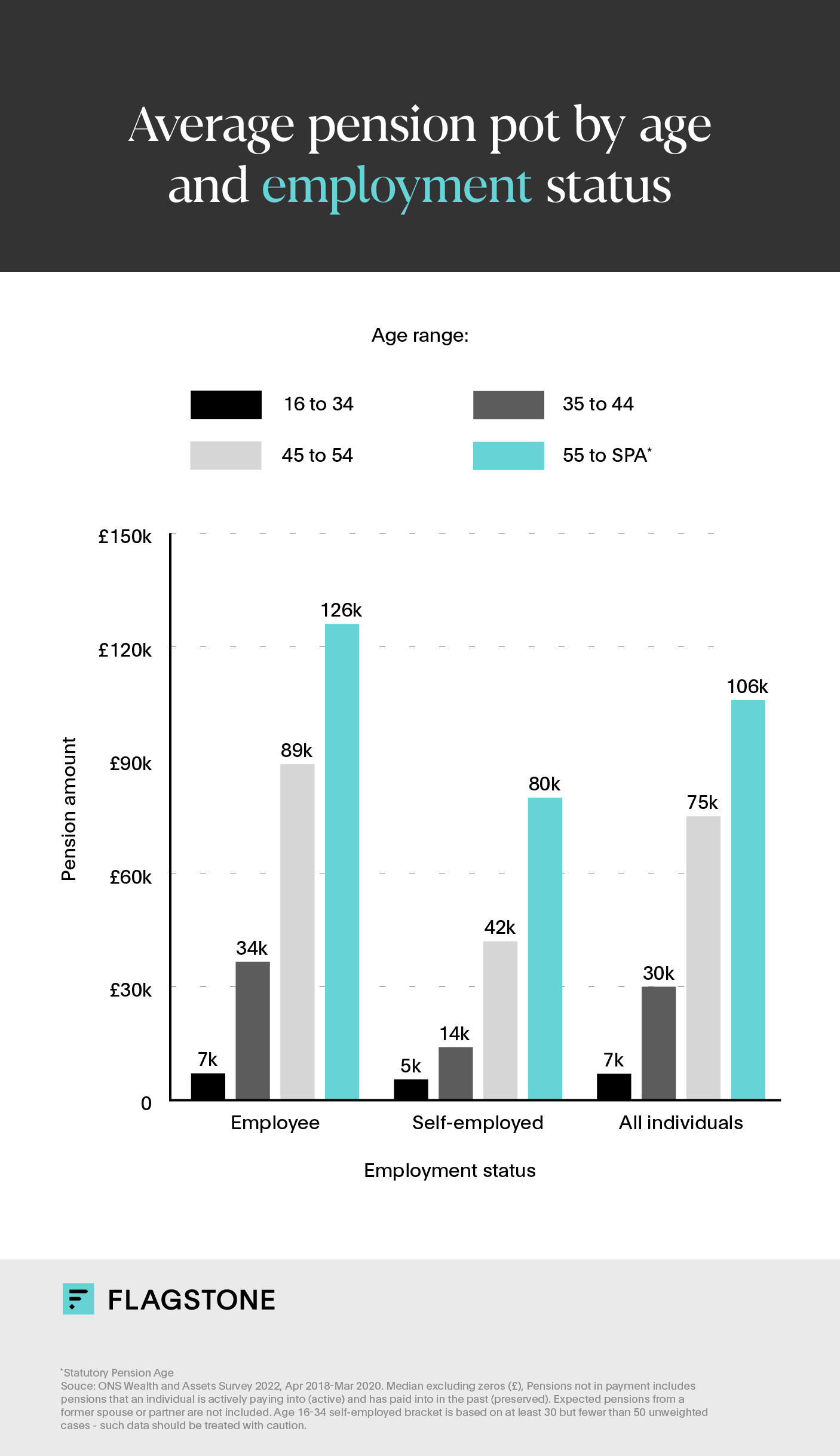

How does your current pension pot compare to others your age? Take a look at the average pension pot based on age and employment status below.

Those self-employed aged 55 and above had less retirement funds than employee individuals of the same age bracket, perhaps due to missing out on employer’s pension contributions. Self-employed savers also miss out on being auto-enrolled into a pension scheme, which may affect the value of their pension pot. Pension saving for self-employed people has declined since the mid-1990s to 16%, compared to 88% of workers who are eligible for auto-enrolment.

Determining your retirement income needs

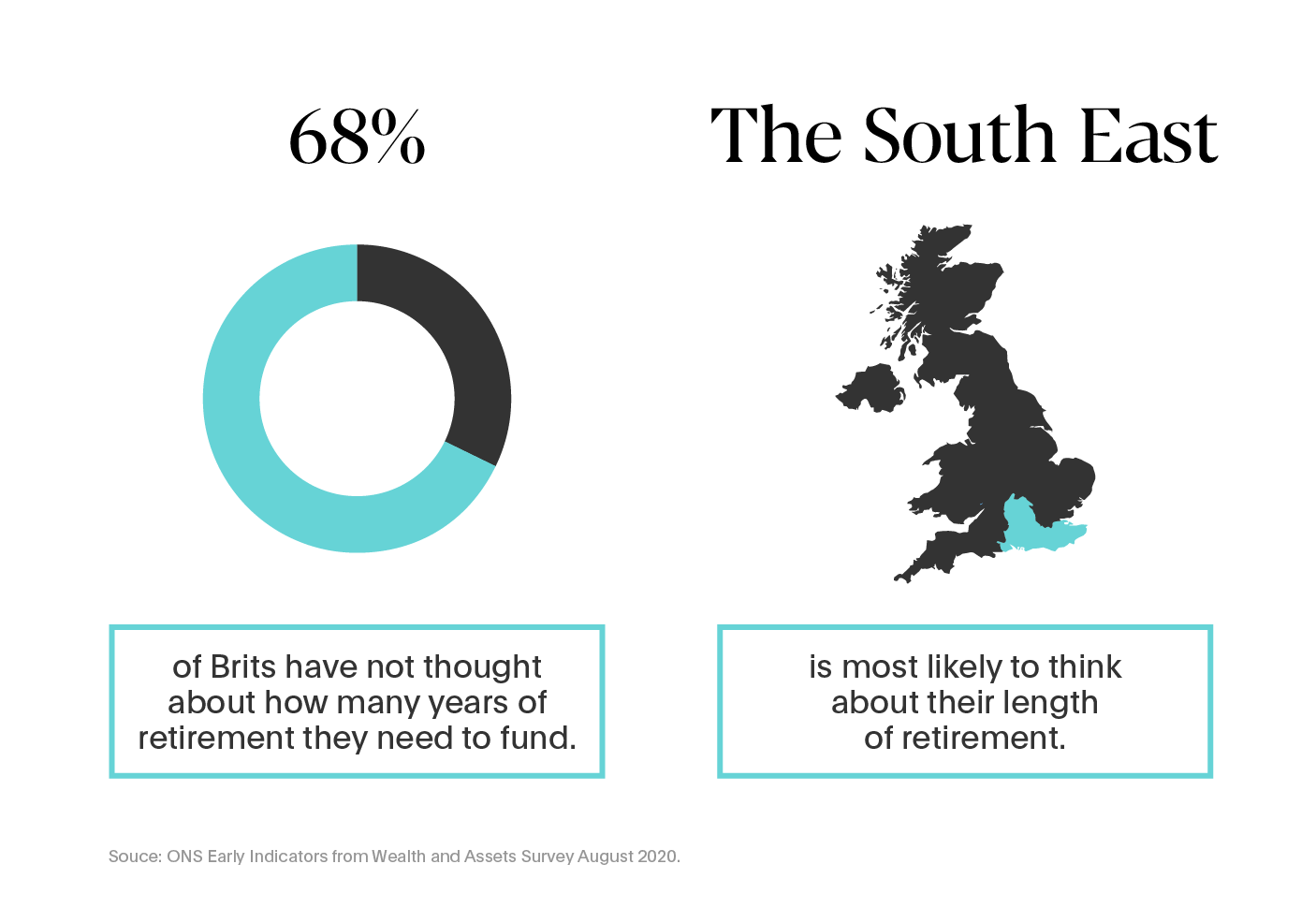

There is no set amount you should aim for when it comes to your retirement income. Instead, the money you’ll need will vary depending on your lifestyle and retirement plans, including the length of your retirement.

Perhaps you’re looking to travel the world or collect classic cars, which, of course, would be a more expensive venture than your everyday spending. While you may be mortgage free once your retirement comes around, the cost of your utility bills is likely to increase as you spend more time at home.

There are several considerations to factor into your retirement budget, including:

Current vs. future expenses

According to the Pensions and Lifetime Savings Association’s Retirement Living Standards, the minimum income a single person would need for retirement is £12,800 a year, while those looking for a comfortable more luxurious lifestyle would need £37,300 a year. This is entirely dependent on your individual circumstances, so it’s worth considering what money you’ll need to cover your current living expenses, and an estimate of your expenses during retirement.

To help you evaluate your expenses and predict the income you’d need for your next adventure, we’ve put together a list of factors to consider.

Your outgoings

Calculate the minimum income you’ll need to cover your current expenses as well as what you expect to pay during retirement. While you may be free from rent or mortgage payments, you’ll still need to cover the cost of utility bills, transport, food shopping and any insurance or subscriptions. These are considered the necessary expenses you’ll need to comfortably pay during your retirement.

It’s important to be realistic about your potential financial circumstances during your later years. You may need to cover care costs in the future, such as social care or health support. While your future needs are unknown right now, it can be worth adding an additional cost to your outgoings to factor in any social care so your predictions are as accurate as possible.

Non-essentials and luxuries

While a good retirement income is one that covers your existing standard of living, it’s only natural to have aspirations for a more luxurious lifestyle later in life. After all, your retirement is your chance to celebrate years of hard work. Perhaps you’re looking to travel, tick a couple of bucket list activities off, eat out more or treat your grandchildren to days out. Remember to plan for these non-essentials in your budget too. As mentioned, for a ‘comfortable’ retirement income, you’re likely to need £37,300 a year or £50,000 for a couple, but again this will depend on your unique financial situation.

With one in five employed individuals not having a pension, putting together an estimated retirement budget can alleviate financial anxieties and help you to plan for your future adventures.

Understanding the impact of inflation on your pension

So, how do rising inflation and interest rates affect pension funds? To answer this question, we first need to define what is meant by inflation. Inflation is when the cost of goods and services rises over a period of time, which can cause the cost of living to rise. The UK has faced a significant spike in the cost of living in the last two years, with the annual rate of inflation reaching 11.1% in October 2022 - the highest in 41 years.

The Bank of England raises interest rates in line with inflation in an attempt to bring it down. When inflation is low, your pension will usually grow faster whereas when inflation is high, your investments are likely to decline in value.

Whether your pension will be able to keep up with inflation will depend on the current rate. For example, if inflation hits 11% as it did in 2022, your pension would need to grow by more than that to keep up. But high inflation is usually short term and it’s likely your pension will grow in value again once the rate of inflation decreases. Remember that pensions are a long-term investment - they’re designed to cope with the rise and fall of inflation across your career.

Independent Financial Adviser, Alan Tytherleigh, explains:

"Inflation is the silent force that quietly erodes the value of your savings and can have the same impact on your pension fund. When we were children, the cost of a chocolate was far less, with it likely being bigger as well. In the same vein, your pension pot needs to offset this silent force and grow over and above the rate of inflation, to ensure you have the same spending power when you retire.

"Investing your pension in suitable investments ensures it has the capability and capacity to grow more than inflation over the long term and shield against inflation's impact."

Choosing the right retirement investments for you

Financial planning for retirement can feel complicated, and it’s natural to worry about making the right choice for your financial future.

While risk is inevitable when it comes to investing, there are steps you can take to minimise the risk to your portfolio, to ride the waves of stock market volatility. Diversifying your investments can minimise your exposure to risk and potentially improve the return on your investments too. This involves investing in different asset types, such as stocks and shares, cash, property and bonds - so if one declines in value, your others shouldn’t be affected.

Alternatively, a high-interest savings account may be the right fit for you, giving you easier access to your money and financial protection through the FSCS. Using a savings account could also minimise risk, as investments can lose value should the market decline. But it is important to note that inflation can still cause your savings to lose value, as your money can end up being worth less than before.

Ultimately, the right retirement investment for you will depend on your risk tolerance, future plans and financial preferences. If you’re looking for guidance to help make informed financial decisions, consider speaking to a Financial Adviser.

Further resources to help with financial planning for retirement

The more knowledge and tools you have, the better equipped you’ll be to make financial decisions around your retirement.

Looking for guidance to make the right decisions for your retirement? MoneyHelper’s Pension Wise is a free, government-backed service that offers guidance for the over 50s. You can make an appointment with a pension specialist, who will explain the ins and outs of your pension options, to offer you clarity and support.