Are fixed-rate bonds safe, and how do high-interest savings accounts compare?

Fixed-rate bonds promise a predictable return for cautious investors, but how safe are they as an investment? In this article, learn how secure fixed-rate bonds are and how they compare to savings accounts.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

When investing your money, managing risk is always a priority. But it’s especially so during times of economic uncertainty.

Fixed-rate bonds are popular with investors because they offer predictable returns. But are fixed-rate bonds safe? Are there any hidden risks to consider?

In this article, you’ll learn about the pros and cons of fixed bonds, and how they compare with high-interest savings accounts.

How do fixed-rate bonds work?

Bonds are investments that work as a loan to companies or governments. You invest a particular amount of money into the bond in return for regular interest payments.

Fixed-rate bonds offer a set interest rate over a period of time, known as the ‘term’. The interest rate will vary depending on the length of the term, and most providers will ask for a minimum deposit to open the account.

Bonds usually pay your interest annually, but you may receive interest monthly or quarterly depending on your provider. You may also have the option to choose how frequently your interest is paid.

Are there different types of fixed-rate bonds?

There are different types of fixed-rate bonds you can invest in:

- Short-term (Under two years): Fixed-rate bonds with the shortest terms usually offer the lowest interest rates.

- Medium-term (3-5 years): You’re likely to be offered higher interest rates with these bonds, as you’re locking your savings away without access for a longer period.

- Long-term (Six years or more): With long-term bonds, your money won’t be accessible for an extended period. You’re likely to find higher interest rates on long-term bonds as a result.

How safe are fixed-rate bonds?

Fixed-rate bonds aren’t affected by market volatility. This means that, unlike Stocks and Shares ISAs, their value doesn’t decline if a given company loses value. You can usually predict exactly how much you’ll earn at the end of the term.

As a result, fixed-rate bonds are a relatively safe investment. But as with all investments, there are some risks to consider.

What are the risks of fixed-rate bonds?

Impact of changing interest rates

Committing to an interest rate upfront might mean you stand to earn less than other investment options. This is because you won’t benefit from the increase if interest rates rise elsewhere. By contrast, a mix of fixed and variable interest rates across multiple savings accounts can maximise your earnings, and offer better access to your savings.

During periods of high inflation, the Bank of England increases interest rates. If prices were to rise considerably during the term of your bond, your returns may no longer keep up with inflation. That means you’d be losing out in real terms.

Penalties for early withdrawal

If you need to withdraw your funds early you may incur a penalty, which can include the interest you’ve earned.

Risk of default

Because bonds work as a loan, it’s possible for companies or governments to ‘default’. A default means the organisation can’t (or won’t) repay their debts. When that happens, you could lose everything you invest. Although bond holders will usually be prioritised over shareholders should a business go into administration, there are no guarantees you’ll get your money back.

Whether you’re protected against this or not depends on the provider of the bond.

Are fixed rate bonds protected by FSCS?

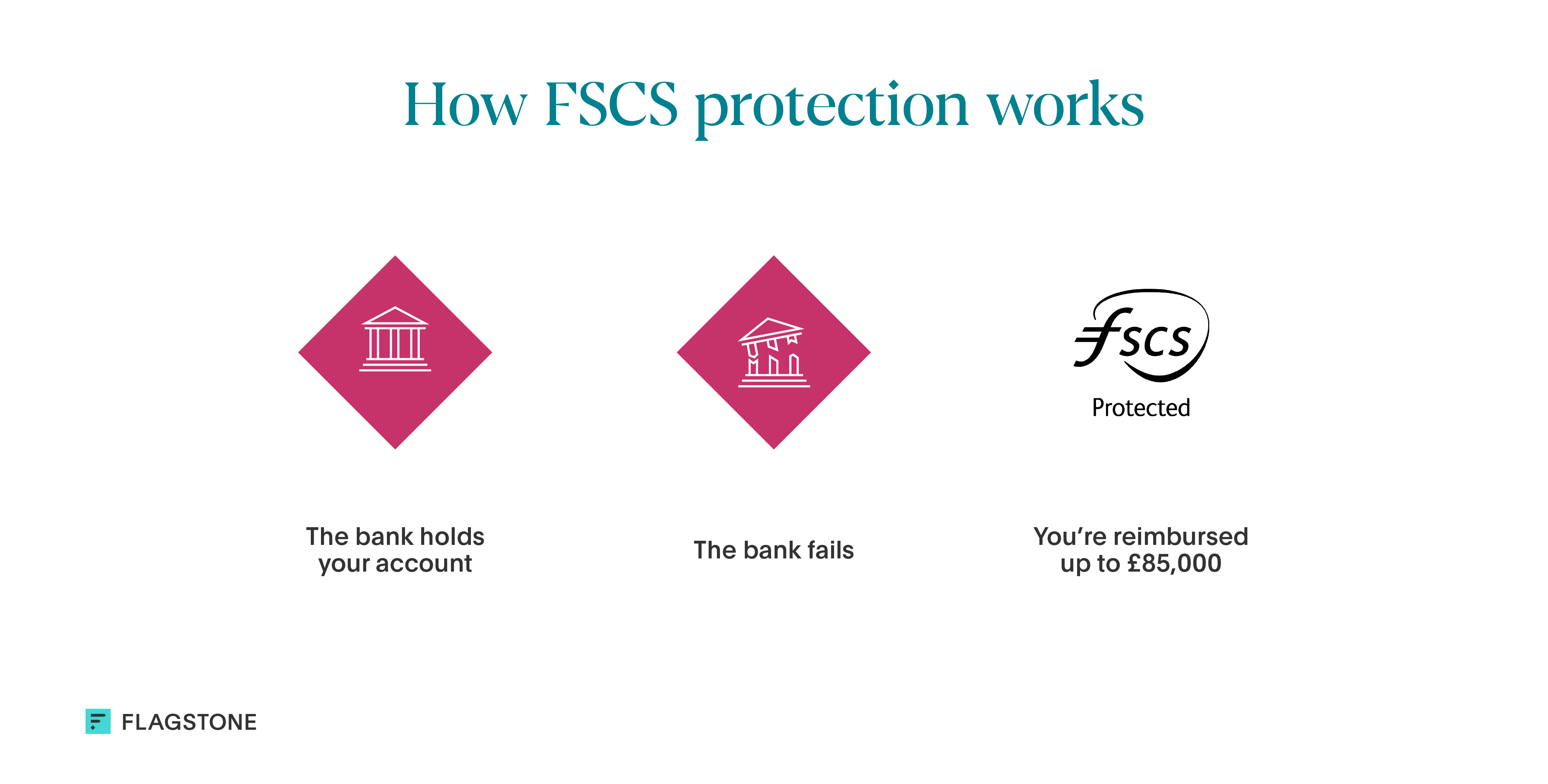

Fixed-rate bonds offered by UK banks and building societies are usually protected by the Financial Services Compensation Scheme (FSCS). This means that if your provider fails, your investments are covered up to £85,000 per individual, per banking group. For joint accounts, this doubles to £170,000.

Before you invest in bonds, it’s important to confirm whether your bond provider is eligible for FSCS protection.

How do fixed-rate bonds compare to savings accounts?

Fixed-rate bonds are considered one of the safest investment options for people interested in building a financial portfolio. But they are not without risk, as they involve three parties (you, the bank holding the bond, and the business or government with the loan).

By contrast, high-interest savings accounts are between you and the bank alone, and they are also protected by the FSCS.

High-interest savings accounts also have fixed-term options, allowing you to create a cash portfolio that matches your short, medium, and long-term goals.

Fixed-rate bonds are relatively safe investments

A balanced financial portfolio should include a range of assets. Fixed-rate bonds can be useful for cautious investors experimenting with new ways to build wealth.

But with high interest and fixed-rate options for savings accounts, bonds are not the only way to expand the earning potential of your cash.

Protect and grow your savings with high-interest savings accounts

Choose from hundreds of accounts from 60+ banks with Flagstone. All in one place, with a single application.