Building a diversified portfolio - the key considerations

A diversified portfolio can combat stock market volatility and economic change. We’ve created this guide on building a diversified portfolio, so you know how to approach diversification and understand how it can help you manage risk.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

Imagine your investment portfolio as a garden. Each asset a unique plant with its own set of needs. Just as a well-tended garden adapts to seasons, your investments may flourish or face challenges depending on economic and market conditions.

A diversified portfolio involves several different elements, or assets, working together. This creates a balanced and resilient whole that can combat stock market volatility and economic change.

We’ve created this guide on building a diversified portfolio, so you know how to approach diversification and understand how it can help you manage risk.

What is a diversified portfolio?

The phrase ‘don’t put all your eggs in one basket,’ can apply to your investment portfolio. Spreading your investments across different asset classes can help to protect your wealth.

A diversified portfolio is a key investment strategy used to minimise risk and combat stock market volatility. It involves spreading your investments across different asset classes (such as cash, stocks, bonds, and property), industries, sectors, and regions. The aim of diversification is that, if one investment underperforms, your other assets can help to offset any losses. Rather than relying on one type of investment, you’re spreading your level of risk to improve stability across your portfolio.

![]()

Likewise, you may look to diversify your savings by spreading your cash across different types of accounts to benefit from different interest rates and reduce risk. For example, you might deposit money into a high-interest savings account for short-term goals, while also setting up an Individual Savings Accounts for tax-efficient saving.

The benefits of diversification

Here are some of the key benefits of constructing a diversified portfolio:

Reducing risk

While maximising your returns is a key component of investing, it isn’t the primary goal of diversification. Instead, the aim is to reduce the impact of market volatility. As prices change over time, your investments can take a hit. To minimise this risk, you can choose to spread your investments across different asset classes, sectors, and geographic areas to reduce the chances of a loss.

![]()

Adapting to economic conditions

The economy can change significantly and rapidly. Take the dot-com bubble burst, for example, which saw the FTSE techMARK 100 index affected by a sharp decline in the value of tech and internet-related stocks.

A diversified portfolio can withstand changing economic conditions, such as inflation and interest rate changes, as certain assets thrive in different conditions. Diversification acts like a shield, helping to protect your investments from market volatility. However, it's important to keep in mind that, even with this strategy, there's still a risk of losing money.

Enhancing potential returns

A diversified portfolio often performs better long-term than focusing your investments in one area. This is because you’re aiming to protect yourself from losses by spreading your wealth across different asset classes. This can lead to steady growth and consistent returns over time.

How does diversification help you manage risk?

Portfolio diversification helps with risk management by allowing you to absorb shocks (e.g. market change and economic events), as some asset classes will be more heavily affected than others. Given the events of the past few years, such as the COVID-19 pandemic and the cost of living crisis, it’s not surprising that the market was affected by high inflation and interest rates. This means, for your investments to keep their value in real terms they’d need to rise at least by the rate of inflation.

During periods of economic downturn, assets such as bonds may offer you more stability than stocks. The interest is fixed when you buy a bond, so you can know for certain how much you’ll receive. Whereas stocks tend to decline during inflation due to consumer spending slowing down.

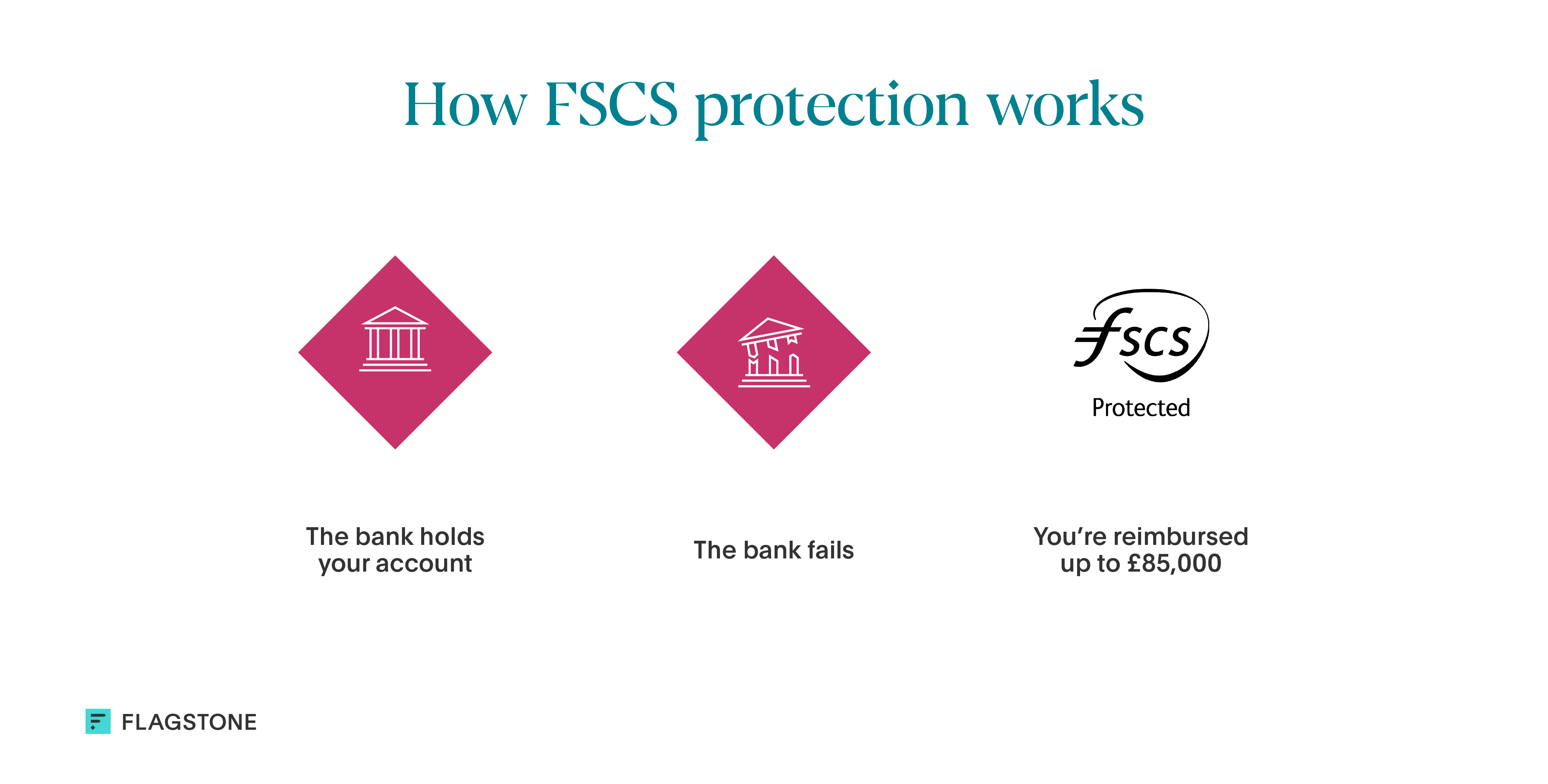

Consider sharing your wealth across both investments and savings accounts to boost your portfolio’s resilience. If you have a high-interest savings account, check they’re regulated under the Financial Services Compensation Scheme (FSCS). This means, if your bank or building society fails, you’ll receive compensation of up to £85,000, per account, per financial institution.

You can use the Financial Conduct Authority register to check if your provider is FSCS protected.

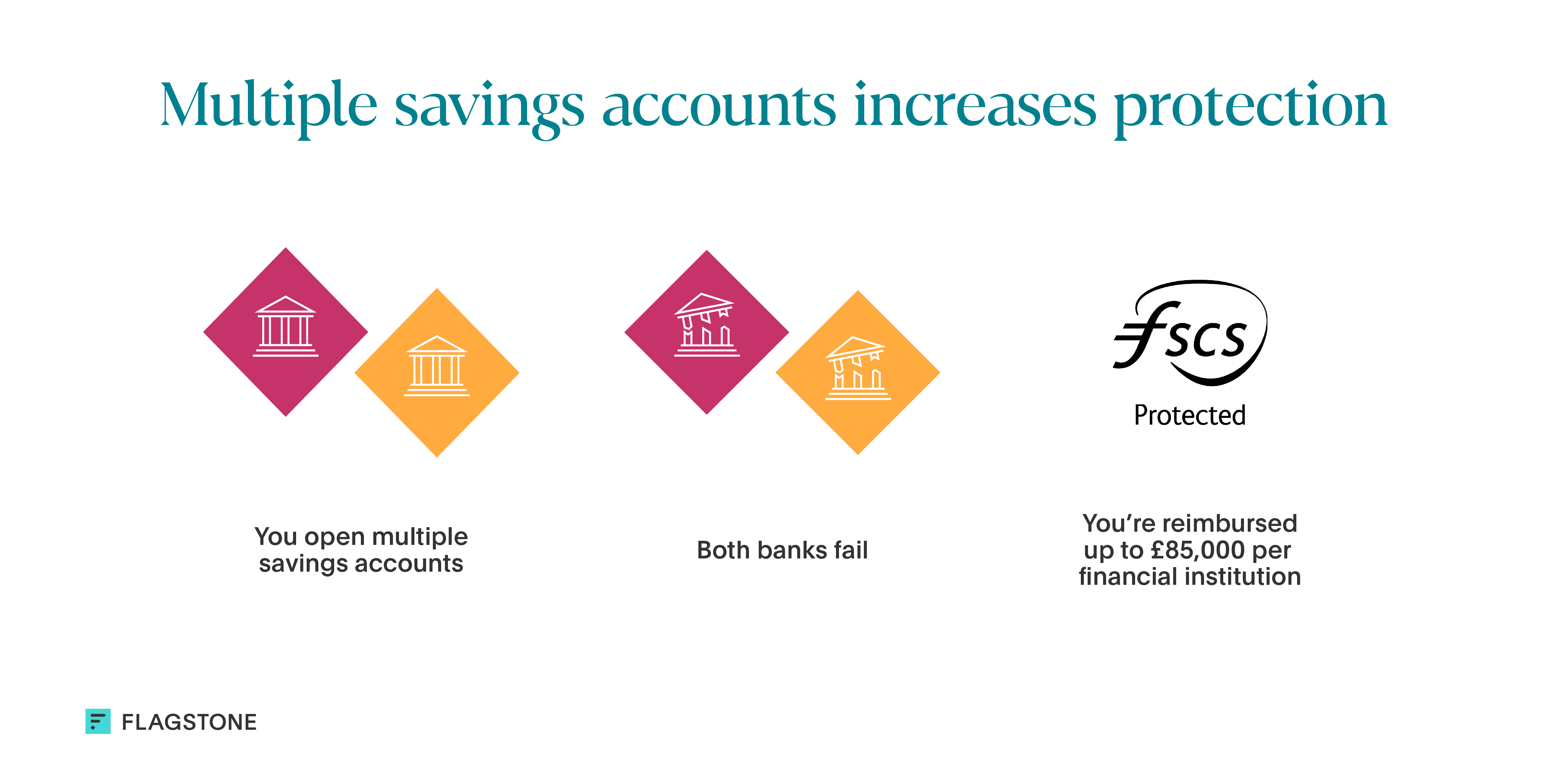

Diversifying your savings portfolio

Spreading your money across different accounts not only helps it grow through accessing different interest rates, but also enhances your level of protection. Follow the golden rule of not depositing more than £85,000 into each individual bank account (or £170,000 for each joint account) with a single financial institution to maximise FSCS protection in case your bank or building society fails.

If you’re looking for a hassle-free way to grow your savings, a cash deposit platform like Flagstone can help you achieve your savings goals. With just one login, you can easily spread your money across multiple banks and accounts. All while knowing your funds are protected by the FSCS.

Common questions about diversifying your portfolio

What is a well-diversified portfolio?

A well-diversified portfolio is a powerful investment strategy and risk mitigation tool that balances risk and return by spreading investments across a variety of asset classes, sectors, and geographic regions. In doing so, if one asset underperforms, it shouldn’t be detrimental to the portfolio’s overall performance and return.

How do I start a diversified portfolio?

Constructing a diversified portfolio requires planning, monitoring, and rebalancing. Here are some key considerations to get started:

1. Set your intentions: Establish your investment goals and risk tolerance. Your risk tolerance is how comfortable you are with the chance of your investments losing value.

2. Decide on your asset classes: Choose a mix of asset classes that align with your risk tolerance and financial goals, such as cash, stocks, and bonds. Consider geographic diversification and investments that span different industries and sectors.

3. Rebalance your portfolio: Rebalancing is the process of reviewing your portfolio to realign it back to your original goals and risk tolerance, through buying and selling. Read our guide to rebalancing your portfolio for more information.

4. Stay informed: Keep an eye on economic and market trends, and adjust your portfolio accordingly to maximise your returns and minimise risk.

How Flagstone can help you diversify your portfolio

If you’re looking to diversify your portfolio to reduce risk and keep your investments flourishing, a high-interest savings account could suit you. Spreading your funds across several accounts can help you access the best interest rates, all while protecting your savings under the FSCS.

Our cash deposit platform can help you protect your wealth, while maximising the returns on your savings. As a Flagstone client, you’ll gain access to hundreds of accounts from 60 banks, with exclusive interest rates to boost your balance. You’ll have complete control over your portfolio and immediate visibility of all your money.

See how Flagstone can help you achieve your savings goals.