New data published by Flagstone, the UK’s leading cash savings platform*, shows that the proportion of financial advisers and savings professionals at UK banks who believe the base rate will continue to hold at 5.25% continues to fall significantly.

Confidence in high rates holding drops again among savings professionals and advisers

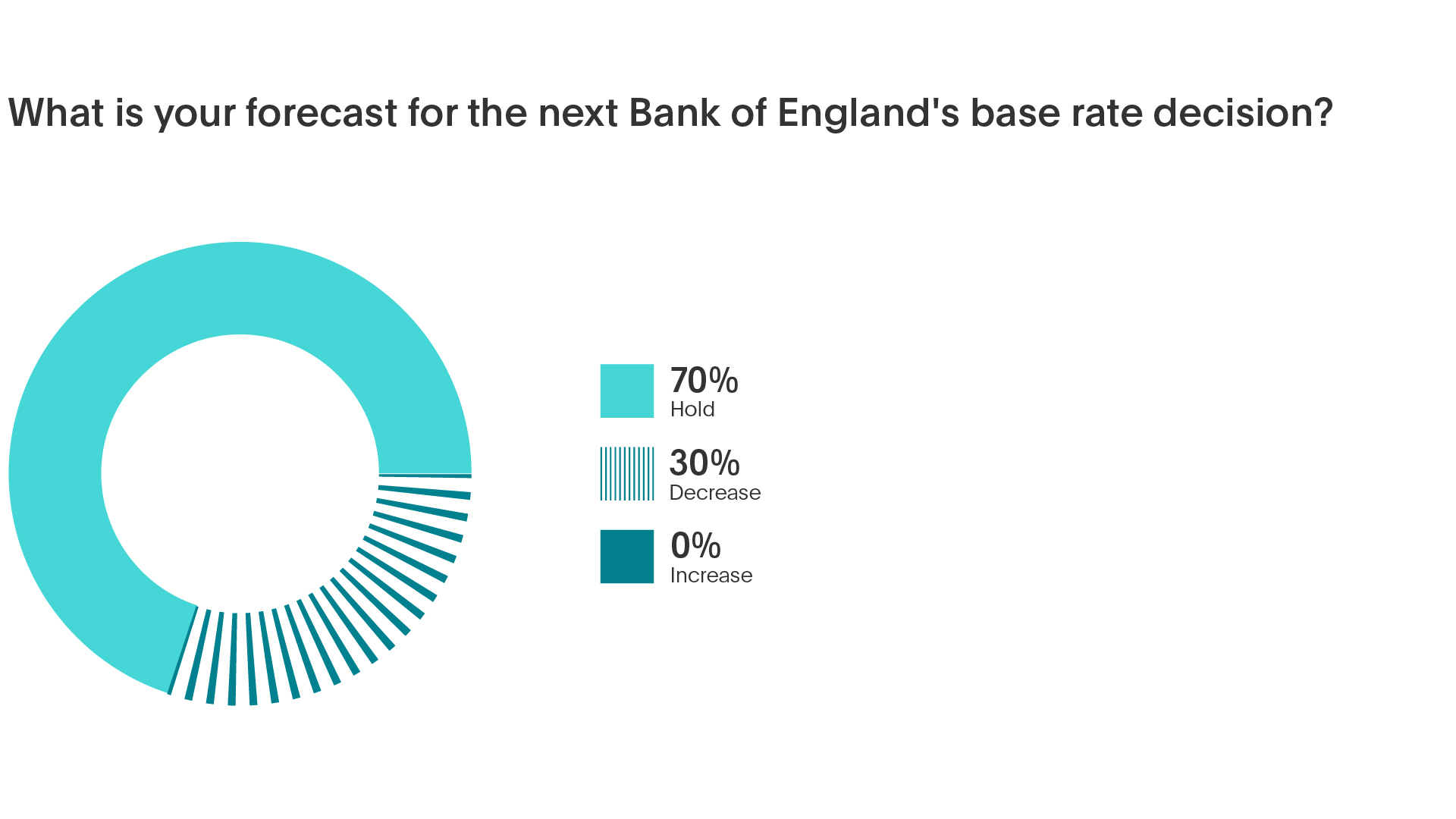

The Flagstone Base Rate Poll canvassed the opinions of 212 independent financial advisers, wealth managers, and senior savings professionals at banks and building societies. The survey found that 70% of respondents expect the base rate to remain unchanged at 5.25% at the next Monetary Policy Committee (MPC) meeting on 20 June.

This marks a second consecutive 15% drop in confidence in polls conducted ahead of the last two base rate decisions. In March, 96% of respondents predicted a no-change vote. In May, this proportion slid 15% to 82%.

General Election casts its shadow of uncertainty

Asked to share their perspective on the trajectory of the base rate, almost a third (29%) of respondents say that the base rate has been close to decreasing, but such a move will not happen now until later in the year as a consequence of the snap General Election on 4 July. This proportion rises to more than 2 in 5 (42%) savings professionals at banks.

Almost a quarter (22%) of advisers go on to say that among the clients they’ve engaged with since the General Election was announced, many are unsure what it will mean for their wealth and finances. 1 in 8 (12%) add that the General Election announcement has prompted more clients than usual to request time to discuss their portfolios and strategies.

In response to client queries, 1 in 9 (11%) advisers say the impending Election is prompting them to advise clients to lock in move savings in long-term products, or to allocate more wealth to cash.

Rates to remain high until year-end at the earliest

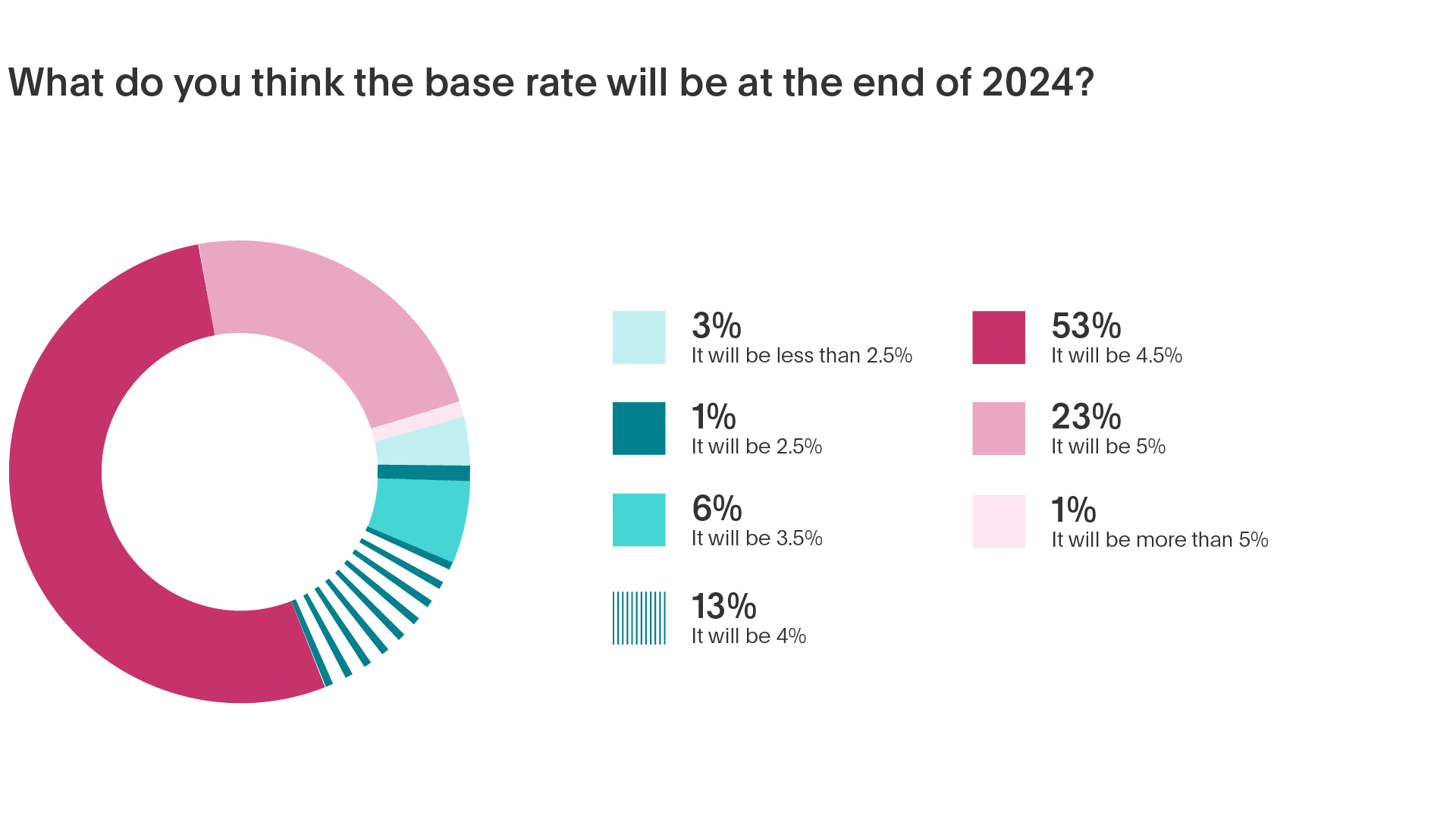

While conviction that the base rate will hold continues to fall, uncertainty in the market makes considerable rate changes over several months more unlikely. 76% of respondents to this latest poll say that the base rate will end the year at no less than 4.5%. This contrasts hugely with the results of the last poll, before the 9 May base rate vote, when 79% of advisers and wealth managers predicted the base rate would end the year at 4.5% or lower.

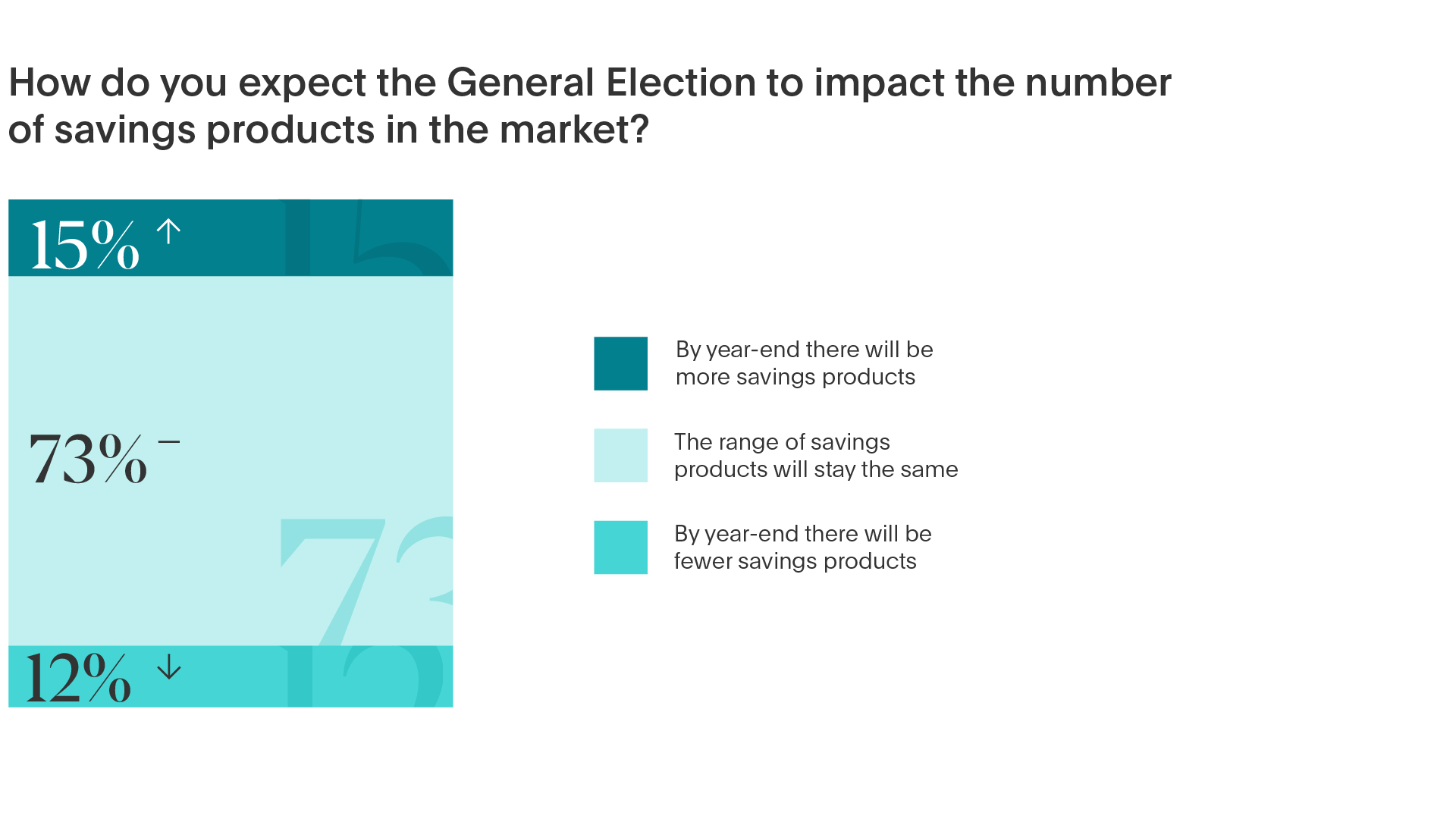

The impact of limited change will not necessarily be beneficial to the savings market. Asked how they expect the General Election to impact the size of the savings market, less than 1 in 6 (15%) banks expect there to be more products than fewer by year-end.

Simon Merchant, Co-Founder & CEO of Flagstone, comments:

“A snap general election will always send shockwaves through markets, and this one is no different in the case of savings. Last month we were buoyed by the economic green shoots we were starting to see. It seems six weeks is a long time in market economics and plenty can happen to provoke turbulence in the interim.

“On the one hand, savings professionals and advisers are less happy than before to predict a base rate hold when the MPC meets next week. And on the other hand, they’re significantly less confident now than they were last month in the likelihood of the base rate falling far before the year is out.

“The impact of this uncertainty over the base rate continues to be felt in the savings market and we would be wise to factor in more headwinds for the industry ahead, as the election plays out and the next government takes shape. In these sorts of circumstances, it’s reassuring to see more advisers pointing more clients to take action to lock in longer-term savings and allocate more to cash.”

Flagstone’s six-weekly Base Rate Poll is conducted in the days leading up to MPC base rate decisions to capture live sentiment and expectations among those setting the agenda for the cash deposits and cash management markets.

* Based on number of banks and savings accounts on the platform, and Trustpilot customer review ratings (4.5/5)

** Flagstone Base Rate Poll methodology: industry research canvassing opinions of 212 financial advisers, wealth managers and savings professionals at UK and international banks, 4 - 10 June 2024.

*** Source: FCA Cash Savings Market Review 2023

Press office contacts

Carmen Dixon: 07717 278846 | carmen@ripplecomms.co

Jo Candy 07909: 992082 | jo@ripplecomms.co