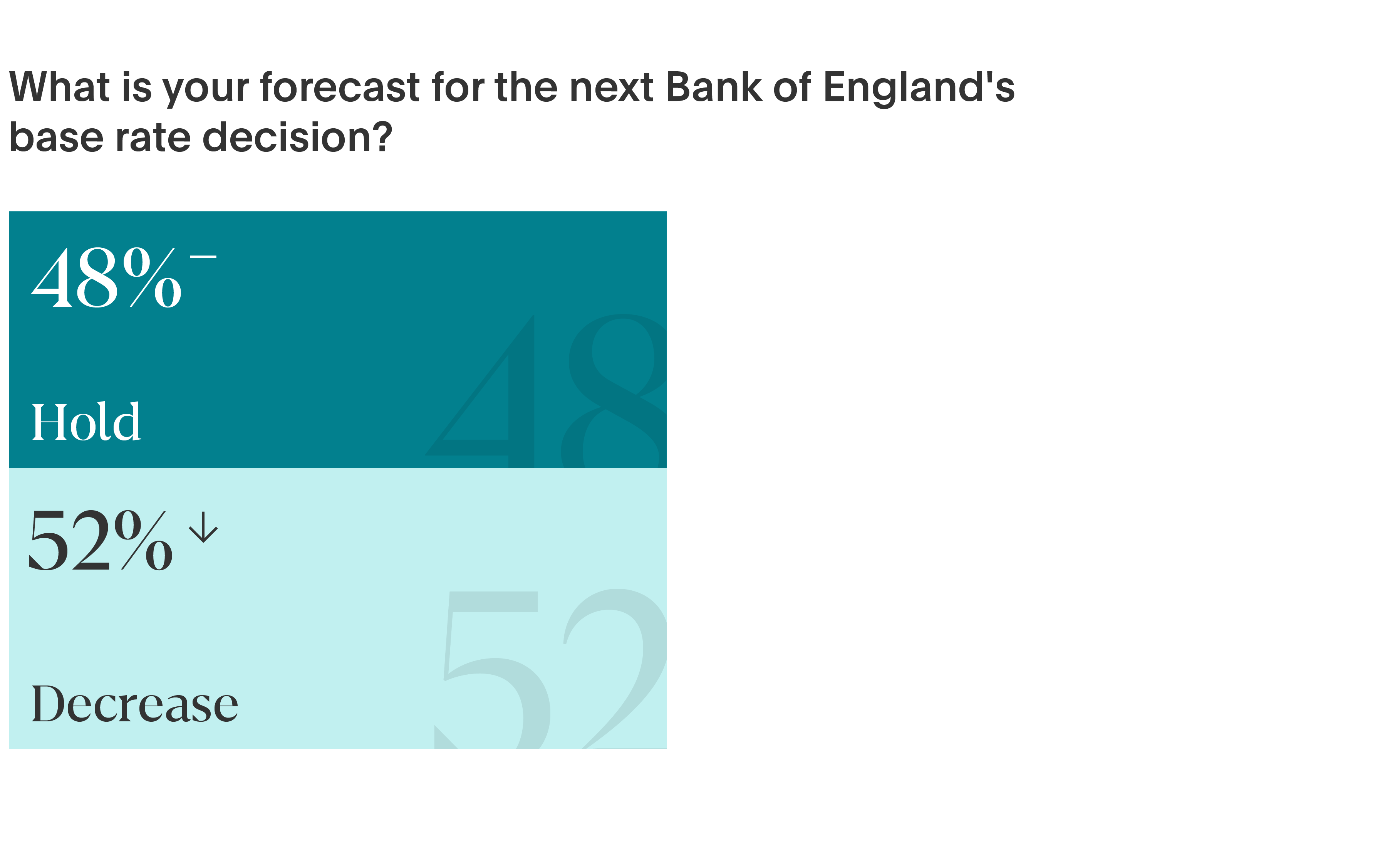

New data published by Flagstone, the UK’s leading cash savings platform*, shows that the proportion of financial advisers and savings professionals at banks who believe the base rate will be cut at the next Monetary Policy Committee (MPC) meeting on 01 August has jumped significantly to just over half (52%).

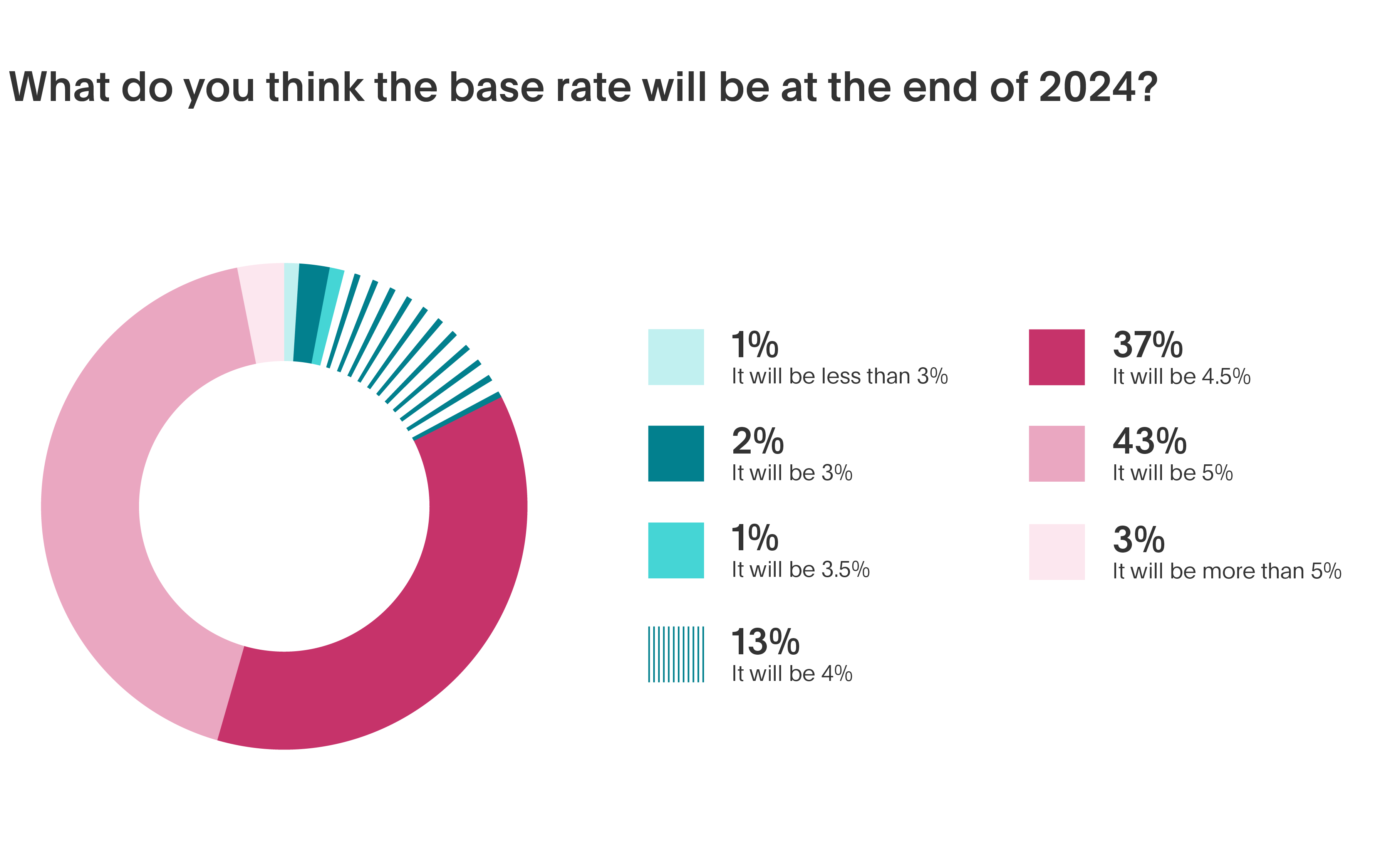

However, they remain cautious about significant cuts, with 83% not expecting the base rate to drop below 4.5% by the end of the year.

Confidence in a rate cut increases among savings professionals and advisers, but is still divided

The Flagstone Base Rate Poll** surveyed 136 independent financial advisers, wealth managers, and senior savings professionals at banks and building societies. The survey found that 52% of respondents expect the base rate to be cut from 5.25% in August, marking a significant shift in opinion from the last poll in June, when 30% anticipated a cut. Ahead of the 09 May MPC decision, less than a fifth (18%) of respondents predicted a cut.

Despite this shift, savings professionals and advisers are largely split on their predictions. 14% are not expecting a cut at all in August or September.

Competition for savers to increase among banks

When asked what a base rate cut in August or September would mean for savings rates by the end of the year, a quarter (23%) believe competition among banks will increase to win instant access and shorter-term account funds. 21% believe the spread between the most and least competitive rates will narrow.

Three-fifths (59%) of respondents believe savings rates will fall moderately (25 to 50 basis points) between now and the year-end, while a third predict rates will only drop by up to 25 basis points.

Savers advised to act now to lock in the best savings rates

59% of savings professionals and advisers are advising savers to lock in the best longer-term rates for cash not needed immediately. 48% are advising savers to spread their cash across savings accounts with different term lengths.

Simon Merchant, Co-Founder & CEO of Flagstone, comments:

“Uncertainty around where the base rate is heading, and when, is unhelpful for savers, encouraging inaction and stasis.

“Savers would do well to follow the guidance of advisers and savings professionals, and take advantage of the competitive rates available on long and shorter-term savings accounts right across the market. From instant access accounts to five-year fixed-term accounts, it’s not hard to find inflation-beating rates.

“When the base rate does eventually fall, we’ll start to see some softening in the rates banks pass on. Savers should act now and enjoy the variety on offer.

“It’s no wonder expectations regarding the base rate cut are so divided. Multiple factors are creating indecision. While some believe continued inflation control and wider economic conditions support a rate cut in the near term, others emphasise the need for caution and further stability before making such a move. The consensus seems to lean towards a potential rate cut, but not necessarily in August, with many predicting a decision might be deferred to later in the year.”

Flagstone’s six-weekly Base Rate Poll is conducted in the days leading up to MPC base rate decisions to capture live sentiment and expectations among those setting the agenda for the cash deposits and cash management markets.

* Based on number of banks and savings accounts on the platform, and Trustpilot customer review ratings (4.5/5)

** Flagstone Base Rate Poll methodology: industry research canvassing opinions of 136 financial advisers, wealth managers and savings professionals at UK and international banks, 04 – 10 June 2024.

Press office contacts

Carmen Dixon: 07717 278846 | carmen@ripplecomms.co

Jo Candy 07909: 992082 | jo@ripplecomms.co