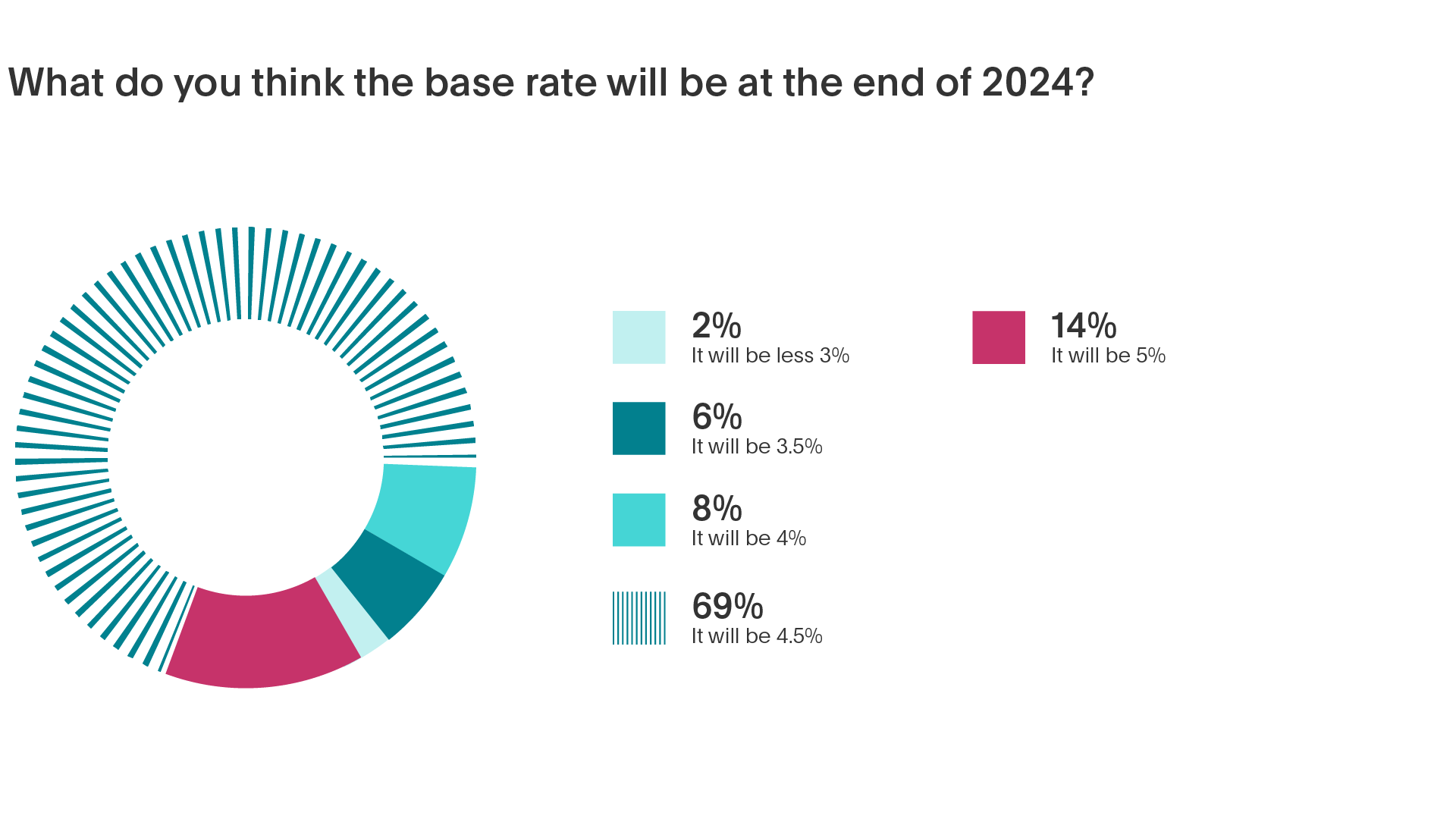

Seven in ten (69%) savings professionals at banks and advisory firms in the UK predict that the Bank of England base rate will end the year at 4.5%, according to the latest Flagstone Base Rate Poll*.

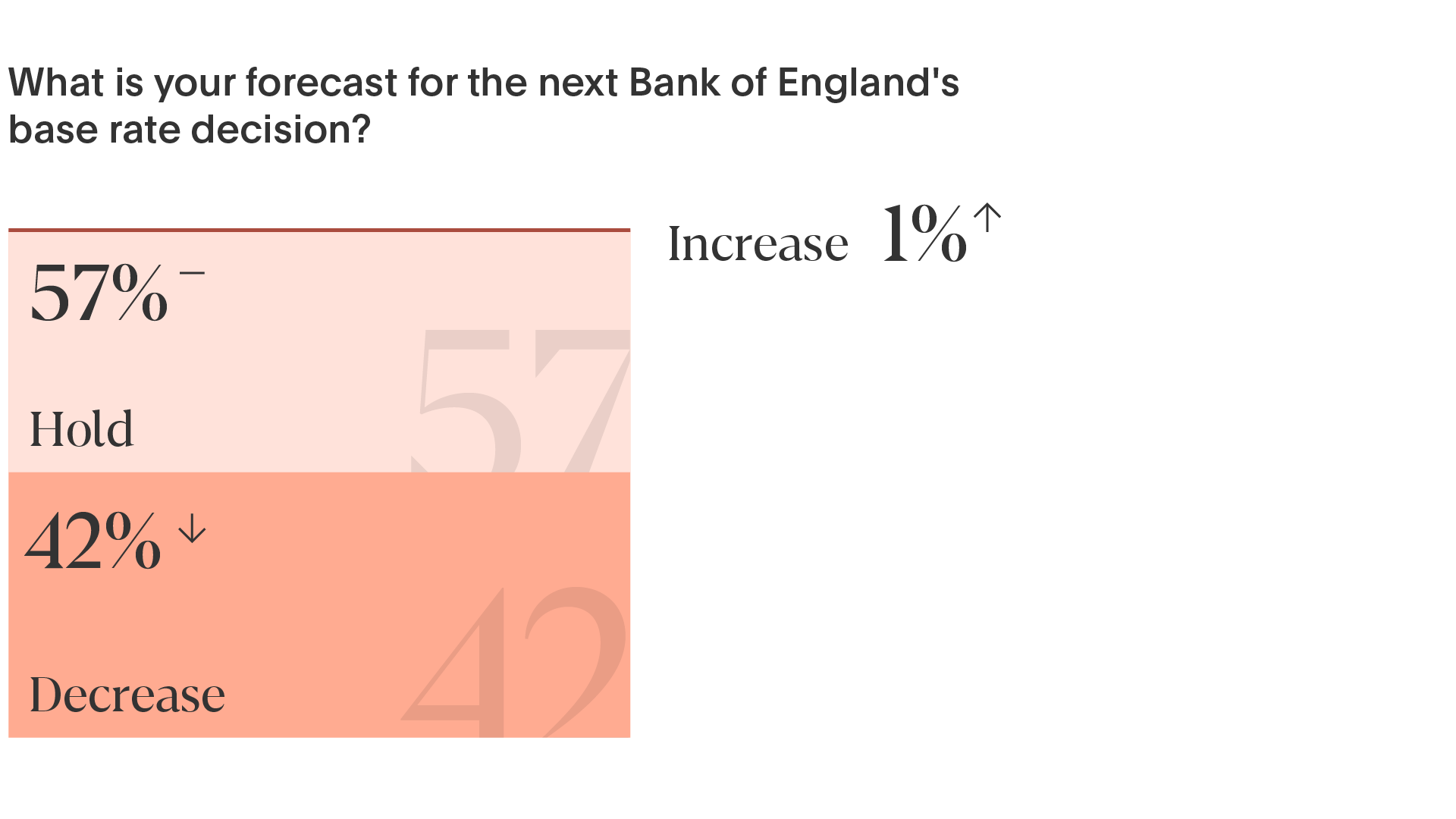

Flagstone’s poll finds that the Bank’s Monetary Policy Committee is unlikely to vote for a second consecutive cut to the base rate when it meets on Thursday 19 September. 57% of respondents are predicting a hold, indicating greater certainty in the base rate staying firm in September. This contrasts with the 1 August base rate decision, when opinions were more divided and 52% of respondents predicted a decrease.

Simon Merchant, CEO of Flagstone, comments:

“In a market where rates are softening, it pays to do your homework and diversify your savings. Savers who maintain multiple savings accounts with portions of their cash maturing on a regular basis stand to benefit the most. These savers recognise the advantages of diversifying their savings by term length – ensuring reliable liquidity, strong returns, and the opportunity to capitalise on the relentless competition among banks to stay at the top of the best-buy tables.”

Savings professionals are sanguine about the impact of the August base rate cut on savings interest rates this autumn. Four in five respondents (80%) say that banks and building societies have cut their savings interest rates in line with expectations or more slowly than anticipated. The same proportion (79%) expect average rates to fall by no more than 50 basis points before year-end.

The best interest rates for instant access accounts are just shy of 5%. One in five (19%) respondents say the best instant access rates won’t drop below 4.25% before December. A further 30% expect best rates to remain at or higher than 4.25% until 2025.

Despite these predictions of persistent, buoyant rates, savings professionals are urging savers to actively manage their cash. 60% of respondents believe the key thing savers can do is to lock in the best rates for 12 month terms or longer. A further third (33%) recommend spreading cash across savings accounts with different terms.

Flagstone accounts currently offer some of the market’s highest interest rates.

Merchant concludes:

“Labour is issuing near-daily warnings to expect a considerable set of tax changes in the 30 October Budget that will force adults across the UK to rethink and reset their personal finances. While investing may be about to become less palatable for some and unsustainable for others, active savers who act now and plan ahead stand to come out on top.”

This poll follows the publication of new Flagstone research** into the issue of ‘saver inertia’ to mark UK Savings Week (9-15 September). The research found that:

- 1 in 6 (15%) UK adults haven’t a single savings account

- A further third (32%) have only one

- Half (49%) of savers haven’t moved savings between existing saving accounts within the same bank in the last 12 months

- 62% haven't moved savings to a new savings account in a different bank in the last 12 months

* Flagstone Base Rate Poll methodology: industry research canvassing opinions of 84 financial advisers, wealth managers, and savings professionals at UK and international banks, 2-8 September 2024.

** Market research commissioned by Flagstone and conducted by Opinium among 2,000 UK adults, Q2 2024.

Press office contacts

Carmen Dixon: 07717 278846 | carmen@ripplecomms.co

Jo Candy 07909: 992082 | jo@ripplecomms.co