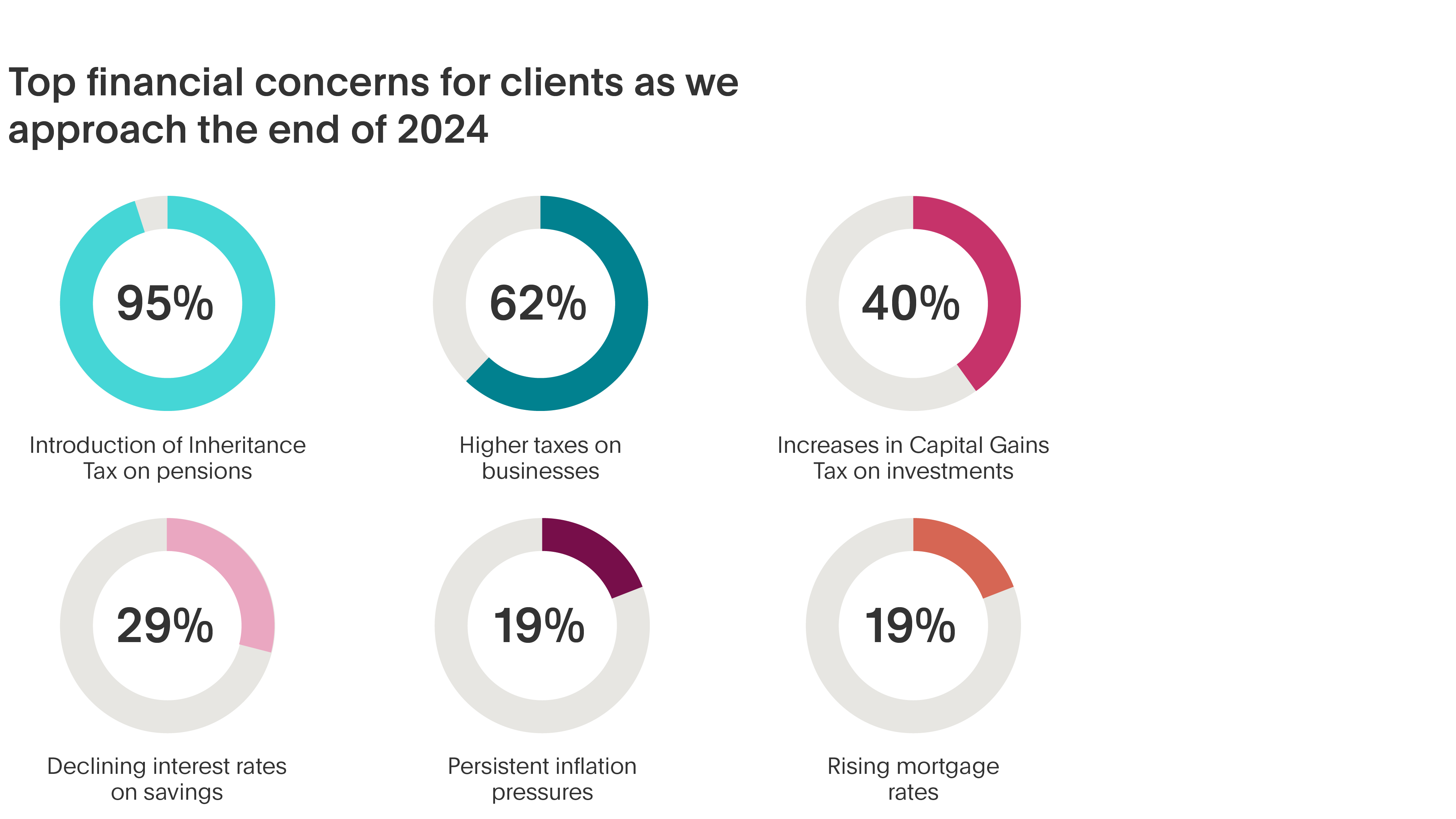

Almost all UK IFAs point to Inheritance Tax (IHT) on pensions as the primary financial concern for their clients, according to the latest Flagstone Base Rate Poll*. Asked to name the biggest financial worries facing their clients at the end of 2024, 95% of respondents cited the expansion of the so-called ‘death duty’.

Flagstone’s six-weekly poll surveys the attitudes and experiences of UK IFAs ahead of every Bank of England base rate decision. Higher taxes on businesses (for instance, increases to employers’ NICs) and the immediate increase to Capital Gains Tax on investments are also key concerns, according to 63% and 40% of the poll’s respondents respectively.

The findings tally with IFA and customer polls conducted by Flagstone in October. Almost seven in ten (69%) advisers expected most clients to hold investments longer to defer higher CGT. Additionally, 34% of Flagstone savers expected to invest less now or in the future as a result of the CGT change.

Simon Merchant, CEO of Flagstone, comments:

‘While tax changes were signposted before the Budget, the impact is now hitting home. Many are reconsidering their financial plans - both personal and business. A troubling trend risks emerging here where savers raid their pensions to reduce their tax exposure, but lack a clear plan to maximise those new lump sums. Here lies an invigorating opportunity for advisers to help their clients explore a wider range of asset classes with more favourable tax conditions.’

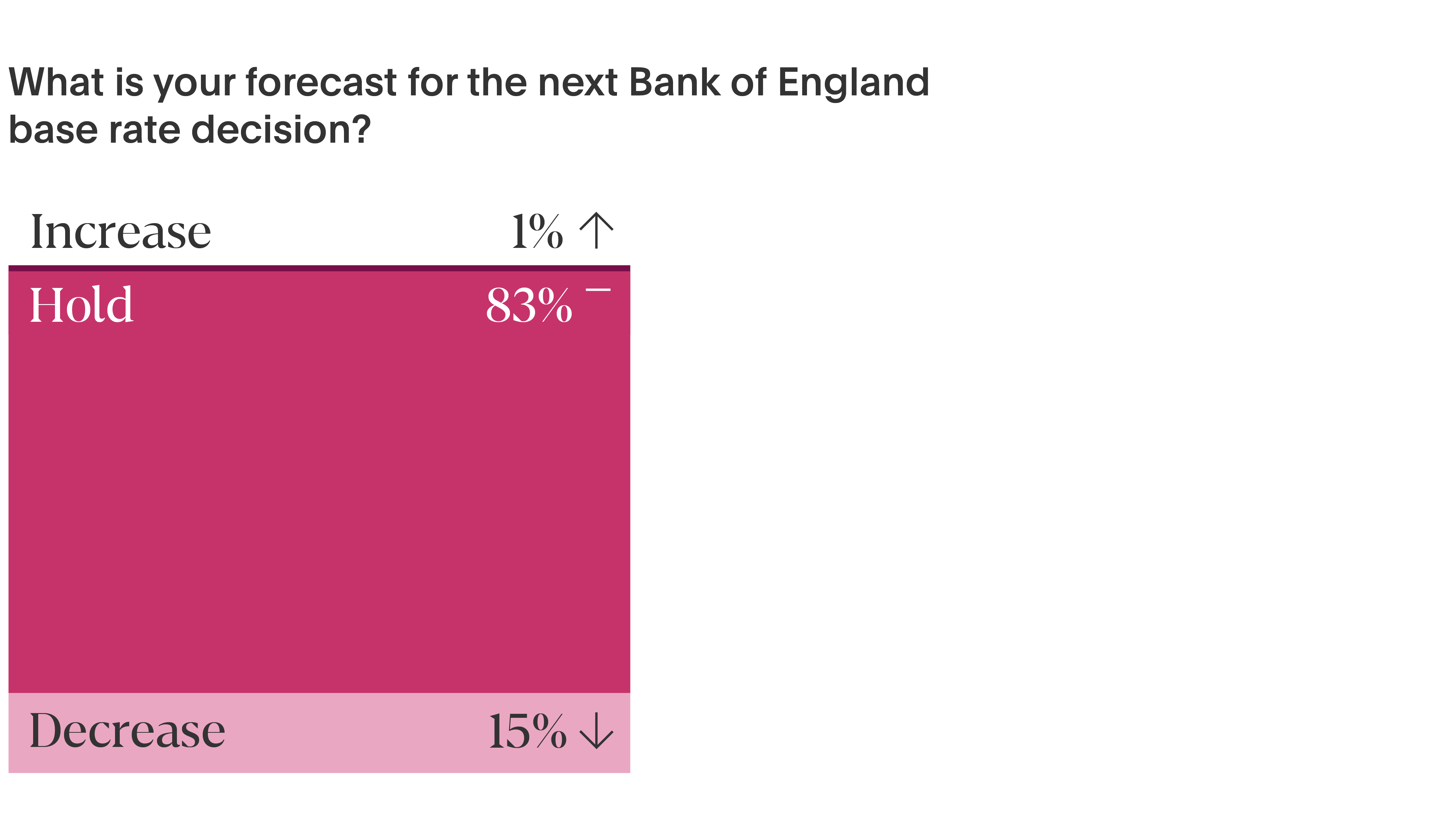

Flagstone’s poll also finds that 83% of UK IFAs are predicting a base rate hold when the MPC meets on Thursday 19 December. While this proportion is high, there is greater uncertainty over the direction of the base rate than previously. The vast majority (88%) of poll respondents correctly predicted a cut ahead of the last base rate vote in early November.

Merchant concludes: ‘Many banks priced in several base rate cuts back in August and September, making the decline in rates since November’s base rate cut more subdued than anticipated. Added to that, banks are pricing savings rates competitively as they raise deposits to fuel future growth and lending plans. It’s not hard to find dozens of Fixed Term, Notice, and Instant Access accounts right now that continue to exceed inflation by as much as 2.5%. These rates won’t stick around for long as and when base rate reductions begin again in 2025. Savers would be wise to take advantage now when re-evaluating their financial plans in light of the new tax regime.’

*Flagstone Base Rate Poll methodology: industry research canvassing opinions of c. 80 UK financial advisers and wealth managers, 2-8 December 2024

Press office contacts

Carmen Dixon: 07717 278846 | carmen@ripplecomms.co

Jo Candy: 07909 992082 | jo@ripplecomms.co