FSCS protection eligibility

All UK based banks and building societies on our platform are members of the Financial Service Compensation Scheme (FSCS).

In the event that one of the UK based banks and building societies on the platform were to go into administration then our client (if eligible) would have a single claim under the FSCS limited to the deposit compensation limit of £85,000 per depositor (£170,000 for joint accounts) per UK bank.

The FSCS protects certain qualifying temporary high balances up to £1 million for six months from when the amount was first deposited.

You do not need to do anything – the FSCS will compensate you automatically.

For more information, please refer to the FSCS website.

CURRENT PERSONAL RATES ON OUR PLATFORM

5 year fixed term

4.57%

(AER)

12 month fixed term

5.20%

(AER)

95 day notice

5.23%

(AER)

Instant access

5.10%

(AER)

Greater value for your clients

Grow your business

Acquire new, high-value clients by offering greater protection for their savings via our award-winning online cash deposit platform.

Gain greater visibility

Understand the full picture of your clients' wealth with greater visibility of their cash assets - increasing your influence and building revenue.

Market-leading rates

Offer your clients access to hundreds of savings accounts - including market-leading and exclusive rates - to grow their money.

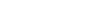

Your clients can start saving with Flagstone in three simple steps

Start saving from £50K

The Flagstone platform is available to your clients (aged 18 or older) looking to deposit £50k or more. And to companies, charities and trusts (including SIPPs and SSASs) with £250K or more to deposit.

Client testimonials

Evelyn Partners

Simon Reeks, Head of Finance

St. James's Place

Royden Greaves, Senior Partner

St. James's Place

Nicola Gillespie Syme, Senior Partner

Your clients' cash is safe

FCA authorised and regulated

As a company authorised and regulated by the Financial Conduct Authority (FCA), we are required to manage our business to the high standards set by the FCA.

Trust structure

All funds held by Flagstone on behalf of clients are separated from Flagstone's own funds and only held in designated trust accounts.

Secure encryption

Flagstone partners with top tier experts to ensure end to end security. All data is held on secure, encrypted servers, protected by multi-layer firewalls.

FREQUENTLY ASKED QUESTIONS

Due to the volume of deposits we intermediate and through the

relationships we have developed with our partner banks, we are

able to access exclusive and competitive deposit rates for

Flagstone clients.

Partnering with more than 60+ banks and building societies,

Flagstone gives you access to more than 200 deposit accounts

through a single application.

Using Flagstone's secure online platform, you can quickly and

easily diversify your deposits with different UK banks and building

societies to increase the total value of those deposits that are

eligible for FSCS protection.

Ongoing access to exclusive and market-leading interest rates

empowers you to maximise the interest income from your cash.

There is an annual management fee of between 0.15% p.a. and

0.25% p.a. depending on the value of deposits you

hold on our platform.

For deposits of £250k or more, a one time setup fee of £500 will be

payable and automatically taken from your initial deposit. For US

Dollar accounts this fee is $500 and for Euro Accounts it is

€500. This admin fee applies to all Individual, Joint, company,

charity and trust clients.

No Administration fee is charged for deposits between £50,000 to

£249,999.

Ensuring the funds belonging to our clients are secure is our

number one priority. As a company authorised and regulated by

the Financial Conduct Authority (FCA), we are required to hold

appropriate levels of regulatory capital and generally organise and

manage our business to the high standards set by the FCA.

Flagstone partners with top tier technology providers and security

experts to ensure the end to end security. We employ practices

and techniques to keep our platform up to date with the ever-

changing security landscape and to provide a secure platform to

our clients.

Flagstone has adopted internal systems and controls designed to

protect client funds from the risk of fraud. These include relevant IT

controls, appropriate segregation of duties, restricted access

rights and signature protocols.

Importantly, Flagstone does not allow any third-party payments

and will only ever authorise payments from a client’s Flagstone

Hub Account to their Nominated Return Account.

Yes. In the event that one of the banks on the platform were to go

into administration, assuming the bank in question was a member

of the Financial Services Compensation Scheme (FSCS), then our

client (if eligible) would have a single claim under the FSCS limited

to the deposit compensation limit of £85,000.¹

¹FSCS deposit protection is £85,000 per depositor (£170,000 for

joint accounts) per bank (as at 27 May 2020). For more information

please refer to https://www.fscs.org.uk

Flagstone implements safeguarding measures to protect

customer funds.

All funds held by Flagstone on behalf of clients are separated from

Flagstone’s own funds and only held in designated trust accounts.

Furthermore, each client’s individual deposits are held against a

unique alphanumeric reference number.

Were Flagstone to be placed in administration or wound up,

clients retain full beneficial ownership of their funds at all times and

as such these will be paid back to the client by the administrator.

Clients have no credit exposure to Flagstone.

When you transfer money to your Flagstone account, it is

deposited into a ‘Hub Account’ provided by HSBC Bank plc. The

Hub Account is a segregated trust account set up to receive and

hold funds before they are sent on to a deposit account. When a

deposit account matures or a request for the return of instant

access or notice account deposits is made, the funds are returned

to the Hub Account.

No, using the online Flagstone platform you have full control of

which banks you choose to deposit your money with and which

accounts you open.

Flagstone gives you visibility of every pound earned and the

simplicity of consolidated reporting.

Once you have a Flagstone account, you will have 24/7 access to

consolidated statements for all your deposit accounts for any

period of time, available to view and download via the platform.

At the end of each tax year, Flagstone will provide you with a

summary of interest earned.

The Flagstone platform is available to individual and joint

applicants who are resident in the UK and 18 years of age or older.

Accounts are also available to UK-registered companies, charities

and trusts (including SIPPs and SSASs). The minimum amount

required to open a Flagstone account is currently £50,000 for

individual and joint applicants, and £250,000 for companies,

charities and trusts.

Simply click on the 'Open an Account' button on our website.

For individual and joint applicants, you can complete our new

online account opening process.

For all other account types, provide us with your details and we will

send you an application pack to complete and return.

If you need any help at any stage, don’t hesitate to contact us at

applications@flagstoneim.com

We need your completed application form to open your Flagstone

account. If you are submitting a paper version, your application

form and engagement letter should be signed.

Provision of the required source of funds information and certified

identification documents with your application will avoid delays in

setting up your Flagstone account.

We may need further information or documentation to enable us to

complete the processing of your application and meet our regulatory

requirements as an FCA authorised firm.

Yes, US Dollar and Euro Flagstone accounts are also available.

At a maturity event, all monies (principal and interest) will be

returned to your Flagstone Hub Account.

Join a network of leading referrers

Trusted by leading Wealth Managers, including St.

James' Place, Evelyn Partners, Quilter Group and

Coutts, plus many of the UK's leading banks and

building societies.

With Flagstone, your clients can spread their cash

across up to 60+ banks in one simple portfolio.