Interest rates are back in the headlines

After January’s surprise economic dip, the Bank of England (BoE) hit pause – keeping the base rate at 4.5%. But while this (non) move was widely predicted, it’s generally expected that once inflation settles, rates will drop. And with banks’ interest rates likely to follow, it opens an ideal window of opportunity for financial advisers and their clients.

Our suite of three articles explains why now’s the time to consider cash as part of an investment portfolio. In this article, we look back at recent financial shifts and why locking in great rates can benefit savers.

From record inflation to falling rates

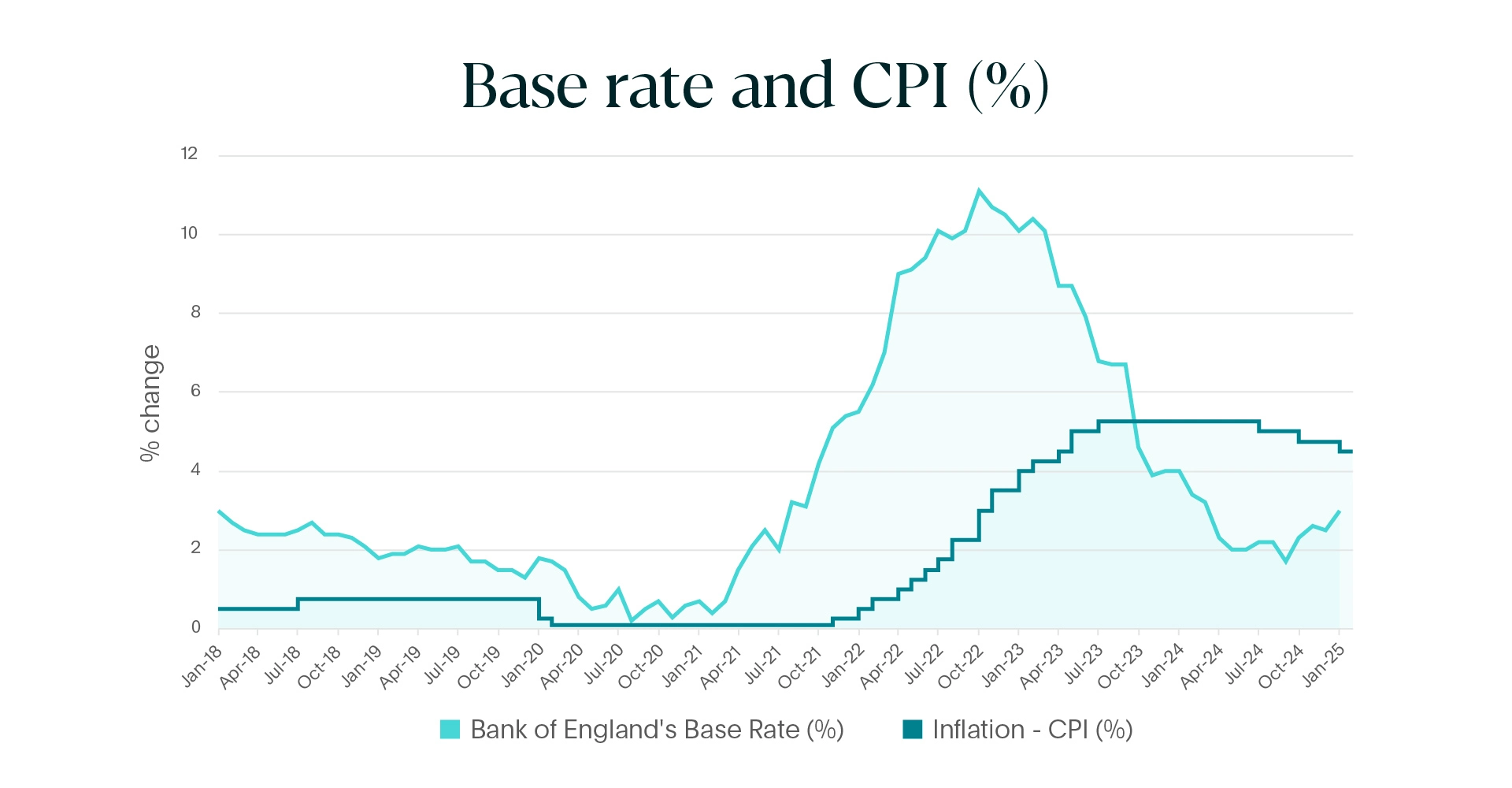

Not long ago, surging inflation dominated the economy. The pandemic shattered supply chains, and the Ukraine conflict sent energy prices soaring. By October 2022, inflation peaked at 11.1% – the highest in 40 years. Food costs spiralled, and rising prices rippled through every sector.

To bring inflation back under control, the BoE raised interest rates to 5.25% in 2023. It worked – to an extent. Though inflation has cooled, it’s still volatile. At 2.8% today, it’s above the government’s 2% target and has crept back up from December’s 2.5%. That’s nearly twice the 1.7% we saw last September. The BoE adds it could touch 3.7% by mid-2025 before falling back toward target by 2026.

It's also important to highlight the government's economic projections for the coming years. While growth is expected to be modest at 1% in 2025, the Spring Statement forecasts a rise to 1.9% in 2026, 1.8% in 2027, 1.7% in 2028, and 1.8% in 2029.

As inflation falls, the base rate is likely to follow. And with growth anticipated in the coming years, being proactive now can help your clients get more from their savings.

Rates can change quickly

Clients might naturally think rate reductions will filter through gradually, giving them plenty of time to react. But that’s not always how the market works. Banks sometimes pre-empt the BoE, adjusting their rates early to protect profit margins.

It’s well worth flagging to your clients – especially those looking to make the most out of current savings opportunities. Right now, savers are in a strong position. Inflation has eased over the last few years, and interest rates are still high. It’s clear that now’s the time to snap up the best deals.

Fixed Term doesn’t mean locked away forever

It’s easy to assume clients understand banking terms - but that’s not always true, especially when it comes to savings products. A 2024 study, commissioned by Klarna, shows that younger savers find financial jargon more challenging to understand than a foreign language.

It’s no surprise that some clients shy away from Fixed Term savings, thinking their money will be inaccessible for years.

It might seem obvious, but a quick recap on how Fixed Term accounts work can boost client confidence. With competitive rates available, they’re a strong option for growing cash savings – especially when combined with other savings products.

Flagstone makes saving simple. Our award-winning platform offers a broad range of Fixed Term savings accounts – from one month to seven years – all in one place.