Secure, grow and manage your cash - quickly and simply

Apply for your single Flagstone account, supported by our expert and trusted client service team. No need to complete paperwork for multiple banks.

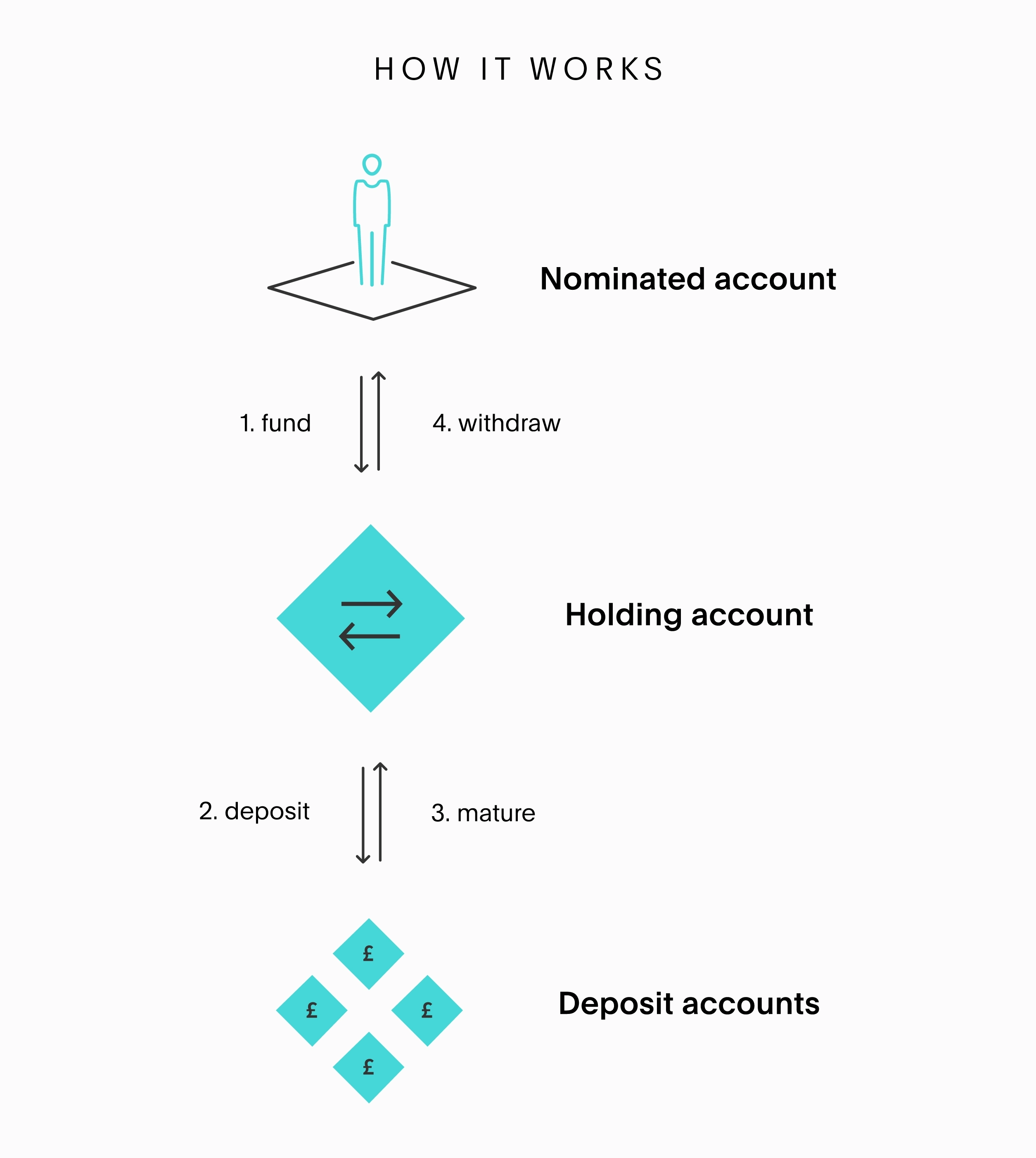

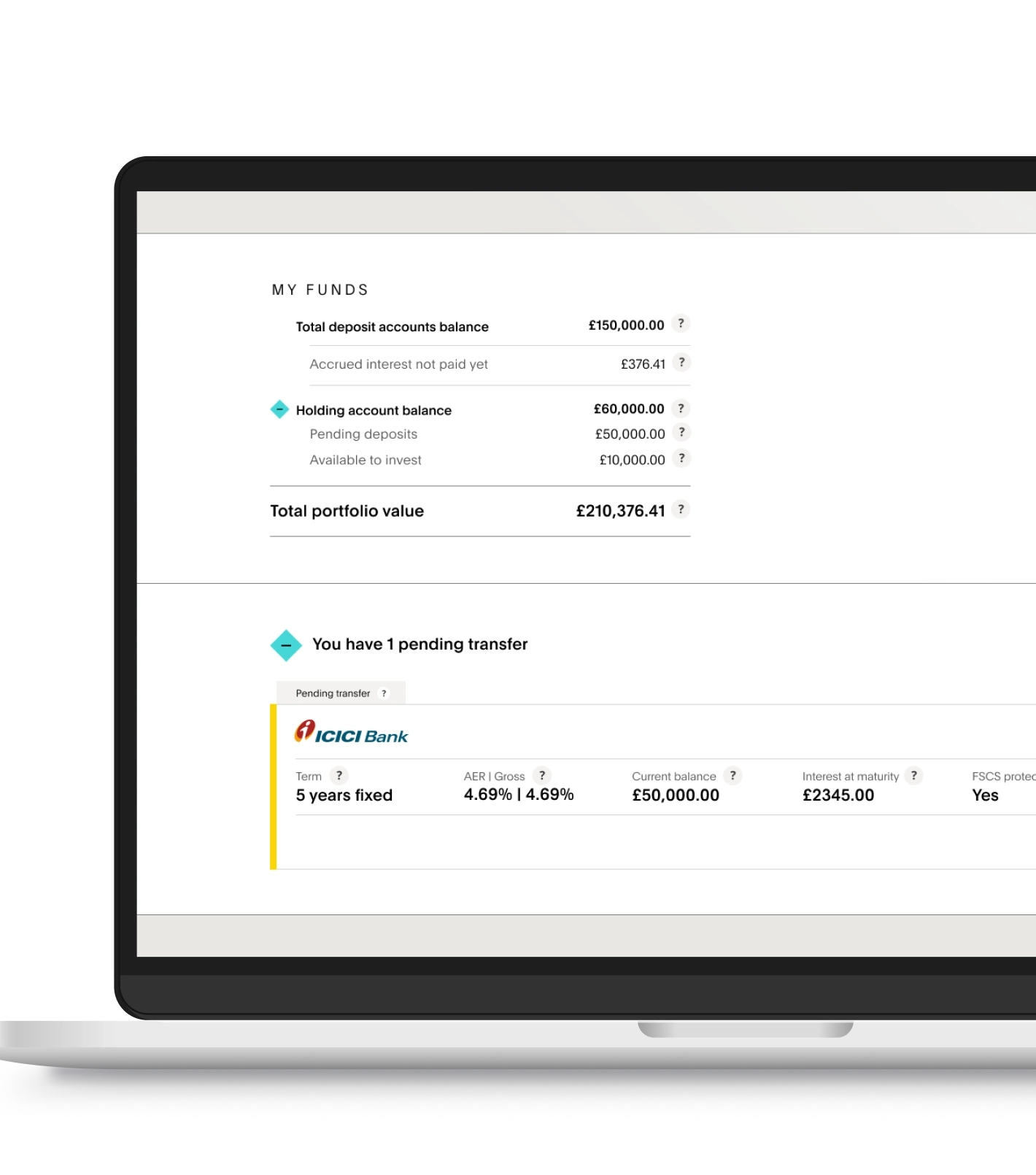

Transfer funds from your bank to your Flagstone account (min. £100,000 for businesses).

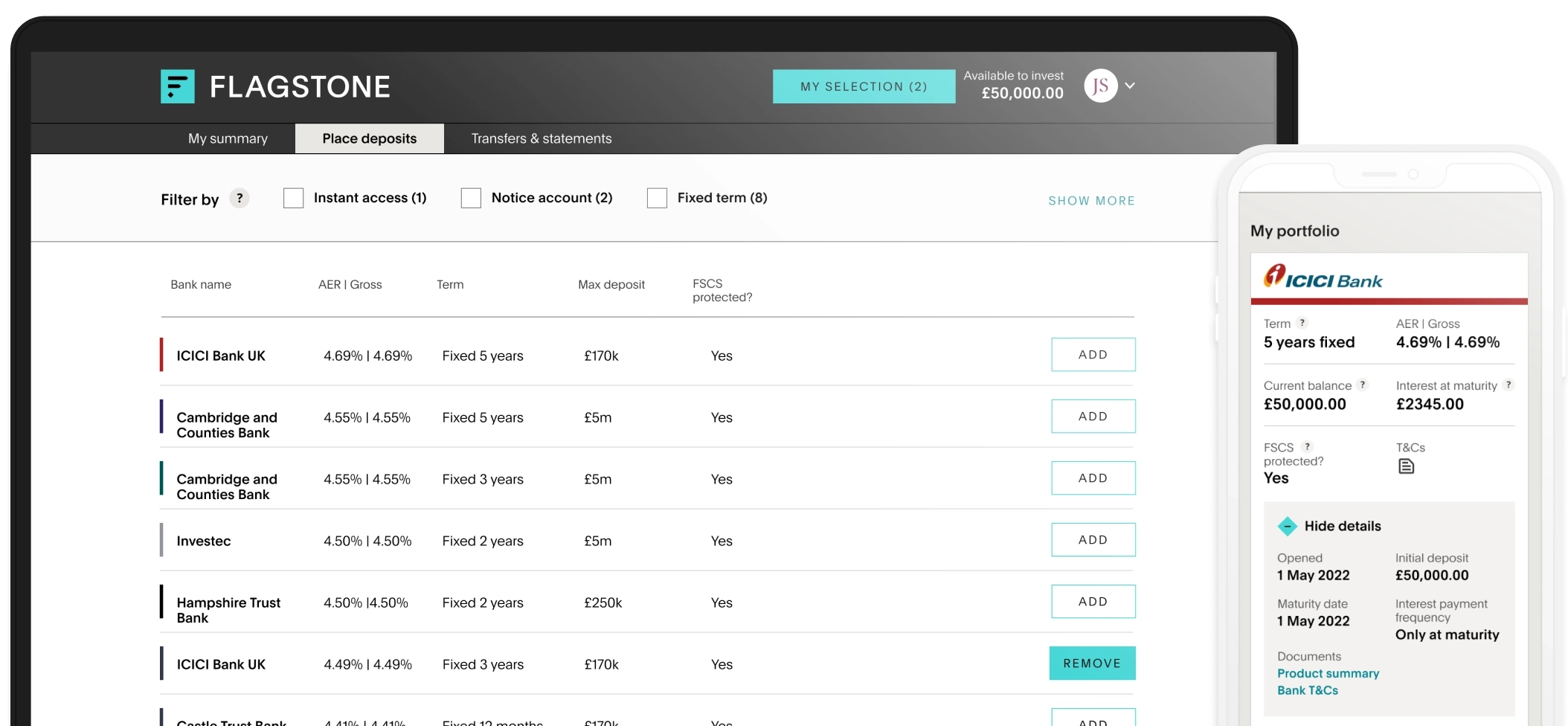

Our platform provides access to hundreds of accounts from up to 30+ banks – enabling you to maximise interest and FSCS protection, if eligible.

Meet changing needs, plans and aspirations with complete visibility of your entire portfolio.

All UK-based banks and building societies on our platform are members of the Financial Service Compensation Scheme. Your eligible deposits are protected up to £85K for each individual bank account opened.

Once your deposits mature, funds are returned to your holding account and then can be withdrawn to your own bank account at any time.

Your money, your way

Complete control over your portfolio and immediate visibility of all your money.

Move, place or spread your deposits, 24 hours a day, 7 days a week.

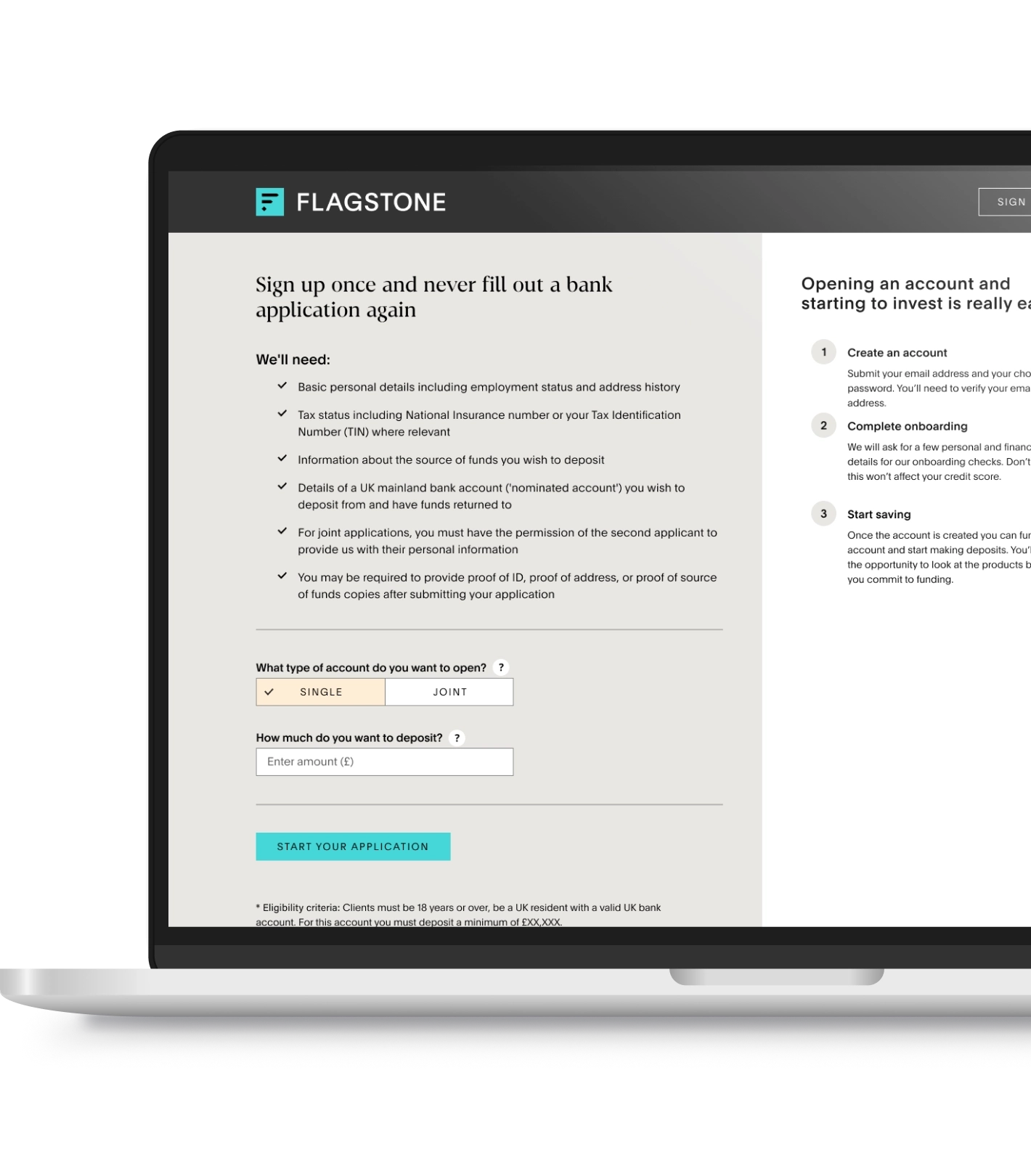

Opening your account

Any company with available deposits of £100K+ can

open a Flagstone account.

- Basic personal details including employment

status and address history. - Tax status including National Insurance number

or your Tax Identification number (TIN) where

relevant. - Information about the source of funds you wish

to deposit. - Details of a UK mainland bank account

('nominated account') you wish to deposit from

and have funds returned to. - You may be required to provide copies of proof

of ID, proof of address, or proof of source of

funds after submitting your application.

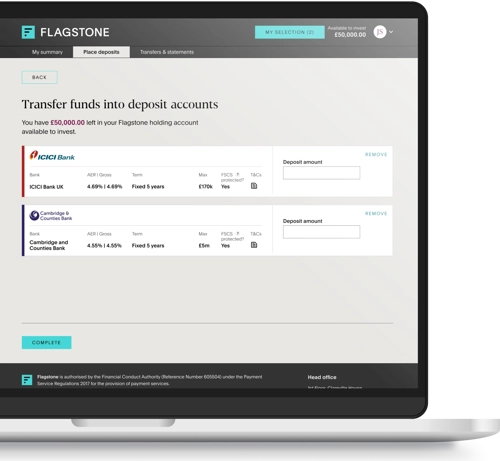

Transferring funds

Once set up, simply transfer funds to your Flagstone

holding account.

Your holding account is set up to receive and hold

your funds before they are transferred to deposit

accounts. Your holding account acts as the account to

which all monies (principal and interest) are returned

at the maturity of a fixed term deposit account, or

when an instant access account or notice account is

closed. Once the matured funds are deposited in your

holding account, you may then withdraw them to your

nominated account, or place them in another deposit

account of your choosing.

The holding account will be provided by HSBC.

Multiple accounts

After funding your Flagstone holding account, browse, open and manage as many savings accounts as you need, including instant access, notice and fixed-term accounts.

Complete control

You are in control. Manage your money - quickly and easily - via our highly secure Flagstone platform. Move, place or spread your deposits - 24 hours a day, 7 days a week - with no additional applications to complete.

Peace of mind

Complete visibility of all your money. View

consolidated information across all of your cash

savings accounts, including a single tax certificate at

the end of the year. Enjoy protection for your money

up to FSCS limits of £85K for each UK bank (£170K for

joint accounts).

If you hold an eligible deposit with a UK-authorised bank or building society that fails, the FSCS will automatically compensate you.

FSCS protection eligibility

All UK based banks and building societies on our platform are members of the Financial Service Compensation Scheme (FSCS).

In the event that one of the UK based banks and building societies on the platform were to go into administration then our client (if eligible) would have a single claim under the FSCS limited to the deposit compensation limit of £85,000 per depositor (£170,000 for joint accounts) per UK bank.

The FSCS protects certain qualifying temporary high balances up to £1 million for six months from when the amount was first deposited.

You do not need to do anything – the FSCS will compensate you automatically.

For more information, please refer to the FSCS website.

Make your money work harder.

See how much interest your business could earn, while spreading your deposits to maximise FSCS protection.

FREQUENTLY ASKED QUESTIONS

Using our platform is simple.

- Apply for one Flagstone account.

- Move funds from your bank to your Flagstone account.

- Browse and choose from hundreds of accounts – including

exclusive and market-leading rates – on our online platform. - Enjoy complete protection for your money – up to FSCS

limits.

As the UK's leading cash deposit platform, the volume of deposits

placed with us, and the relationships developed with our partner

banks gives us access to exclusive and market-leading deposit rates

for our clients.

All UK-based banks and building societies on our platform are

members of the Financial Service Compensation Scheme (FSCS).

This allows you to protect your savings by spreading your cash

across several banks or building societies, and receive the FSCS

protection of £85K each time.

All accounts on the Flagstone Platform are “segregated client trust

accounts”. Our clients are individual beneficiaries of this trust for

the amount of money they deposit (plus interest). They are

absolutely entitled to this money. As an individual beneficiary, a

client’s money is eligible for FSCS protection, provided that the

client is eligible. In the unlikely event that there is an issue with

one of our partner banks, Flagstone would carry out the FSCS

claim on behalf of its clients.

Our platform provides immediate visibility of all your money,

including consolidated information across all of your cash deposit

accounts, and a single tax certificate at the end of the year.

For each savings account you open through Flagstone, we receive a small share of the interest. We deduct that share before we feature any savings account on our platform – so the rate you see will be the rate you receive.

We also receive interest from cash in the holding account

Peace of mind

FSCS Protection

All UK-based banks and building societies on our platform are members of the Financial Service Compensation Scheme. Your eligible deposits are protected up to £85K for each individual bank account opened.

TLS Secure encryption

We use industry-leading Transport Layer Security (TLS) to encrypt and transport data. All data is held on secure, encrypted servers, protected by multi-layer firewalls.

Ready to get started?

We are trusted by leading Wealth Managers,

including St. James’s Place, Evelyn Partners, and

Quilter Group, plus many of the UK’s leading banks

and building societies.

Join Flagstone and protect the art of the possible.