Base rate held after inflation spike – what it means for savers

With inflation’s recent rise and new tax policies, the economic outlook for 2025 remains uncertain. Discover what this means for savers, and why now could be the time to secure better returns.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

In the final meeting of the year, the Bank of England’s Monetary Policy Committee (MPC) decided to maintain the base rate at 4.75%. This was widely anticipated, with 83% of Independent Financial Advisers correctly predicting a ‘hold’ outcome.

The MPC was divided on this decision, with three members – Swati Dhingra, Dave Ramsden, and Alan Taylor – voting against the proposition. They favoured lowering the base rate by 0.25 percentage points to 4.5%, arguing that a ‘very restrictive’ policy stance could push inflation well below the 2% target in the medium term.

Governor Andrew Bailey said the Bank of England will continue with the existing ‘gradual approach’ to cutting rates.

‘With the heightened uncertainty in the economy we can't commit to when or by how much we will cut rates in the coming year,’ he said.

Inflation spikes and tax changes add to economic uncertainty

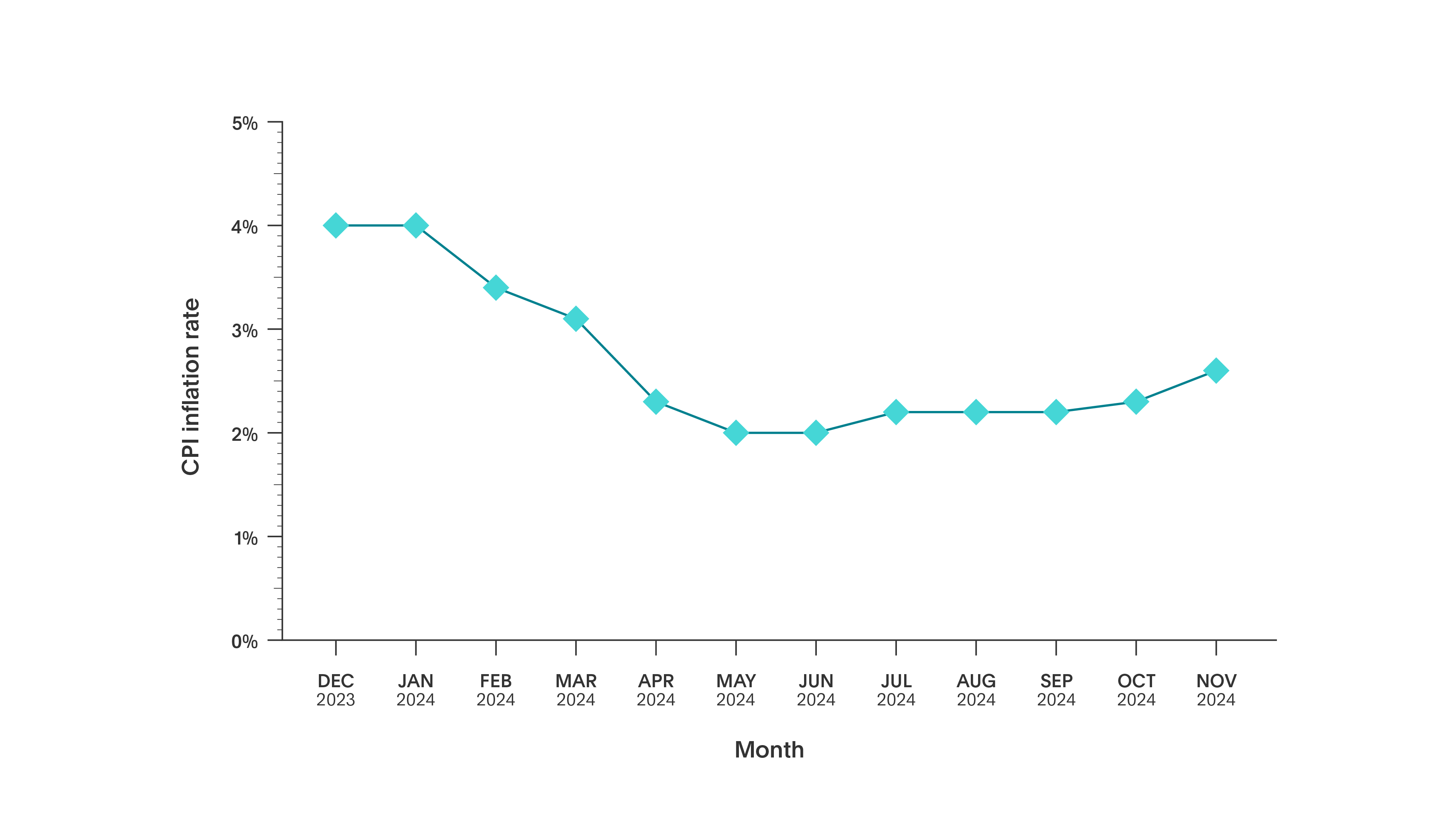

Earlier this year, inflation briefly dipped below the Bank of England’s 2% target, which led to base rate cuts in August and November. But inflation rose for the second consecutive time in November to 2.6% – the highest it’s been in eight months. Economists predict this upwards trajectory will continue as we head into 2025.

Today’s cautious stance is also likely influenced by the recent increase in taxes on businesses. Chancellor Rachel Reeves raised National Insurance contributions (NICs) for businesses in her Autumn Budget, aiming to fund public sector improvements. But economists anticipate that it may stoke inflationary pressures.

Bailey noted that it’s still too early to determine the full impact of these tax changes, but he’s called them the ‘biggest issue’ following the Budget.

What does this mean for savers?

For savers, the base rate holding at 4.75% presents a clear opportunity. With the inflation rate currently at 2.6%, the gap between inflation and savings rates remains wide, allowing you the chance to find accounts that exceed inflation.

It’s important to evaluate your savings strategy now. If your cash is tucked away in a low interest account for convenience, there’s a strong chance you’re missing out on better returns.

Simon Merchant, CEO of Flagstone, comments:

‘It’s not hard to find dozens of fixed-rate, notice, and instant access accounts right now that continue to exceed inflation by more than 2%. These rates won’t stick around for long as and when base rate reductions begin again in 2025. Savers would be wise to take advantage now when re-evaluating their financial plans in light of the new tax regime.’

If you’re able to lock your cash away in a Fixed Term account, you can potentially secure better returns and shield your savings from the inevitable rate cuts that are expected in 2025.

Are your savings standing still?

Despite the availability of competitive savings rates, a surprising number of people leave their cash in accounts that offer minimal returns. The lack of movement is more than just inconvenient – it’s costly.

This is where platforms like Flagstone come in. We offer a simple, secure way to access 60+ banks and hundreds of savings accounts, all through one login. It’s never been easier to manage your cash and maximise your returns without completing multiple applications.

See how much interest you could earn

What’s the outlook for interest rates in 2025?

Bailey recently told the Financial Times that the Bank of England will potentially cut rates by up to four times next year. But he emphasised that any cuts would be gradual, and the Bank of England remains committed to its goal of returning inflation to the 2% target.

The next MPC meeting will take place on Thursday 6 February 2025. Any changes to the base rate will depend on further developments to inflation and the economic performance in the coming months.