Tax is a fact of life. But the rules can be confusing. Exemptions and allowances can sound similar but mean very different things. Worse, the penalties for disclosing the wrong income to HMRC can have negative consequences on your finances for years.

So, how does tax work in the UK? What are the different kinds of taxes, and what are the legal allowances designed to help you grow your wealth? In this guide, you’ll learn about the different kinds of UK taxes, when they apply, and how you can make the most of legal tax relief to protect your earnings.

What is the difference between direct and indirect tax?

You pay tax either by giving a share of the money you earn to HMRC (direct), or via increased prices handed down to you by businesses (indirect).

Let’s explore both in more detail.

What is direct tax?

You pay a share of profits, earned either through work or other income streams, to the government. Direct taxes in the UK include:

• Income Tax: The amount of tax you pay depends on your income.

• Capital Gains Tax (CGT): When you make a profit, you pay a share of the money you earn.

• Inheritance Tax (IHT): You pay tax above a set threshold on the money you leave behind when you pass away.

What is indirect tax?

Taxes that make goods or services more expensive before they reach the customer. Businesses often raise their prices to protect their profitability, which is how you pay the cost of the tax indirectly. Here are some examples of indirect taxes in the UK:

• Value Added Tax (VAT): The government adds tax at each point within the supply chain, raising the cost of goods.

• Stamp Duty: When you buy property or land over a certain value, an additional tax is payable to the government. The value at which Stamp Duty applies can vary significantly depending on your personal circumstances.

• Environmental taxes (or ecotaxes): Businesses that disproportionately affect the environment can be charged taxes such as the Climate Change Levy (CCL), Landfill Tax, Aggregates Levy, or the Plastic Packaging Tax.

• Excise duties: You pay taxes placed on goods during manufacturing. The government often applies excise duties to items that can be harmful to the health of consumers, such as alcohol or tobacco.

• Tariffs: The amount you pay for a foreign import is increased to encourage you to buy locally. Businesses often pass these costs on to their customers.

How does Income Tax work?

Income Tax is one of the most important direct taxes in the UK, especially in relation to your personal finances. That’s because, once you exceed your allowances, HMRC typically categorises any additional earnings as income – whether you earned it from a job or not.

What is a tax bracket?

In the UK, the level of Income Tax you pay increases with your earnings. You’re charged within thresholds known as tax brackets, or tax bands.

Most taxpayers are entitled to a Personal Allowance, which means they can earn income tax-free up to a limit (usually £12,570 per year).

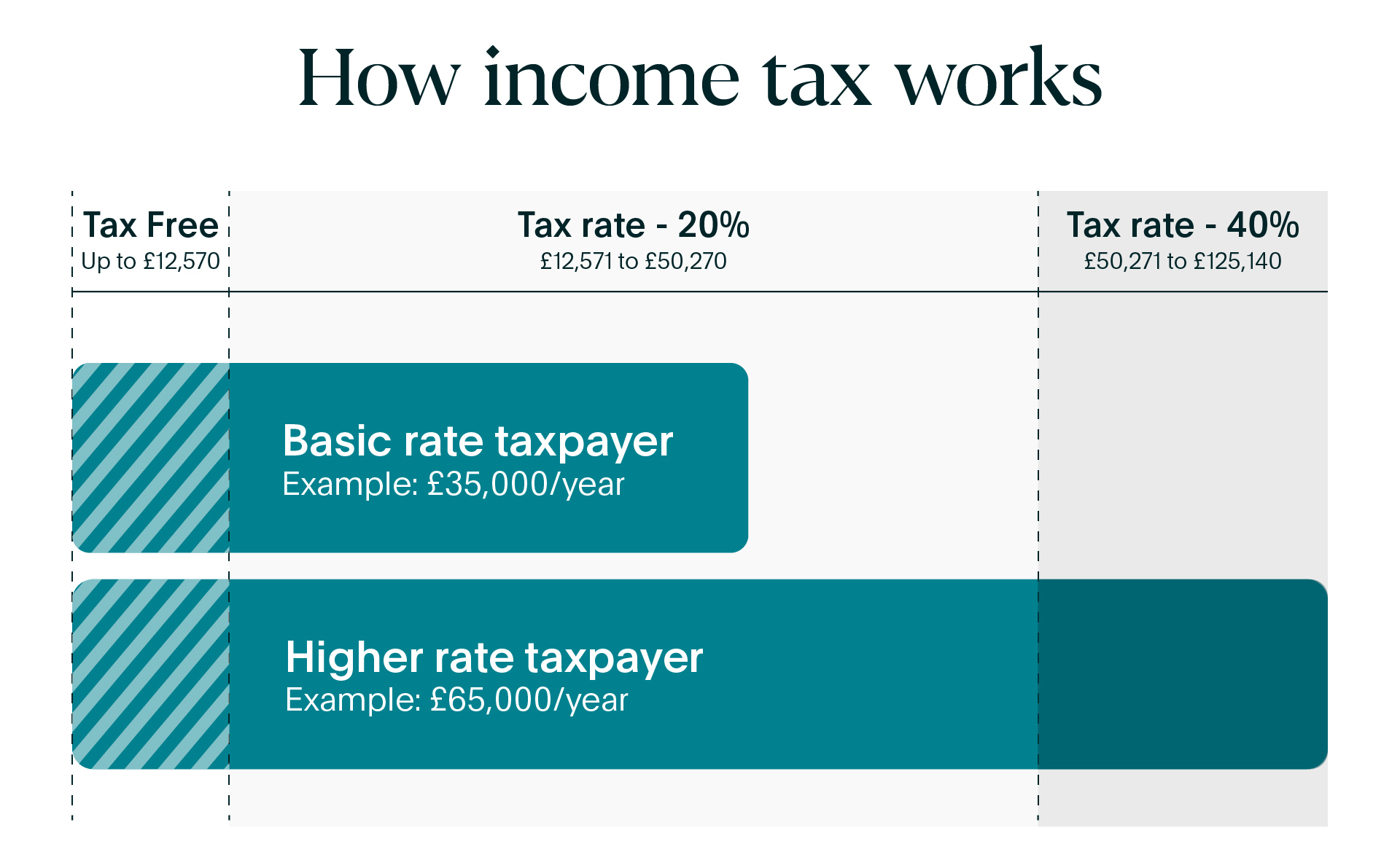

You may sometimes see references to people within a tax bracket, for example ‘basic rate taxpayers’. This term relates to the highest level of income tax they pay, even though a ‘higher rate taxpayer’ will have portions of their income taxed at both rates.

Here’s a diagram showing what that looks like:

There are circumstances in which you may not qualify for allowances. If you’re unsure how tax rules affect you, consider speaking with a financial adviser.

UK tax brackets and what they mean

In England, Wales, and Northern Ireland there are three tax brackets:

| Tax bracket | Rate | Income |

| Basic | 20% | £12,571 - £50,270 |

| Higher | 40% | £50,271 - £150,000 |

| Advanced | 45% | Over £150,000 |

In Scotland, there are six tax brackets:

| Tax bracket | Rate | Income |

| Starter | 19% | £12,571 - £15,397 |

| Scottish basic | 20% | £15,398 - £27,491 |

| Intermediate | 21% | £27,492 - £43,662 |

| Higher | 42% | £43,663 - £75,000 |

| Advanced | 45% | £75,001 - £125,140 |

| Top | 48% | Over £125,140 |

Your tax code determines what Income Tax you pay

You can check the amount of Income Tax you pay by looking up your tax code in the UK. They appear on your payslips if you’re a PAYE (Pay As You Earn) employee, or your pension statement if you’re retired.

Tax codes are the system HMRC uses to determine how much Income Tax you owe. Tax codes are a combination of numbers and letters that explain your allowances, where you’re a tax resident, and whether special rules apply to you.

If you get the wrong tax code, you could be paying more tax than you should. You can contact HMRC to get your tax code corrected.

Learn more about tax codes by reading our detailed guide, which contains all the tax code variations and what they mean.

Why pensions are subject to Income Tax

The government encourages you to pay into your pension by offering tax relief on the money you put aside. When you increase pension contributions through your employer, HMRC treats the amount you have left over as taxable.

Because you benefit from a tax break when you put savings into pensions, you’re taxed when you take them out in retirement instead. This is usually more tax efficient, though the benefits depend on your personal circumstances.

You can read more about how taxes work in retirement by exploring our interactive guide.

What is National Insurance and how much do you pay?

National Insurance is another form of Income Tax. It was originally created to fund the National Health Service (NHS). Both employees and employers pay National Insurance, though the amounts they pay are different.

When you pay National Insurance as an employee, the amount you owe is deducted from your income. Employers pay the tax directly to HMRC.

In general, the more money you earn, the higher your rate of National Insurance. The calculations involving National Insurance are complex, with different types of employment assigned categories that sometimes allow for exemptions.

Depending on what you earn and the kind of work you do, employees can expect to pay between 1.85% to as much as 8% of their monthly salary. Your employer is responsible for ensuring you pay the correct amount of National Insurance.

As of April 2025, employers pay an amount equivalent to 15% of your salary in National Insurance. But there are jobs that are exempt from the charge, provided your employees’ wages don’t exceed certain limits.

Self Assessment tax returns: how they work

If you’re self-employed, the responsibility for notifying HMRC about your taxes rests with you. This means you’ll need to provide an accurate breakdown of your accounts as well as arranging payment yourself. This process involves submitting a Self Assessment tax return.

You may also need to provide a Self Assessment tax return in a handful of other circumstances, including when you:

- earn more than £150,000

- earn income from a trust

- need to pay Capital Gains Tax

- earn income from abroad

- exceed £10,000 in earnings from savings interest, investments, shares, or dividends

- earn money from renting out property, or other untaxed income

You can check whether you need to provide a Self Assessment tax return through HMRC’s interactive tool on their website.

When are taxes due?

Online Self Assessments are due on 31 January every year, but you need to inform HRMC if you intend to send them an assessment by 05 October.

You must pay the taxes you owe to HMRC by 31 January. If you don’t, or pay late, you can be fined with interest payable on top.

The UK tax year always begins on 06 April.

What is tax relief?

There are circumstances where you can lower your taxes, known as ‘tax relief’. This can either come in the form of reducing your tax bills (tax efficiency) or getting some of your charges written off (exemptions).

The government sets rules to encourage people to make financial choices that benefit the economy. Tax efficiency is making use of those rules to legally reduce the amount you pay. This is not the same as tax avoidance, which is when someone attempts to hide part or all of what they owe. Tax avoidance is illegal.

The three kinds of tax relief

Tax relief can apply when you use:

- allowances to which you’re entitled

- special accounts that shield you from tax

- deductions on costs you paid throughout the tax year

A list of UK tax allowances

Tax rules change regularly, with new allowances and updates to the charges announced as part of the Chancellor’s annual budget. Although the allowances below are referenced by HMRC, you should check with a financial adviser whether your personal circumstances restrict you from tax relief if you’re unsure.

- Personal Allowance: You can earn £12,570 in income tax-free. If you earn a salary of over £100,000, your allowance gradually tapers off. Your allowance can reach zero.

- Personal Savings Allowance (PSA): Depending on your income, you can earn as much as £1,000 in interest every year tax-free. For higher rate taxpayers, the allowance reduces to £500. If you pay the advanced rate of tax, you’re not entitled to this allowance.

- Trading allowance: You can earn £1,000 in annual trading income from activities that are considered ‘casual services’, such as babysitting, gardening, or equipment hire. Using this allowance means that you’re not allowed to also claim capital allowances, which you’ll learn more about later.

- Property allowance: You can earn £1,000 tax-free on income you make from land or property. The allowance applies to individuals, so if you share the property with others, you’re both eligible for the allowance.

- Marriage allowance transfer: If you’re married, you can transfer some of your Personal Allowance to your partner so that they pay less tax.

The rules around this can be complex. This list is not exhaustive, and tax rules are subject to change.

ISAs: accounts that shield you from tax

In the UK, certain types of accounts have special rules that let you protect the money you earn from tax. These are known as ISAs (Individual Savings Accounts). There are two types of earnings that ISAs protect, depending on the account you’ve opened:

- Savings: The interest you earn on your cash deposits is tax-free, even if it exceeds the Personal Savings Allowance.

- Stocks and shares: Any profits you enjoy from investments are tax-free. Investments can go up or down in value, meaning you may lose money when you invest.

There’s a £20,000 limit on total ISA contributions per tax year (across all types of ISA). A handful of ISAs have additional benefits and rules, which is why learning about the different types of ISA is useful before deciding to open them.

Tax deductions and what they mean

When you’re self-employed, you can get tax relief on some of the costs you pay to run your business. This means you can keep more of your profits. Any costs you claim back in this way are called ‘allowable expenses’.

Not all expenses are covered, and they must relate to your business activities. For example, if you use a mobile phone for work and spend £100 on business calls, you may be able to claim some of the cost back. If you use the same phone to make an additional £30 of private calls, that £30 would not be eligible.

Here are a handful of examples of allowable expenses:

- Clothing: uniforms, costumes, and protective gear

- Office operations: rent, phone bills, and stationery

- Travel: parking, vehicle hire, and fuel

- Stock: raw materials, direct costs for producing goods

- Marketing: newspaper advertising, free samples, and website costs

You can find the full list of allowable expenses on HMRC’s website.

You can only use allowable expenses if you’ve not claimed property or trading allowances. If you’re unsure whether you can claim allowable expenses, consider consulting a financial adviser.

Wealth taxes in the UK

In the UK, HMRC usually taxes wealth when you:

- give money to people that are not your spouse when you pass away

- sell an asset at a large profit

- leave assets in a trust for an extended period

Gifting money to family: Inheritance Tax

When you pass away, you can gift a certain amount of your wealth to anyone you wish, tax-free. If the value of your possessions exceeds the limit of £325,000, then you may be charged Inheritance Tax.

It may be possible to limit the Inheritance Tax you pay, depending on who inherits your assets, and when you give them away.

You can learn more about gifting money to children in our full guide.

Large profits from asset sales: Capital Gains Tax

When you profit from the sale of an asset that has increased in value, this is known as a ‘capital gain’. If the gain exceeds £3,000 in one year, you may have to pay Capital Gains Tax on any profit that exceeds that limit. The amount you could earn from a trust before paying Capital Gains Tax is £1,500 per year.

There are some items that are exempt from Capital Gains Tax. These include your car, Premium Bonds, earnings made within ISAs, and lottery winnings.

It’s important to note that you’re only charged Capital Gains Tax on the profit from any asset sale – not the full value of the asset.

Explore how Capital Gains Tax works in more detail, and how you can potentially reduce your CGT bill, in our guide.

Charges on assets held in a trust

There are complex rules governing trusts and taxation. The type of trust you set up, who benefits, and your personal circumstances can change the amount of tax you pay considerably.

HMRC can charge you Inheritance Tax, Income Tax, and Capital Gains on money you earn through a trust. But the rules are complex.

You can learn more about how trusts work and the different types in our guide.

Frequently asked questions similar to ‘how does tax work?’

How does tax on salary work?

If you’re a PAYE (Pay As You Earn) employee, your employer automatically deducts Income Tax and pays this to HMRC. Most employees in the UK are paid under the PAYE system.

The amount of tax you pay on your salary only increases on earnings above each threshold.

For example, the rate of Income Tax increases from 20% to 40% when your pay exceeds £50,270. If your pay increases from £50,000 to £65,000 per year, you’ll only pay 40% on the £14,730 that took you into the higher rate of tax.

Who pays 20% tax in the UK?

You pay 20% on income you earn between £12,571 to £50,270 per year.

Do I pay 40% tax on my whole salary?

No. You only pay tax at the higher rate on whatever you earn above the threshold. This means that, as your take-home pay grows, so does the tax you’ll pay. It also means that lower earners keep a greater portion of their salary.

Learning how tax works can maximise your wealth

Understanding how tax works can help you navigate the complex rules that determine how much you pay HMRC. Direct taxes are the most relevant to personal finances, as they 'directly’ affect your wealth and income. Indirect taxes are still relevant. But they are likely to remain out of your control.

Maximising the use of your legal allowances can place your finances in the best position to grow your wealth in the long term.

Protect and grow your cash with Flagstone

To make more of what you’ve earnt, it’s important to make the most of the tools and systems available. That includes Flagstone.

With Flagstone it’s easy to maximise your cash, and protect it too. With a single sign-up, you can spread your cash between hundreds of high-interest savings accounts.

All in one platform, with one password.