How advisers can build close client relationships with their referral portal

How do advisers deliver a personal, proactive service without working 24 hours a day? How do they ensure clients always feel valued and supported? Our dedicated referral portal helps in three key ways.

This article is not advice. It is provided for information purposes and should not be treated as a recommendation. Advisers remain responsible for the advice they provide to their clients.

Things change fast in finance. Markets are often at the mercy of the latest government shift or global event. And amidst the tumult, advisers do their best to guide clients. One of the tools in their arsenal? Closeness.

It sounds obvious. But building close relationships with multiple clients (all while attending to a myriad of daily tasks and pressures) isn’t easy. How do advisers deliver a personal, proactive service without working 24 hours a day? How do they ensure clients always feel valued and supported?

Flagstone has a dedicated referral portal which can help in three key ways:

1. Total visibility

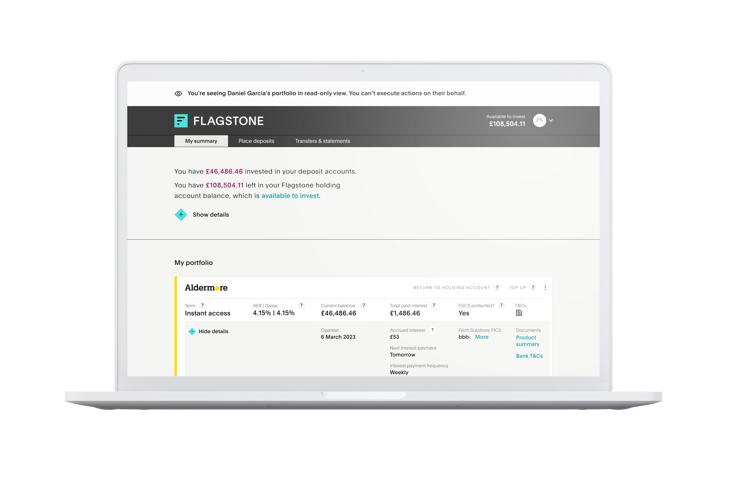

You may never quite see the world through your clients’ eyes. But you can see their cash portfolio in the Flagstone referral portal – which may be the next best thing.

The portal lets you see everything your clients see, all in one place. That includes:

- transactions & statements

- upcoming maturity dates

- the latest rates

This clarity helps you spot any issues in advance, offer personalised support, and enhance your clients' experience. By proactively starting conversations about their savings or addressing concerns before they escalate, you can demonstrate both care and expertise.

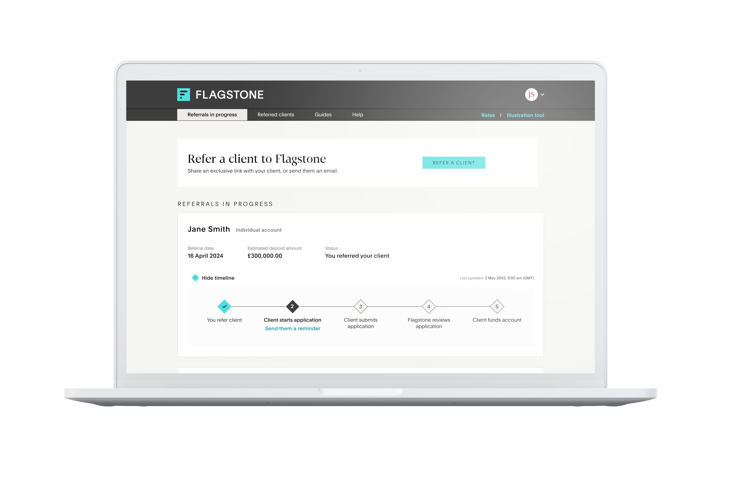

2. Track every application

With one application, your clients will never need to apply for another savings account again. But we understand that, with multiple clients to support, you need to know where each of them are in their cash saving journey.

With our referral portal, you’ll always have a clear picture of where they are in that process, and what comes next. This helps you offer tailored support at every step, and ultimately ensure your clients can benefit from Flagstone sooner.

Your ability to navigate the platform confidently can also reassure clients who may be less familiar with technology. All reinforcing your role as a trusted adviser.

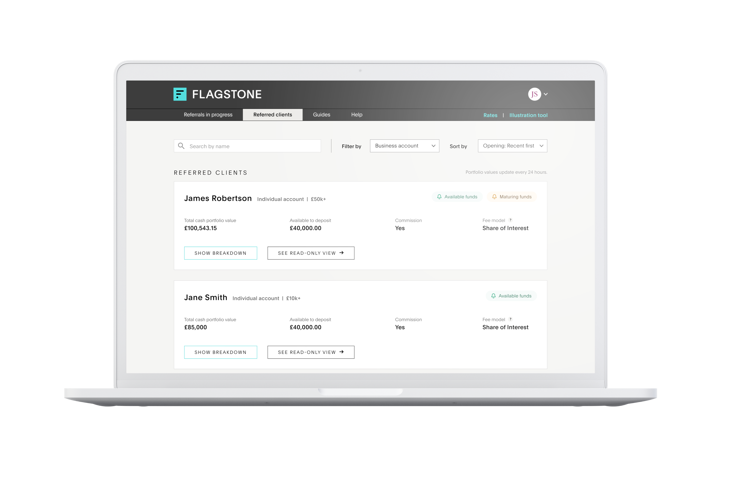

3. Achieving clients’ financial goals

With a perfect picture of upcoming maturities, you can make sure your clients are always earning competitive interest on their cash. The result? Your clients can achieve their goals sooner – whether it’s a looming tax bill, or a rosy retirement.

With more than £1.1tn in UK cash currently earning less than 2% interest, the referral portal can protect your clients from inertia. It gives you the ideal foundation to guide their decision-making, and ultimately ensure their cash is always earning competitive interest.

How to use the referral portal

In the same way that clients use Flagstone to manage and monitor their cash, you can use the referral platform to manage and support your clients. One platform for them, one portal for you.

The power of closeness

In a volatile world, more clients than ever are turning to experts for help. But this naturally increases the pressures those experts experience to deliver quality service and build close relationships.

The Flagstone referral portal already helps thousands of advisers forge lasting bonds with their clients.