Saving for retirement at 30, 40, and 50 years old to protect your quality of life

Your financial priorities will change over the course of your career, and so should your retirement plans. In this article, we explore how you can save for retirement in your 30s, 40s and 50s to get the golden years you deserve.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

After years of hard work, you deserve to enjoy your retirement. But to achieve the lifestyle you want, you need to save and invest throughout your career. This is especially important as recent data suggests that 74% of the UK public isn’t saving enough to maintain their current lifestyle once they leave the workforce.

In this article, we’ll explore how to start saving for retirement, adapting your strategy over the course of your career. We’ve broken down these savings tips into key milestones, so you can assess how much you have in savings, and take action to prepare your finances for your golden years.

Why is saving for retirement important?

Pension auto-enrolment means most workers are saving for retirement. But the amount going into your pension pot varies significantly depending on where you work, how long you’ve been employed, and your employment contract.

Savings or higher contributions are usually needed to maintain a comfortable lifestyle. This is especially true as the UK government taxes pension withdrawals in a similar way to income.

The sooner you start, the greater the rewards

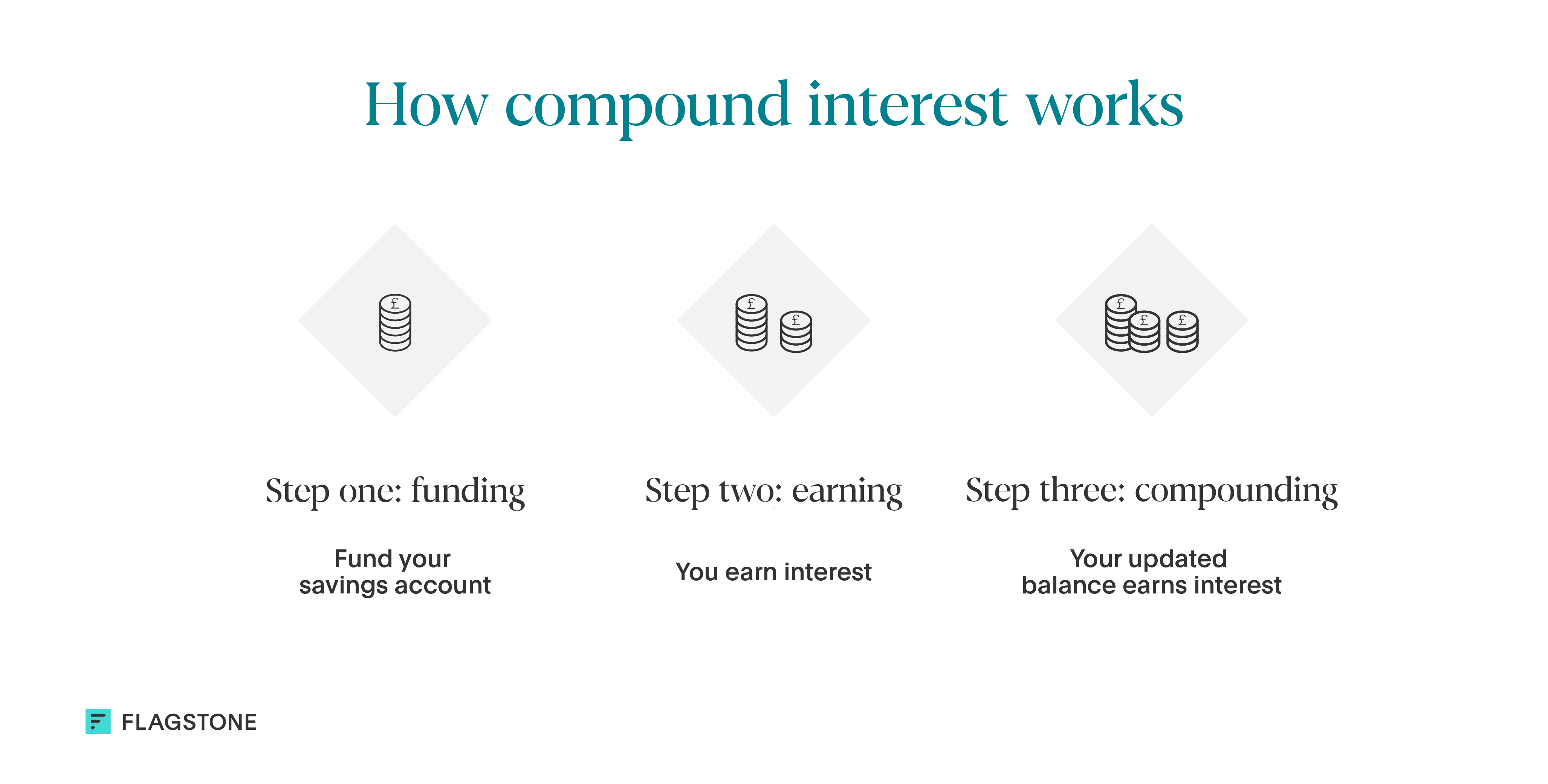

Taking advantage of financial incentives for longer means you’ll enjoy more of the rewards. For example, the earlier you begin saving, the more you’ll benefit from compound interest.

Additionally, you can choose to contribute more of your salary to a pension before paying tax. If you’re employed, you can do this by asking to increase your pension contributions. Some employers offer to match your investment up to an agreed percentage, so it’s a good idea to check your contract to see if your workplace offers this.

Beyond monthly pension contributions, you can ask to have some of your pay put into your retirement fund. This is known as ‘salary sacrifice’, and it can mean you pay less tax on income in the long term.

Let’s explore how this works.

How to use salary sacrifice for pensions: an example

Paul earns £145,000 a year. He pays the additional rate of tax (45%) on anything he earns above £125,140. Paul’s employer offers a salary sacrifice scheme, where he can put a portion of his earnings into his retirement fund before tax. He chooses to sacrifice £25,000 a year, which means that as far as HMRC is concerned, he earns a salary of £120,000.

When Paul retires, he’ll choose to withdraw £50,000 a year from his pension. HMRC will count this as his income. As a result, Paul will eventually pay the same basic rate of tax as a working person earning a salary of £50,000, reducing his tax burden from 45% to 20% on the amount he’s saved.

Not all employers offer salary sacrifice, so you may want to consider asking if this is a benefit when you change jobs.

The benefits of increased risk tolerance as a younger saver

Saving for retirement earlier also gives you more scope to earn higher returns on investments. When you’re younger, you can generally afford to invest in riskier assets with higher returns. This is because you have more time to make up the difference if you make a loss on an investment.

As you approach retirement, it’s likely that your risk tolerance will diminish because you’ll need to withdraw your money sooner.

Saving for retirement throughout your career

Building your retirement fund is career-long, but how much you set aside may vary over the years.

Financial benchmarks based on age can be helpful to track your progress when saving for retirement. Below, we’ll explain some key saving strategies you could adopt, depending on your age bracket.

Start saving in your 30s

While it’s likely you have other financial priorities in your 30s, such as raising a family or paying your mortgage, this is a great age to start thinking about your retirement goals.

As your career progresses, you may want to contribute a larger amount to your pension. How much you decide to pay into your pension will depend on your unique, personal circumstances. But there is a useful rule of thumb to gauge your progress so far.

The ‘half your age’ pension rule

Take the age you start contributing, halve that number, and that is the percentage you should aim to contribute from your salary.

For example, if you were to start contributing to your pension at the age of 30, you could aim to contribute 15% of your salary each year until you retire.

How the ‘half your age’ pension rule works: an example

Louis is 30 years old when he decides to contribute 15% of his salary over 20 years. At a salary of £30,000, this amounts to £4,500 a year. His employer offers to match his contributions up to 5%, meaning that Louis only needs to invest the remaining 10% (£3,000 a year, or £250 per month, before tax).

In the unlikely event his pay stays the same for 20 years, this leaves him with contributions of £90,000 by the time he’s 50 years old. But due to compound interest, and provided that his pension fund grows at a medium level (approximately 5% per year), the projected value of his pension would be £216,000.*

Continuing to save for retirement into your 40s

As you enter your 40s, retirement isn’t such a distant reality, especially if you dream of retiring early. Saving for retirement at 40 requires careful financial planning and making the most of compound interest.

In your 40s, you’re likely to be entering your peak earning years, so you may be able to increase your pension contributions significantly. It may also be worth evaluating your investment strategy and rebalancing your portfolio to maximise your returns.

Further saving for retirement in your 50s

In your 50s, your saving priorities are likely to shift again. With retirement on the horizon, you’ll need to assess the value of your pension pots and whether you’re on track to achieve your dream retirement.

Saving for retirement at 50 requires you to determine exactly how much you’ll need to sustain your lifestyle once you’ve stopped working.

It’s also important to determine how you’ll access your pension, and whether you plan to withdraw your pension early. In the UK, you can start to take money from your private pension once you hit 55, but this is set to increase to the age of 57 in April 2028.

The State Pension age is currently 66, rising to 67 between 2026-28.

How to start saving for retirement

You can save for retirement in a variety of ways, including:

- Savings accounts: Keeping a portion of your retirement funds in a savings account can give you easy access to your cash. You can choose to have a mix of savings accounts, such as combining Fixed Term or Instant Access, to maximise your interest while keeping cash within easy reach.

- Pensions: If you’re employed, it’s likely you’re already enrolled into a workplace pension. Employers are required to automatically enrol employees into their pension scheme. You can also set up your own personal pension to take control of where and how you invest your cash. You’ll also need to do this if you’re self-employed.

- Other investments: Investing your money in stocks and shares, or bonds, may offer a higher rate of return than a pension but does expose you to a greater level of risk. To protect the value of your investments and encourage growth, try to build a diversified portfolio. That way, if one investment underperforms, other assets can offset disappointing results.

- Government-backed schemes: Consider government-backed saving schemes such as a Lifetime ISA (LISA) to save towards your retirement. The government will contribute a 25% bonus on your savings, up to £1,000 per year. You can withdraw money from your LISA for retirement at age 60 and over.

How much money should you save for retirement?

The amount that’s right for you will ultimately depend on your lifestyle and retirement plans, including when you’re looking to retire.

There are numerous factors to consider when deciding on your financial goals. For example, while you may have paid off your mortgage by the time you retire, your energy bills may be higher as you spend more time at home.

It’s important to consider the minimum income you’ll need to cover monthly outgoings, as well as how much you’ll set aside each year towards non-essentials.

If you’re looking to travel the world or pursue a new hobby when retired, you may benefit from accounting for this in your plans. Putting together an estimated retirement budget can help you plan for future aspirations.

When considering your long-term financial options, it may be useful to speak with a Financial Adviser to ensure you’re making the most informed decisions.

Saving for retirement throughout your career

Saving for retirement is a lifelong journey that evolves as you age. Perhaps you’re starting out in your 30s, playing catch up on your pension contributions in your 40s, or looking to retire early in your 50s.

Wherever you are in life, adapting your savings strategy to align with your current financial circumstances is key to a comfortable retirement.

By making regular pension contributions and making the most of tax incentives and investment opportunities, you’ll have sufficient savings to fully enjoy your retirement.

Use our pension calculator to plan the retirement you deserve

Our pension calculator helps you predict how much money you need to save for a comfortable retirement.

With your salary, age and when you plan to retire, you can calculate the projected value of your pension, as well as how much tax you can expect to pay.

Try our pension calculator today

*This calculation is an estimate and does not account for variable rates of interest. A detailed description of our methodology is available on our online pension calculator.